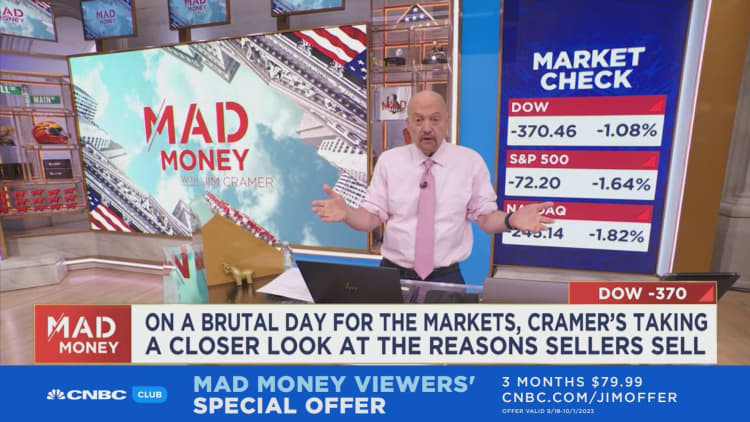

CNBC’s Jim Cramer on Thursday proposed 6 causes why investors are providing and bringing the current market down.

“Some of them make feeling, many others will not. But what you have to know is that each and every time the stock market place goes down, these reasons to offer all develop into less applicable,” Cramer explained. “That is what lessen prices do. They just take points like these into account.”

- Interest charges: Cramer mentioned charges can be a fantastic purpose to sell. If traders feel inflation is coming down as rates go greater, they may possibly want to promote shares and as an alternative enter the bond sector, choosing up extensive-term Treasurys to get a danger-totally free return.

- Macroeconomic weak spot: “Macro” headwinds insert risk to corporations hoping to close bargains and may well generate a “complicated adjustment” for investors, Cramer reported. But he also mentioned shares will come down to compensate for this weakness, and after it is really priced in, there will be a return to normalcy.

- Dread of giving up on gains: Cramer mentioned traders may perhaps sell to lock in gains they have designed previously in the 12 months. He explained this tactic may perhaps make perception for cash managers who are graded on an once-a-year foundation but not always for individual traders. In accordance to Cramer, investors promoting because of fear interprets to promoting reduced and getting superior.

- Federal Reserve: Investors may well feel cautious for the reason that the Fed is just not “sounding an all clear,” Cramer claimed. These kinds of amorphous fears are no rationale to offer, he added. Cramer inspired buyers to purchase shares that do nicely in inflation and provide them after inflation eases.

- Political local climate: Cramer acknowledged that the Democratic and Republican functions have an “insanely toxic romantic relationship,” but he thinks that dysfunction is baked into the market place.

- Strikes: Cramer famous that Wall Street might be terrified of a probable ripple influence prompted by United Vehicle Personnel strike, but he does not think it will come about for the reason that most American personnel do not belong to unions.

Cramer’s bottom line?

“The Fed cannot upend the rally due to the fact there is not a rally. Higher fees will never deliver stocks lower since they are previously down. Which is how you have to feel about things like the stock market,” he explained. “Normally, you know what? There seriously just isn’t a degree where by it feels risk-free to very own shares other than at the prime, when nobody’s concerned about just about anything. Which is not investing, though. Which is termed stupidity.”