Check out the companies making headlines after hours.

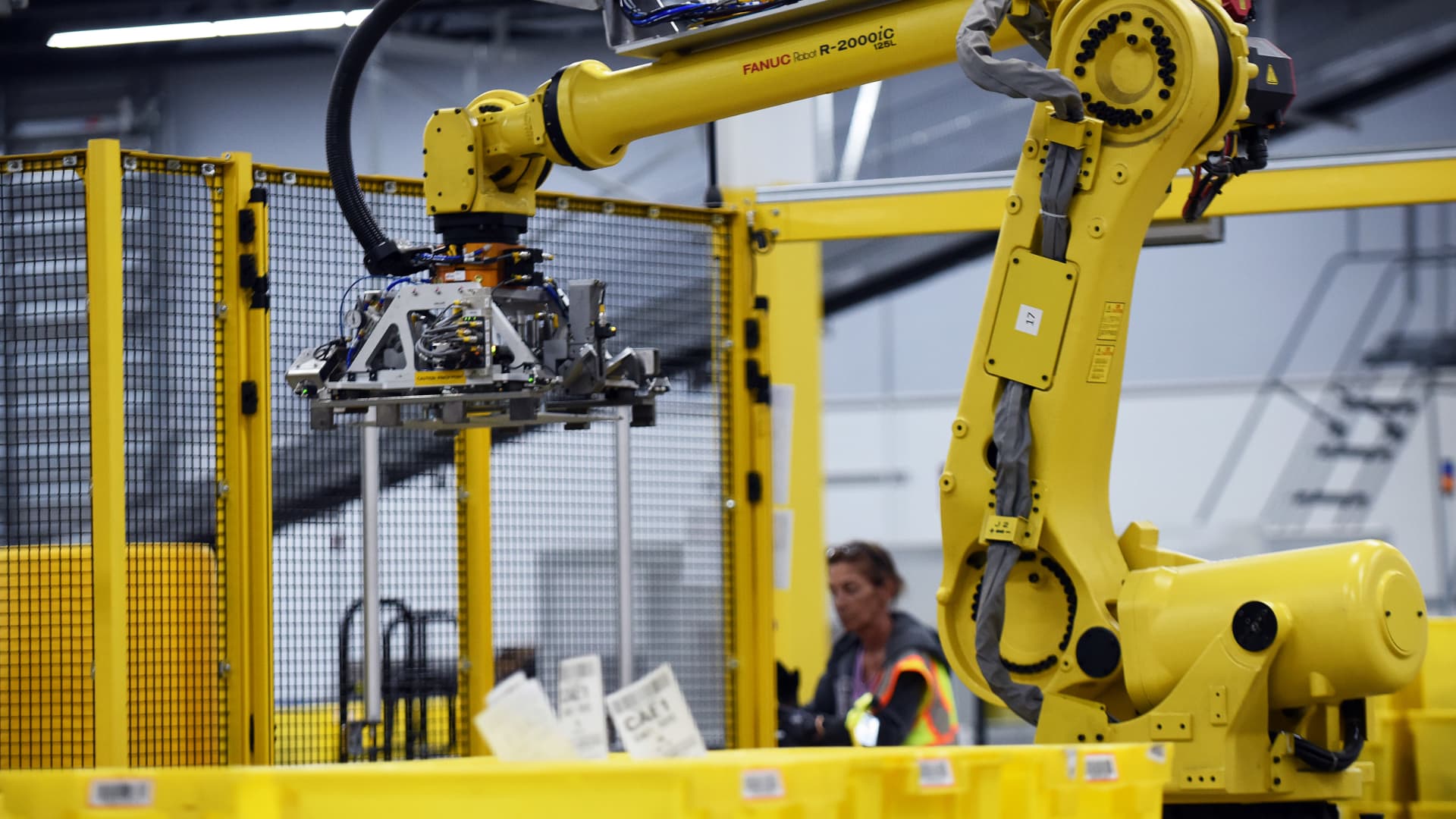

Amazon – Amazon jumped 7% in extended trading after reporting a first-quarter revenue beat. The online retail giant posted revenue of $127.4 billion, greater than the $124.5 billion consensus estimate published by Refinitiv.

Intel – Intel shares were down 1.2% after initially rising in the wake of its first-quarter results. The semiconductor firm reported its largest-ever quarterly loss. However, it did beat analysts’ expectations on the top and bottom lines. The semiconductor firm posted a first-quarter loss of 4 cents per share ex-items on revenue of $11.7 billion. Analysts polled by Refinitiv forecasted a loss per share of 15 cents on revenue of $11.04 billion.

Snap – The social media stock tumbled nearly 20% in extended trading Thursday after the firm’s first-quarter results. Snap reported first-quarter revenue of $989 million, lower than the estimated $1.01 billion, according to Refinitiv data. On the other hand, Snap earned 1 cent per share, excluding items, which was better than the forecasted per-share loss of 1 cent.

Pinterest – Pinterest shares dropped 8%. The image sharing firm surpassed expectations on the top and bottom lines in its first quarter, according to consensus estimates from Refinitiv. However, second-quarter revenue growth expectations were disappointing. The firm expects operating expenses to grow in the low teens.

Boston Beer – Boston Beer shares slid 3.2% in extended trading. The brewery behind Samuel Adams and Twisted Tea brands missed analysts’ expectations on the top and bottom lines, according to Refinitiv data.

First Solar – The solar stock shed more than 5% on disappointing first-quarter results. The firm reported earnings of 40 cents per share on $548 million in revenue. Analysts expected per-share earnings of $1.02 on revenue of $718 million, according to Refinitiv.

T-Mobile US – T-Mobile US shares declined as much as 2.5% after first-quarter revenue for the telecommunications firm came in lower than expected, according to Refinitiv.

Cloudfare – Cloudfare tumbled 23% in extended trading after posting weaker-than-expected first-quarter revenue and issuing a lackluster second-quarter and full-year forecast.

L3Harris Technologies – L3Harris Technologies added more than 3% in extended trading after beating first-quarter earnings and revenue expectations. The defense contractor posted first-quarter earnings of $2.86 per share ex-items on revenue of $4.47 billion. Analysts surveyed by Refinitiv expected per-share earnings of $2.85 on revenue of $4.25 billion.

Amgen – Amgen declined 2.2% after disappointing first-quarter revenue expectations. The biotech firm reported $6.11 billion in revenue, lower than estimates of $6.17 billion from analysts polled by Refinitiv. Amgen did beat on earnings expectations.

Fair Isaac – Shares fell 2% after Fair Isaac missed earnings estimates in its second quarter, though it did beat on revenue expectations. The data analytics firm behind the FICO score reported adjusted earnings of $4.78 per share, weaker than the consensus estimate of $5.04 per share, according to Refinitiv.

Gilead Sciences – Shares of the biopharmaceutical company fell about 1% in extended trading after it reported disappointing earnings, but topped revenue expectations, according to Refinitiv data.

Mondelez International – Mondelez International climbed 2% after posting first-quarter results that exceeded expectations on the top and bottom lines, according to consensus expectations from Refinitiv.