Trader Steve Eisman of “The Significant Brief” fame is questioning the amount of bullishness on Wall Street — even with the market’s tepid start off to the yr.

From enthusiasm bordering the “Outstanding 7” technological innovation stocks to expectations for numerous fascination rate cuts this calendar year, Eisman thinks there is certainly tiny tolerance for things heading mistaken.

“Extended time period, I am nonetheless incredibly bullish. But in the vicinity of phrase I just get worried that every person is coming into the 12 months feeling also very good,” the Neuberger Berman senior portfolio supervisor explained to CNBC’s “Rapid Cash” on Tuesday.

On the year’s first day of buying and selling, the tech-weighty Nasdaq fell 1.6% p.c, the S&P 500 fell .6%, and the Dow eked out a acquire. The big indexes are coming off a traditionally solid year: The Nasdaq rallied 43%, when the S&P 500 soared 24%. The 30-inventory Dow was up approximately 14% in 2023.

“The market place climbed a wall of fear the complete 12 months. So, now in this article we are a 12 months afterwards, and every person including me has a very benign see of the economy,” Eisman stated. “It can be just that all people is coming into the 12 months so bullish that if there are any disappointments, you know, what is actually going to maintain the sector up?”

Eisman notes that much less fee hikes than predicted in 2024 could arise as a adverse short-time period catalyst. The Federal Reserve has penciled in three amount cuts this year, although fed resources futures pricing implies even additional trimming. Eisman thinks these anticipations are too intense.

“The Fed is continue to petrified of making the slip-up that [former Fed Chief Paul] Volcker designed in the early ’80s wherever he stopped boosting costs, and inflation bought out of regulate all over again,” claimed Eisman. “If I am the Fed and I am wanting at the Volcker lesson, I say to myself ‘What’s my rush? Inflation has occur in.'”

But, Eisman implies it’s however a wait-and-see predicament.

“If you had to lay your life on the line, I would say 1 [cut] unless of course there is certainly a recession. If there’s no economic downturn, I don’t see any motive why the Fed demands to be intense at reducing prices,” he stated. “If I am in [Fed chief Jerome] Powell’s seat, I pat myself on the again and say ‘job perfectly accomplished.'”

‘Housing shares are justified’

Eisman, who’s identified for predicting the 2007-2008 housing market collapse and profiting from it, appears to be warming up to homebuilding shares.

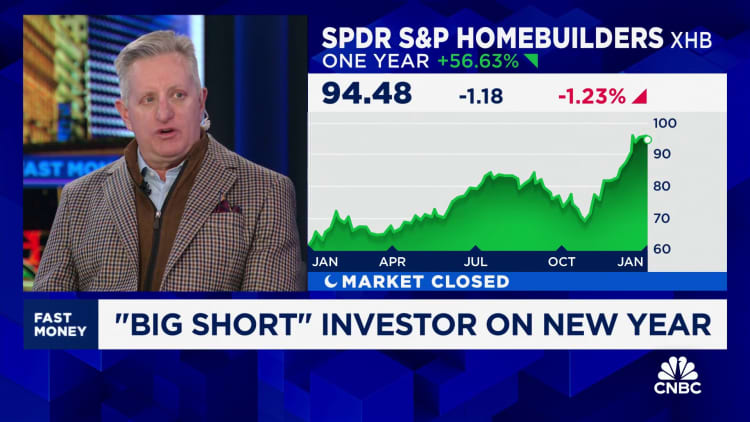

The investor said on “Quick Income” in October it was a team he was staying away from. The SPDR S&P Homebuilders ETF, which tracks the team, is up 25% due to the fact that job interview and 57% over the earlier 52 months.

“The housing shares are justified in the feeling that the homebuilders have fantastic equilibrium sheets. They are equipped to invest in down costs to their clients, so that the shoppers can pay for to purchase new homes,” he said. “There is a scarcity of new households.”

Nevertheless, Eisman skips housing amongst his prime 2024 top performs. He specially likes locations of technological know-how and infrastructure.

Disclaimer