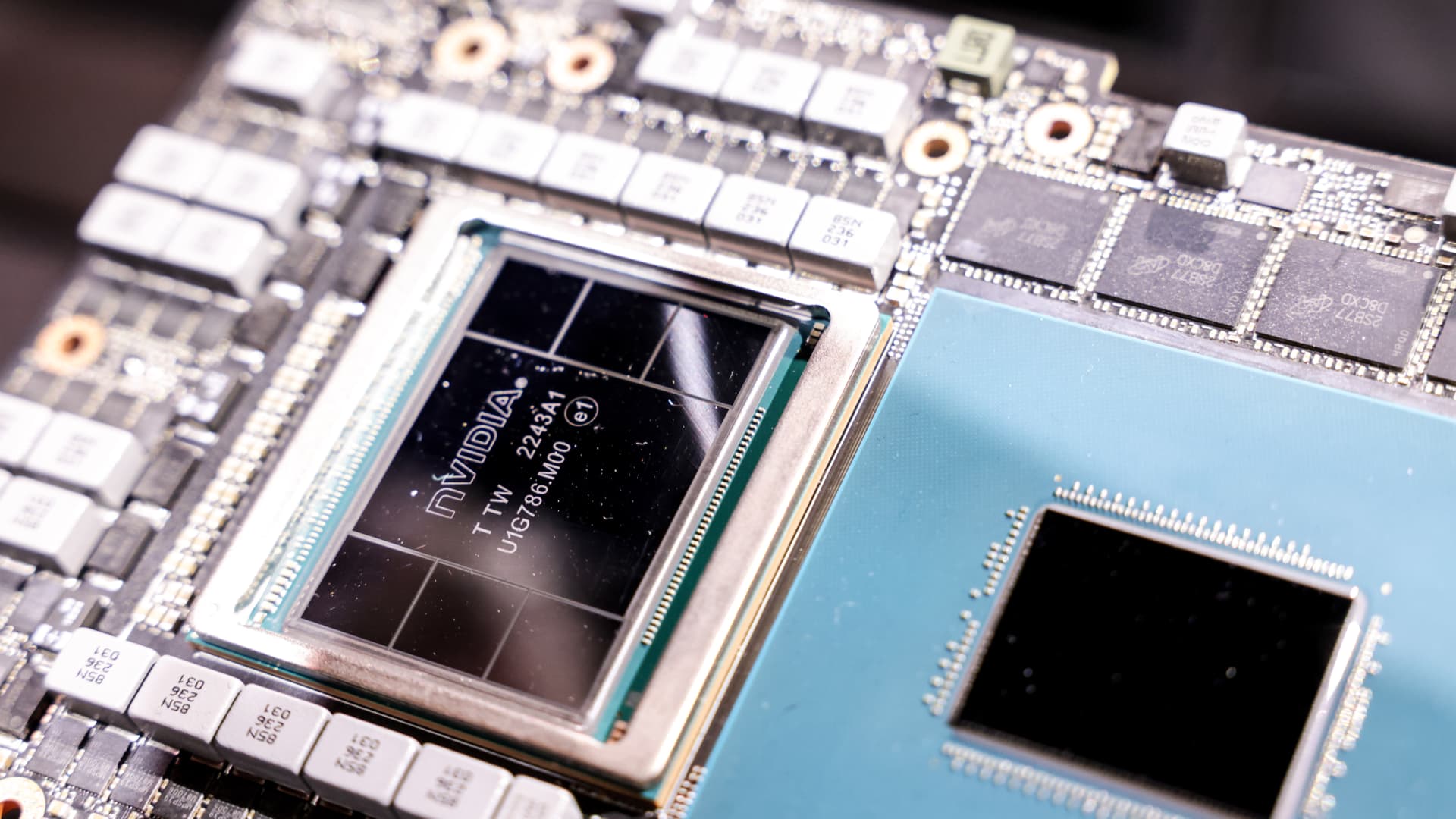

As the buzz around AI demonstrates several signs of slowing, just one analyst has recognized a number of warning indicators that a correction could be on the way. In a exploration notice entitled, “Magic Dollars Tree,” Richard Windsor, veteran tech inventory analyst and founder of investigation firm Radio Totally free Cell, warned that revenue was flowing into the AI sector, “with very very little notice currently being paid to business fundamentals in a absolutely sure sign that when the songs stops there will not be several chairs available.” He outlined a few the latest functions that give him lead to for problem: Cohere valuation The initially is that generative AI enterprise Cohere is reportedly on track to elevate cash at a $5 billion valuation. That is pretty much double its worth in June last yr when the startup raised $270 million at a $2.2 billion valuation. Windsor explained this as “the latest indicator of … reckless abandonment.” “Cohere will now be worth $5bn even though the once-a-year run fee of its profits in 2023 was just $13m,” he explained in the observe on Mar. 28. He claimed the compay’s “valuation equates to a historic value/sales ratio of 384x which implies that buyers have one more bad scenario of FOMO (fear of missing out) and are hurrying into anything that can be remotely linked with AI.” The firm’s President Martin Kon a short while ago instructed CNBC that Cohere — backed by Nvidia and started off by ex-Google AI researchers — is betting on generative AI for enterprise use, relatively than on chatbots. Inflection AI deal Windsor, who for 11 years included the worldwide tech sector at Nomura Securities prior to starting up his have company, elevated another “red flag”: Microsoft’s clear offer with Inflection AI. “An additional red flag was Microsoft’s means to use the CEO and 70 employees from the AI commence-up Inflection AI,” he said. “Points ended up not heading well at Inflection AI simply because if the firm experienced been executing very perfectly, Microsoft’s developments would have been swiftly rebuffed.” In what is actually been described as an ” uncommon offer ,” tech huge Microsoft has reportedly agreed to shell out Inflection AI about $650 million in funds, enabling it to hire the startup’s staff members and use its technology. Amazon investment decision Emphasizing the “FOMO outcome” close to AI, Windsor noted that even tech huge Amazon is just not immune. “Amazon has thrown yet another $2.75bn of its full $4bn determination at Anthropic, and I am fairly selected that Amazon will conclude up obtaining the organization,” he mentioned. Amazon’s biggest-ever investment decision will see it continue on to pump income into the generative AI start-up, which has a chatbot Claude that competes with OpenAI ‘s ChatGPT. Shares to purchase if ‘forced’ “The frenzy continues but it is a person I am correctly snug staying effectively away from,” Windsor claimed of the AI sector at this time. If “forced” to get into the house, Windsor reported he would invest in Nvidia, noting that the U.S. chipmaking big has been the most important beneficiary of the AI hoopla to day. The inventory is up around 80% 12 months-to-date and 240% more than the last 12 months. “Nvidia is truly the only organization that is making tangible income from the current boom in desire in financial investment in generative AI but when there is a correction, there will be nowhere for Nvidia to escape, though I suspect that it will be harm a great deal considerably less than numerous other people,” he mentioned. He additional that he currently owns chip stock Qualcomm , which is in a “quite very good position to reward as generative AI starts to be carried out at the edge.” — CNBC’s Kate Rooney contributed to this report.