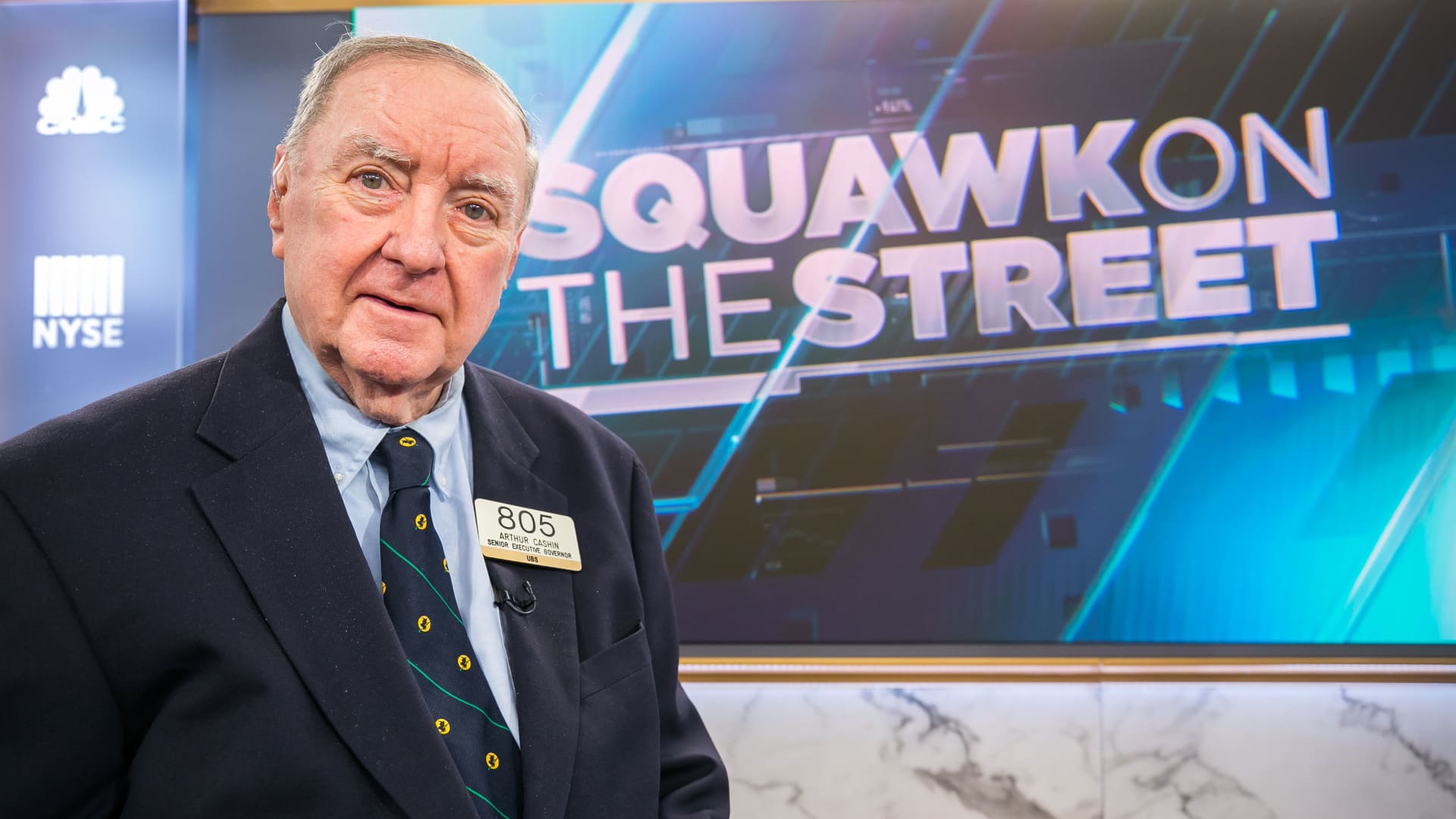

Artwork Cashin, UBS director of ground operations, is wary of this week’s two-working day monster rally in stocks. “The rally was very extraordinary, regretably I was not pleased with the spark that commenced it, that party-danger plan,” he said on CNBC’s “Squawk on the Street” on Wednesday. Cashin sees the rally as commenced by the Lender of England’s transfer to scrap the advertising of gilts (U.K. governing administration bonds) and start out briefly acquiring extensive-dated bonds to quiet a possible current market meltdown that was prompted by the new government’s spending budget. Later, the federal government experienced to reverse its plans to fall its prime profits tax price. Furthermore, the United Nations Conference on Trade and Progress recently warned central banks that ongoing curiosity amount hikes could harm the international economy. “Section of the transfer that we observed, and it truly is actually a great two-working day rally, is people assuming that the Fed and other central banks could possibly pause,” stated Cashin. What is up future Future, Cashin said he will be seeing for earnings season, which begins shortly. Until finally then, he’ll be on the lookout for markdowns to estimates. He is also impressed by a couple of other factors in the marketplace, this kind of as the yields on Treasury inflation-protected securities, which appear to be to display that inflation is coming down and may possibly even be close to the Federal Reserve’s 2% focus on. “Just one swallow will not make a summer months, but maintain your eye on the Suggestions produce below,” he stated. If inflation does proceed to appear down, it could induce policymakers to halt rate hikes and mirror on their upcoming move, Cashin included. “We don’t want to see them basically turn about,” he said. “We just want to see them pause and reflect.”