Investment strategy

Bill Ackman says a more aggressive Fed or market collapse are the only ways to stop this inflation

Billionaire hedge fund manager Bill Ackman said raging inflation will only dissipate if the Federal Reserve acts more aggressively or the market sell-off turns into a full-on collapse. “There is no prospect for a material reduction in inflation unless the Fed aggressively raises rates, or the stock market crashes, catalyzing an economic collapse and demand destruction,” Ackman […]

Read More

5 things to know before the stock market opens Tuesday

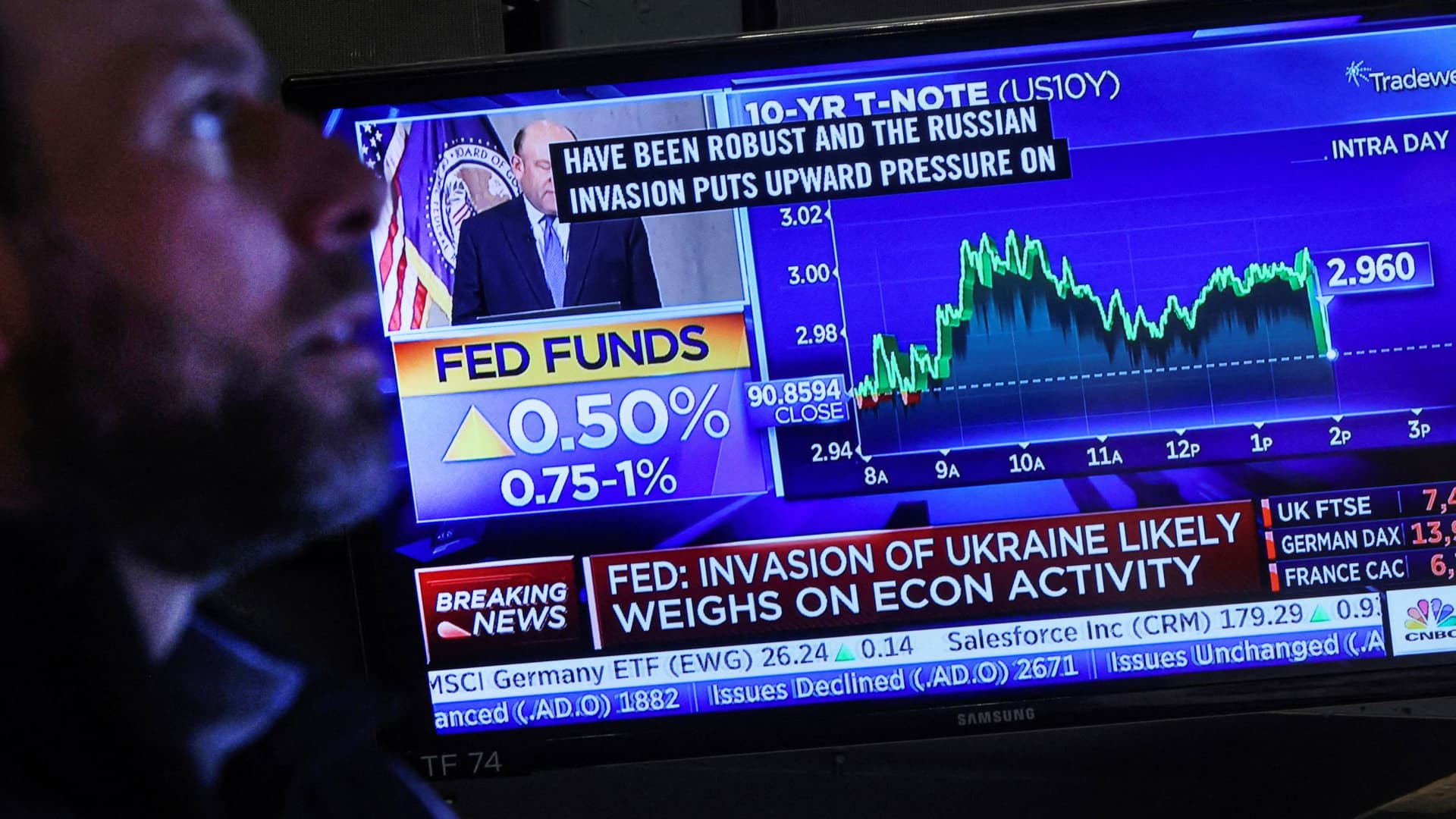

Here are the most important news, trends and analysis that investors need to start their trading day: 1. Dow set to gave back some of Monday’s snapback rally A screen displays the Fed rate announcement as a trader works inside a post on the floor of the New York Stock Exchange (NYSE) in New York […]

Read More

Stocks poised for near-term rally after S&P 500 flirts with bear market, but selling is not over

The stock market’s bounce back from the brink of a bear market has set up the potential for a near-term rally, but there could be more pain in store for stocks this summer, say strategists who follow price charts. Friday’s sharp intraday drop to a low on the S & P 500 of 3,810 was […]

Read More

Bank balances surged during Covid even as pandemic-era stimulus ended, BofA CEO says

Bank of America’s account holders saw strong growth in their balances during Covid and have yet to spend down their pandemic-era stimulus money, CEO Brian Moynihan told CNBC. In an interview on “Squawk Box” from The World Economic Forum in Davos, Switzerland, BofA’s chairman said customers who had between $1,000 to $2,000 before the pandemic, […]

Read More

Tax breaks aren’t prime reason for high-net-worth philanthropy, study finds

Maria Teijeiro | OJO Images | Getty Images Tax breaks aren’t the primary incentive for philanthropy among the ultra-wealthy, according to BNY Mellon Wealth Management’s inaugural Charitable Giving Study. The report, polling 200 individuals with wealth ranging from $5 million to more than $25 million, found the top three motivators were personal satisfaction, connection to […]

Read More

Guggenheim’s Minerd says S&P 500’s decline could double from here if Fed keeps hiking rates

The stock market still has much further to fall and is unlikely to find its footing again until the Federal Reserve stops tightening policy, according to Guggenheim global chief investment officer Scott Minerd. Minerd, who has previously predicted a ” summer of pain ” for the market, said on CNBC’s ” Squawk Box ” that […]

Read More

We’re adding to an underappreciated stock and another that’s right for the moment

The combination of these purchases speaks to the importance of balancing a long view with a short focus. Source

Read More

JPMorgan expects to reach 17% returns sooner than planned as rising rates provide a boost

Jamie Dimon, CEO of JPMorgan Chase speaks to the Economic Club of New York in New York, January 16, 2019. Carlo Allegri | Reuters JPMorgan Chase on Monday reversed course on guidance it gave in January, saying the bank could achieve a key performance target this year after all. The lender said that a 17% […]

Read More

Stocks making the biggest moves in the premarket: Electronic Arts, VMWare, GameStop and more

Take a look at some of the biggest movers in the premarket: Electronic Arts (EA) – The video game maker’s shares rose 2.5% in the premarket after Puck News reported that the company was actively seeking a buyer or merger partner. EA has reportedly held talks with Walt Disney (DIS), Apple (AAPL) and Amazon (AMZN), […]

Read More