The U.S. Federal Reserve is determined not to decrease interest fees as well soon — and some economists say new data has pushed a summer season slash wholly off the desk.

Friday’s jobs report reiterated the seemingly unwavering toughness of the U.S. labor current market and suggested even more need to have for Fed warning. All eyes will now be on Wednesday’s customer price index, after February’s annual inflation level of 3.2% came in a little bit bigger than predicted.

It comes as a developing selection of industry individuals have elevated the risk of no charge cuts at all this yr, like Minneapolis Fed President Neel Kashkari who mentioned final 7 days that no reductions have been a feasible circumstance if inflation continued to go sideways.

George Lagarias, chief economist at Mazars, informed CNBC on Monday that level cuts in the summer time were being now seeking significantly significantly less likely.

“Individually, I wouldn’t be astonished if we observed a lot less charge cuts and pushed far more in direction of the close of the 12 months,” he explained to “Squawk Box Europe” on Monday.

“This is a sturdy economy. Make no oversight, it is backed by credit card debt and relatively by overburdened credit rating playing cards, but it is a strong economy. So the Fed will wrestle to locate the case to minimize costs quickly.”

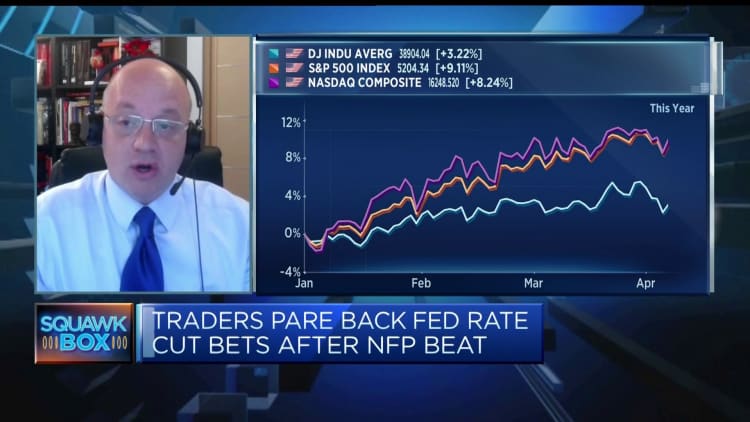

Market place pricing displays the ongoing uncertainty, with the probability of a price minimize now beneath 50% for both equally June and July, according to the CME’s FedWatch instrument — appreciably lower than at the start out of the month.

“The Fed has been punishing alone at any time given that 2021 when ‘team transitory’ ostensibly got it completely wrong. … What they experience is that they cannot get it improper once more, which usually means that they’re far more most likely to err on the facet of warning,” Lagarias included.

Despite this, he mentioned it stays “incredibly possible” that there will be level cuts this calendar year.

“They do have some area to cut, but they don’t want to get it improper. They do not want to be the Fed that cut prices as inflation held beating expectations. So they want to see much more info toward the ideal way and they are ready to hold out,” Lagarias included.

No price cuts?

Speculation that there could be no interest level reductions this yr has been expanding, although economists keep on being divided.

Torsten Slok, chief economist at Apollo Worldwide Administration, said very last month that he would not anticipate any cuts as the U.S. financial system is “merely not slowing down,” and prime U.S. asset manager Vanguard has no charge reductions as its foundation circumstance for the calendar year.

While former Federal Reserve Vice Chairman Roger Ferguson instructed CNBC last 7 days he sees a 10%-15% opportunity of no cuts this 12 months.

Other analysts and economists are however backing the Fed’s individual signaling in March that it expects a few quarter-proportion point cuts this calendar year.

Primarily based on present-day expansion and inflation forecasts, Goldman Sachs Chief Economist Jan Hatzius informed CNBC on Friday he would “assume some fee cuts primarily based on what Chair Powell and other Fed officers have stated.”

“The timing of that of program is going to depend on near-phrase data, on the response perform from the Fed but under our forecast I would be fairly amazed if we failed to get charge cuts this yr. Fairly surprised.”