Bonds

As the U.S. 10-year Treasury yield keeps climbing, here’s what it means for China

BEIJING — The U.S. 10-year Treasury yield has risen rapidly to three-year highs, erasing its gap with its Chinese counterpart, something that hasn’t happened for more than a decade. As the yields cross paths – the U.S. one rising above China’s – that theoretically reverses an investment strategy that bought Chinese bonds for the greater return they offered […]

Read More

A brutal bond market sell-off wreaks havoc on one of fixed income’s most popular ETFs

Things are getting pretty bad for 30-year Treasury bonds, the prices for which are plumbing depths not seen since the early days of the Covid crisis. Source

Read More

China’s property sector could be turning around, but red-hot growth may be a thing of the past

Investor confidence in China’s real estate market appear to be boosted by the government’s promise to support the sector and some loosening of policies. But analysts say China’s high-growth property market may be a thing of the past. Getty Images | Getty Images News | Getty Images The tide may be turning on China’s battered […]

Read More

Market will break out of slump due to peaking inflation, Evercore ISI predicts

The market slump may be in its final innings. According to Evercore ISI’s Julian Emanuel, stocks should start grinding higher due to peaking inflation. He cites a positive trend going back to the last time stocks and bonds fell together: 1994. “The market just sort of digested it, and there was a lot of sideways […]

Read More

Worried about rising inflation? With nearly risk free I bonds soon to pay 9.62%, here’s what you need to know

Eakgrunge | Istock | Getty Images Less risk often means lower returns. But that’s not the case with I bonds, an inflation-protected and government-backed asset, which may soon pay an estimated 9.62%. I bonds currently offer 7.12% annual returns through April, and the rate may reach 9.62% in May based on the latest consumer price index data. Annual […]

Read More

Big banks’ earnings and a hot inflation report could sway markets in short holiday week

A trader on the NYSE, March 11, 2022. Source: NYSE Markets face what could be a hot inflation report in the week ahead and a batch of big bank earnings to start the earnings season. JPMorgan Chase and BlackRock kick off the financial industry’s first-quarter earnings releases Wednesday, with Citigroup, Wells Fargo, Morgan Stanley and […]

Read More

Wild inflation will hurt all financial assets, market researcher Jim Bianco warns

There may be no escape from the bond market turmoil — even for stock investors. Market researcher Jim Bianco warns critical Federal Reserve policies to control wild inflation will inflict widespread losses on Wall Street. “Eventually, this is going to come back and hurt all financial assets,” the Bianco Research president told CNBC “Fast Money” […]

Read More

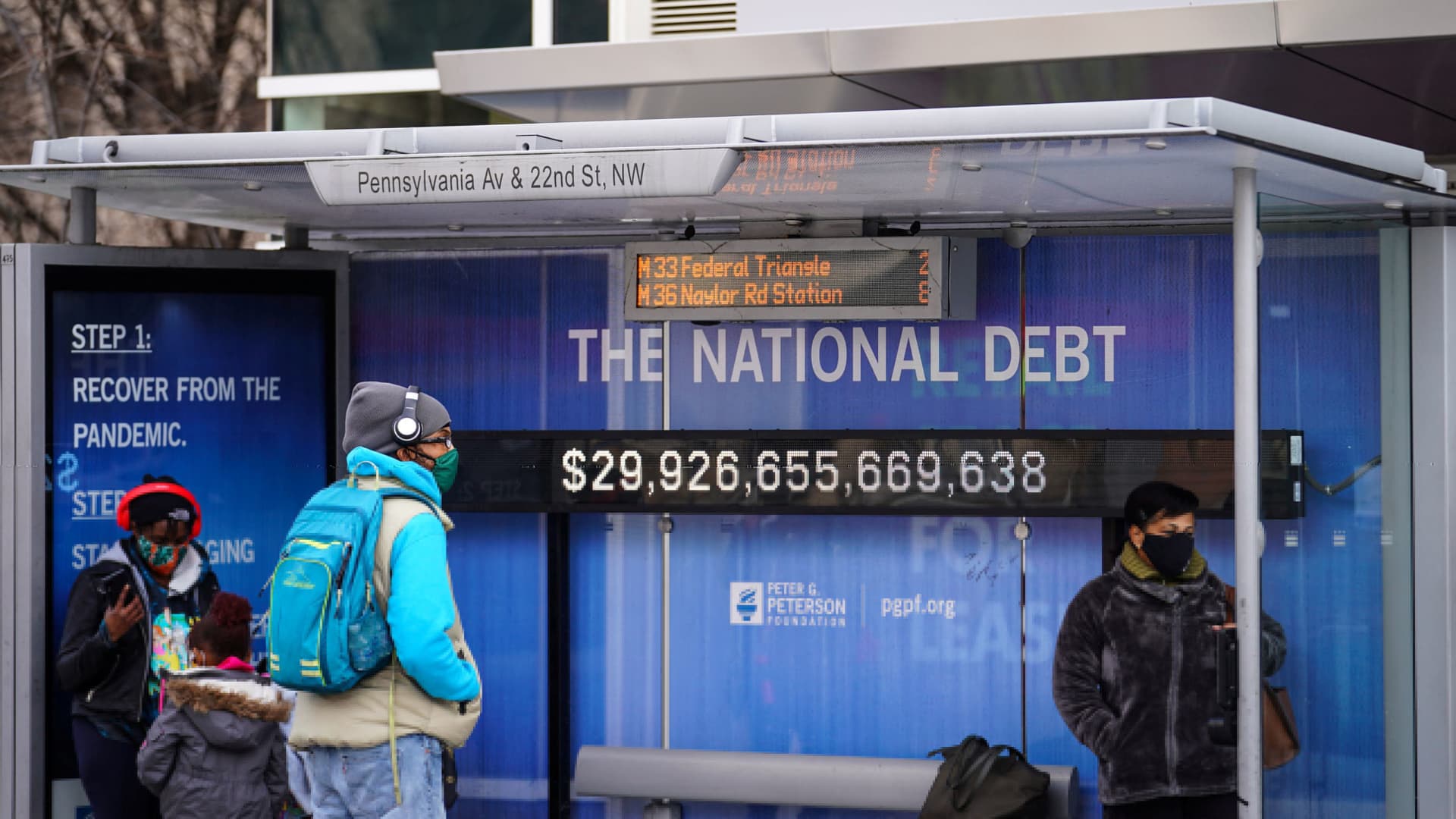

Global government debt set to soar to record $71 trillion this year, new research says

People wearing protective face masks wait at a bus stop with a display of the current national debt amid the coronavirus disease (COVID-19) pandemic in Washington, January 31, 2022. Sarah Silbiger | Reuters LONDON — Global sovereign debt is expected to climb by 9.5% to a record $71.6 trillion in 2022, according to a new […]

Read More

‘Bear market rally’ is setting stage for a correction, Morgan Stanley’s Mike Wilson warns

A major Wall Street firm is on correction watch. Despite the latest market bounce, Morgan Stanley’s Mike Wilson is bracing for an S&P 500 decline of at least 13% between now and September. Wilson cited technical headwinds on CNBC’s “Fast Money” on Monday. “It does have all the hallmarks of what I would call a […]

Read More

Markets will be looking for clues from the Fed ahead, as historically strong month gets underway

Traders work on the floor of the New York Stock Exchange (NYSE) in New York City, U.S., March 29, 2022. Brendan Mcdermid | Reuters The stock market is heading into what promises to be a volatile second quarter, but April is traditionally the best month of the year for stocks. The major indices were higher […]

Read More