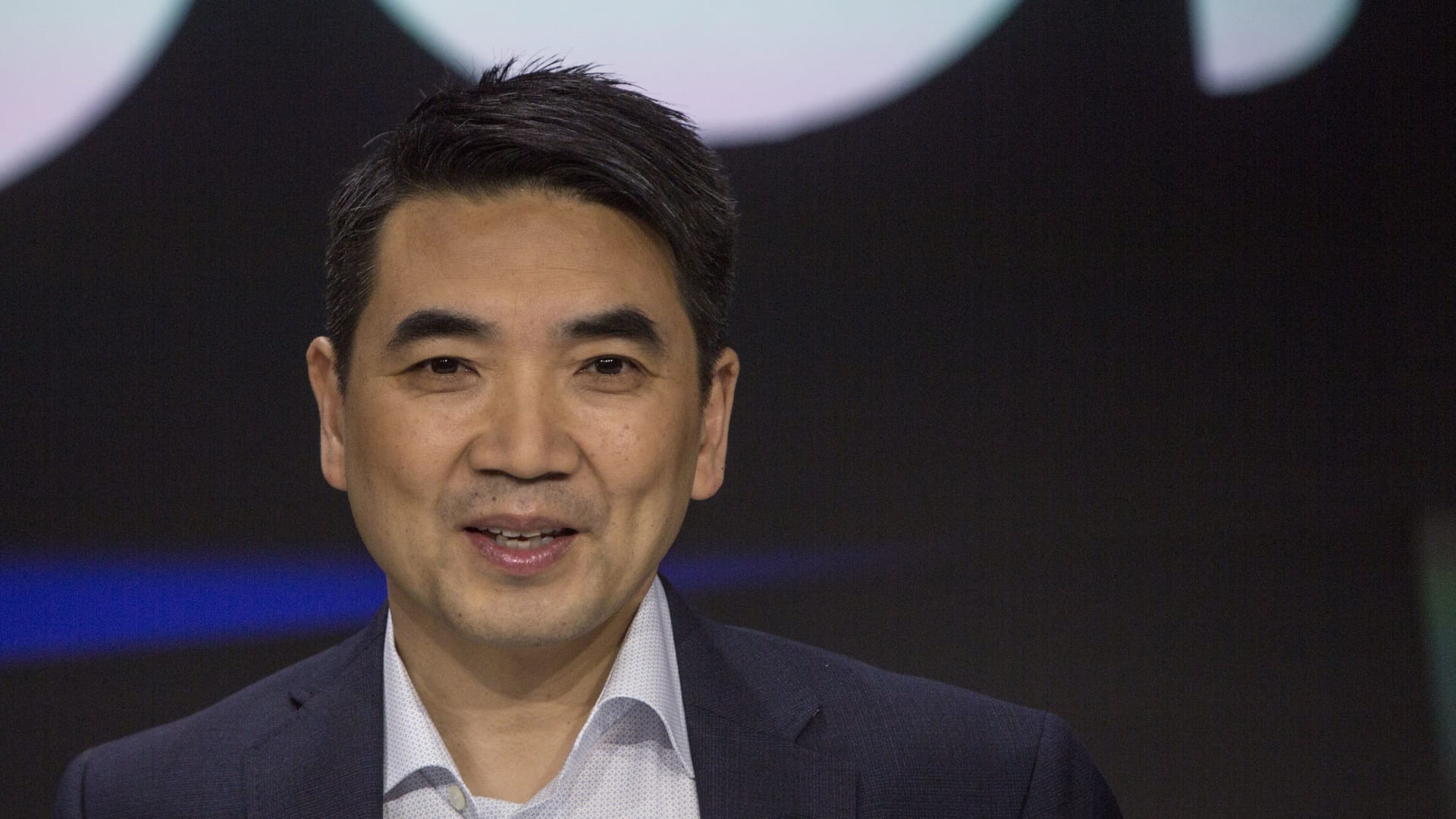

Eric Yuan, founder and main government officer of Zoom Movie Communications, stands in advance of the opening bell all through the firm’s initial community presenting at the Nasdaq MarketSite in New York on April 18, 2019.

Victor J. Blue | Bloomberg | Getty Pictures

Zoom shares rose as considerably as 13% in extended buying and selling on Monday right after the movie chat software program seller introduced fiscal fourth-quarter outcomes that topped analysts’ anticipations.

Here is how the firm did, as opposed with consensus amid analysts polled by LSEG:

- Earnings per share: $1.22, adjusted vs. $1.15 anticipated

- Profits: $1.15 billion vs. $1.13 billion envisioned

Revenue enhanced significantly less than 3% from $1.12 billion a calendar year before, in accordance to a assertion. The organization noted web income of $298.8 million, or 98 cents per share, for the quarter ended Jan. 31, compared with a net reduction of $104.1 million, or 36 cents for every share, in the 12 months-back quarter.

Far from its heyday for the duration of the Covid pandemic, when a surge in the selection of remote workers despatched profits up more than 100% for five straight quarters, Zoom is now mired in solitary-digit advancement.

For the fiscal 1st quarter, Zoom identified as for $1.18 to $1.20 in modified earnings for each share on $1.125 billion in income, which would characterize expansion of considerably less than 2% from a calendar year earlier. Analysts surveyed by LSEG have been wanting for $1.13 in adjusted earnings for each share and $1.13 billion in earnings.

For the 2025 fiscal 12 months, Zoom sees $4.85 to $4.88 in adjusted earnings for each share, with $4.60 billion in earnings, implying 1.7% earnings progress. The LSEG consensus was adjusted earnings of $4.71 for every share and profits of $4.65 billion.

Before the jump, Zoom shares have been down 12% so far this year, although the S&P 500 inventory index experienced acquired 6% in excess of the exact same period of time.

Executives will go over the results with analysts on a meeting connect with starting up at 5 p.m. ET.

This is breaking news. Make sure you check out back again for updates.

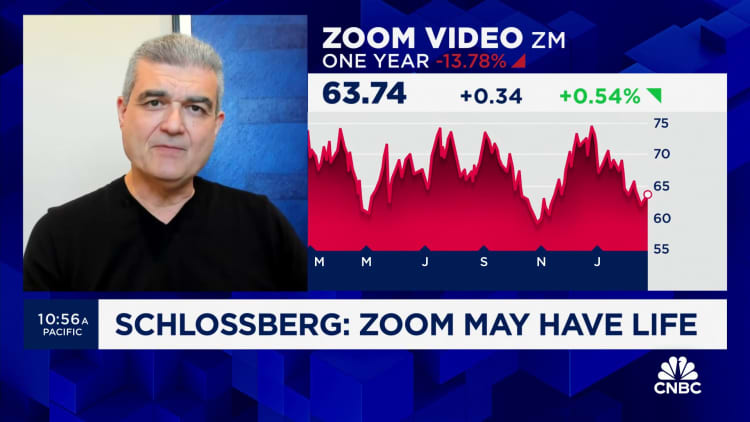

Look at: Boris Schlossberg on Zoom: ‘It has a prospect to definitely glow likely forward’