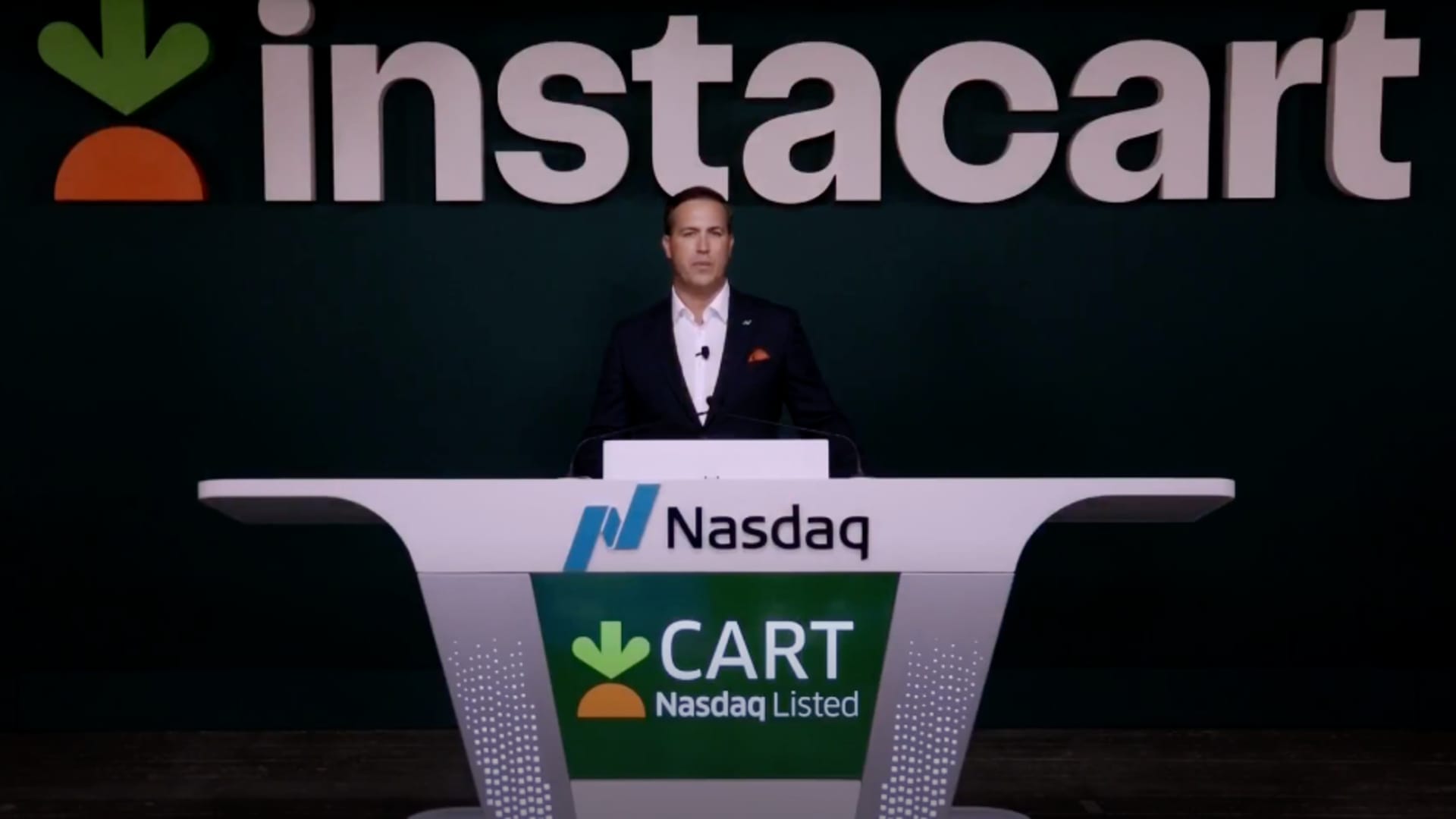

Instacart celebrates their IPO at the Nasdaq on Sept. 19th, 2023.

Courtesy: Nasdaq

Following a 21-thirty day period tech IPO freeze, the current market has cracked opened in the earlier 7 days. But the early success can not be encouraging to any late-stage startups lingering on the sidelines.

Chip designer Arm debuted very last Thursday, followed by grocery delivery organization Instacart this Tuesday, and cloud software program seller Klaviyo the following day. They are 3 really distinctive providers in disparate sections of the tech sector, but Wall Street’s response has been reliable.

Buyers who acquired at the IPO rate built cash if they marketed suitable absent. Just about every person else is in the crimson. That’s high-quality if a company’s purpose is just to be community and produce the possibility for workforce and early traders to get liquidity. But for most corporations in the pipeline, specially people with enough cash on their balance sheet to stay non-public, it presents tiny allure.

“People are concerned about valuations,” reported Eric Juergens, a husband or wife at law company Debevoise & Plimpton who focuses on money marketplaces and non-public fairness. “Viewing how people firms trade above the subsequent couple months will be significant to see how IPO markets and fairness markets a lot more typically are valuing individuals companies and how they may possibly value similar providers wanting to go community.”

Juergens mentioned, based mostly on his conversations with businesses, the current market is likely to open up up more in the first 50 % of following 12 months basically for the reason that of pressure from investors and workforce as effectively as financing prerequisites.

“At some stage companies need to go public, no matter whether it truly is a PE fund hunting to exit or workforce on the lookout for liquidity or just the need to have to elevate capital in a superior interest charge environment,” he reported.

Arm, which is controlled by Japan’s SoftBank, observed its shares soar 25% in their to start with working day of buying and selling to near at $63.59. Every single day considering that then, the stock has fallen, and it closed on Thursday at $52.16, narrowly above the $51 IPO cost.

Instacart popped 40% immediately right after providing shares at $30. But by the stop of its very first day of trading, it was up just 12%, and that acquire was almost all wiped out on day two. The stock rose 1.8% on Thursday to near at $30.65.

Klaviyo rose 23% based on its initially trade on Wednesday, prior to offering off through the day to shut at $32.76, just 9% increased than its IPO price tag. It rose 2.9% on Thursday to $33.72.

None of these firms were being anticipating, or even hoping for, a large pop. In 2020 and 2021, in the course of the frothy zero interest rate times, initial-working day jumps had been so spectacular that bankers have been criticized for handing out free funds to their buyside buddies, and firms were slammed for leaving far too substantially dollars on the desk.

But the deficiency of exhilaration around the past 7 days — amounting to a collective “meh” across Wall Street — is undoubtedly not the wanted consequence either.

Instacart CEO Fidji Simo acknowledged that her company’s IPO was not about seeking to enhance pricing for the firm. Instacart only bought the equivalent of 5% of superb shares in the featuring, with co-founders, early workers, previous staffers and other current traders selling an additional 3%.

“We felt that it was definitely critical to give our personnel liquidity,” Simo told CNBC’s Deirdre Bosa in an job interview just after the presenting. “This IPO is not about raising funds for us. It really is seriously about producing certain that all staff members can have liquidity on shares that they perform quite difficult for. We were not hunting for a fantastic current market window.”

Odds are the window was in no way heading to be great for Instacart. At the tech industry peak in 2021, Instacart elevated cash at a $39 billion valuation, or $125 a share, from top-tier buyers such as Sequoia Funds, Andreessen Horowitz and T. Rowe Price tag.

During previous year’s marketplace plunge, Instacart had to slash its valuation many periods and change from expansion to gain manner to make certain it could make dollars as fascination prices have been climbing and buyers ended up retreating from possibility.

Expanding into valuation

The combination of the Covid shipping and delivery growth, low interest charges and a decade-lengthy bull marketplace in tech drove Instacart and other online, software program and e-commerce corporations to unsustainable heights. Now it can be just a issue of when they get their drugs.

Klaviyo, which provides marketing and advertising automation technological innovation to companies, under no circumstances received as overheated as numerous many others in the industry, elevating at a peak valuation of $9.5 billion in 2021. Its IPO valuation was just beneath that, and CEO Andrew Bialecki instructed CNBC that the company was not beneath strain to go general public.

“We’ve acquired a good deal of momentum as a small business. Now is a wonderful time for us to go public particularly as we go up in the business,” Bialecki stated. “There seriously wasn’t any stress at all.”

Klaviyo’s revenue greater 51% in the most up-to-date quarter from a calendar year before to $165 million, and the business swung to profitability, creating pretty much $11 million in internet money soon after losing $11.7 million in the exact period of time the prior calendar year.

Even although it averted a main down round, Klaviyo had to raise its profits by about 150% about two decades and switch successful to about continue to keep its valuation.

“We consider providers should be rewarding,” Bialecki said. “That way you can be in management of your have destiny.”

Whilst profitability is fantastic for demonstrating sustainability, it is not what tech buyers cared about all through the file IPO a long time of 2020 and 2021. Valuations have been based mostly on a a number of to long term income at the cost of opportunity earnings.

Cloud software and infrastructure companies were in the midst of a landgrab at the time. Venture corporations and large asset professionals were subsidizing their expansion, encouraging them to go significant on gross sales reps and burn up piles of income to get their products and solutions in customers’ hands. On the shopper aspect, startups elevated hundreds of tens of millions of dollars to pour into marketing and, in the scenario of gig financial state providers like Instacart, to entice agreement staff to opt for them more than the levels of competition.

Instacart was proactive in pulling down its valuation to reset trader and worker anticipations. Klaviyo grew into its lofty cost. Amid high-valued companies that are even now personal, payments application developer Stripe has lower its valuation by almost fifty percent to $50 billion, and design computer software startup Canva lowered its valuation in a secondary transaction by 36% to $25.5 billion.

Non-public equity firms and undertaking capitalists are in the organization of profiting on their investments, so ultimately their portfolio corporations have to have to hit the general public market place or get obtained. But for founders and management teams, currently being public usually means a likely unstable inventory price and a need to update buyers each quarter.

Offered how Wall Street has obtained the 1st notable tech IPOs given that late 2021, there may perhaps not be a ton of reward for all that stress.

Still, Aswarth Damodaran, a professor at New York University’s Stern School of Small business, said that with all the skepticism in the sector, the most current IPOs are accomplishing Ok due to the fact there was a panic they could drop 20% to 25% out of the gate.

“At one particular amount the people pushing these companies are possibly heaving a sigh of relief for the reason that there was a pretty authentic chance of disaster on these firms,” Damodaran instructed CNBC’s “Squawk Box” on Wednesday. “I have a sensation it will get a 7 days or two for this to participate in out. But if the inventory cost stays above the offer you price two months from now, I believe these organizations will all watch that as a earn.”

Look at: NYU professor explains why he doesn’t trust SoftBank-backed IPOs