Day: September 21, 2023

Cramer gives six reasons investors are at present offering off

CNBC’s Jim Cramer on Thursday proposed 6 causes why investors are providing and bringing the current market down. “Some of them make feeling, many others will not. But what you have to know is that each and every time the stock market place goes down, these reasons to offer all develop into less applicable,” Cramer […]

Read More

Inventory futures are flat as the current market heads for significant weekly losses: Reside updates

Traders on the floor of the New York Stock Exchange, Aug. 4, 2022. Supply: NYSE Stock futures were flat in overnight investing Thursday as the marketplace is poised to end the week with steep losses. Futures on the Dow Jones Industrial Common were being tiny changed. S&P 500 futures and Nasdaq 100 futures were being […]

Read More

Providers struggle to get latest Covid shots into arms amid early supply issues

New vaccine COMIRNATY® by Pfizer, available at CVS Pharmacy in Eagle Rock, California. Irfan Khan | Los Angeles Times | Getty Images It’s déjà vu for some Americans looking for the latest Covid-19 vaccines. Certain people who were lucky enough to snag an appointment for the latest formulation are receiving cancellation notices or showing up […]

Read More

Maui tourism still not back to entire energy given that wildfires: Hawaiian Airways CEO Peter Ingram

ShareShare Post through FbShare Posting by means of TwitterShare Posting by way of LinkedInShare Write-up by means of E mail Peter Ingram, Hawaiian Airways CEO, joins ‘Closing Bell Overtime’ to communicate downward pressure on airways, increasing gasoline costs, switching journey tendencies, the Maui wildfires and more. Supply

Read More

Wall Street’s ‘meh’ response to tech IPOs reveals Silicon Valley’s valuation trouble

Instacart celebrates their IPO at the Nasdaq on Sept. 19th, 2023. Courtesy: Nasdaq Following a 21-thirty day period tech IPO freeze, the current market has cracked opened in the earlier 7 days. But the early success can not be encouraging to any late-stage startups lingering on the sidelines. Chip designer Arm debuted very last Thursday, […]

Read More

10-12 months Treasury generate hits its highest stage considering that 2007 as jobless claims drop

U.S. Treasury yields continued their march better Thursday, achieving multiyear highs, as traders digested the Federal Reserve’s desire amount decision and forward steerage along with new unemployment info. The generate on the 10-12 months Treasury was up by about 15 basis details at 4.492%, hitting a fresh 2007 significant in the session. The 2-year Treasury […]

Read More

FTC sues Texas anesthesiology provider to bust monopoly

Federal Trade Commission (FTC) Chair Lina Khan testifies before a House Judiciary Committee hearing on “Oversight of the Federal Trade Commission,” on Capitol Hill in Washington, July 13, 2023. Kevin Wurm | Reuters The Federal Trade Commission on Thursday sued the largest anesthesiology provider in Texas, claiming the company has wielded monopoly power to drive […]

Read More

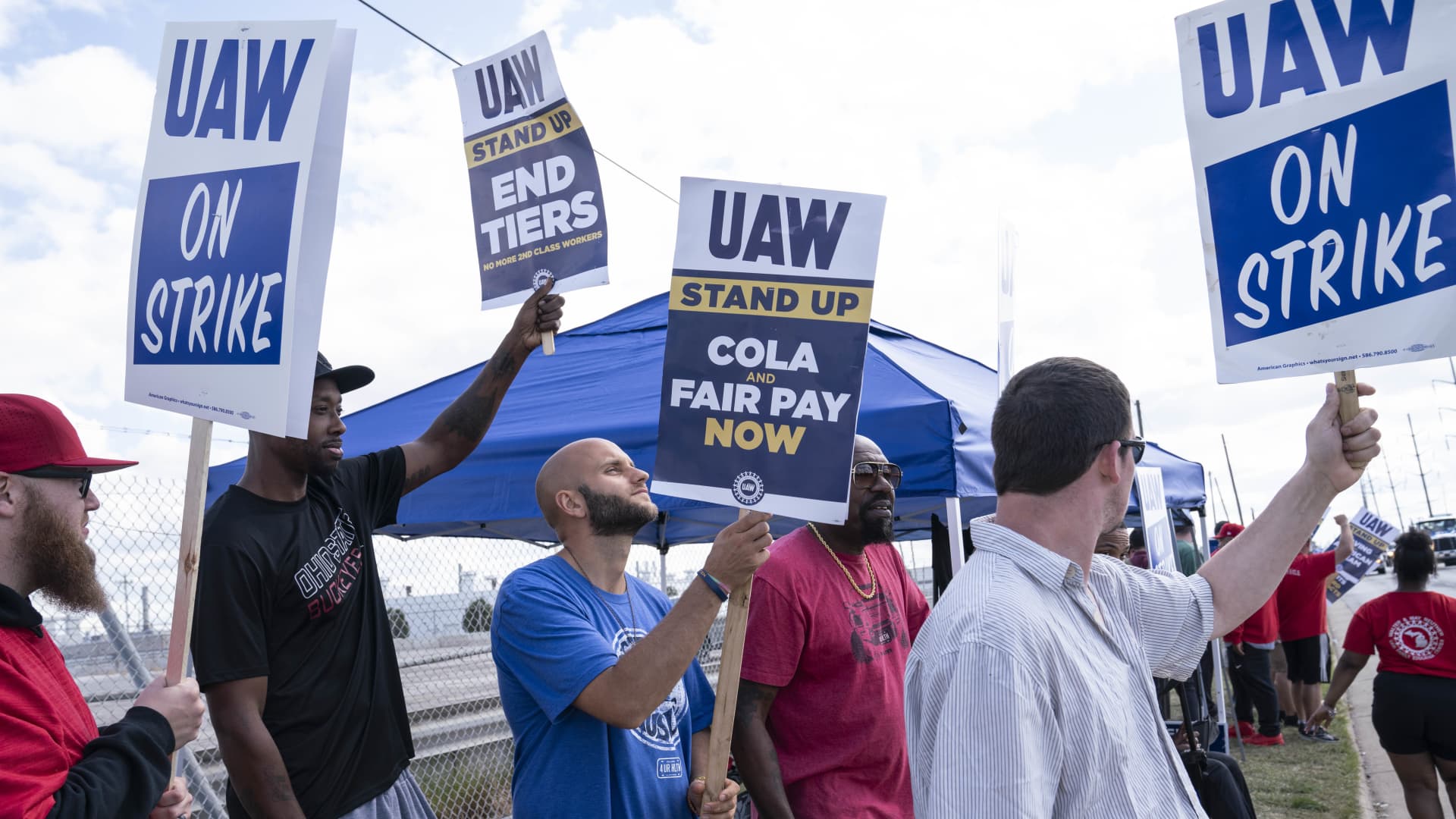

Where key issues stand as UAW closes in on extended strikes against GM, Ford and Stellantis

(L-R) Supporter Ryan Sullivan, and United Auto Workers members Chris Sanders-Stone, Casey Miner, Kennedy R. Barbee Sr. and Stephen Brown picket outside the Jeep Plant on September 18, 2023 in Toledo, Ohio. Sarah Rice | Getty Images DETROIT — With a deadline for expanded strikes by the United Auto Workers against the Detroit automakers closing […]

Read More

What larger-for-extended Fed plan will indicate for the markets and economic climate

From the market’s perspective, this week’s Federal Reserve assembly was not truly about its intentions for September. Or for the relaxation of 2023. Or even for 2024, for that matter. What the central financial institution truly conveyed, and what has rattled marketplaces, is an intent that no matter of irrespective of whether it hikes one […]

Read More