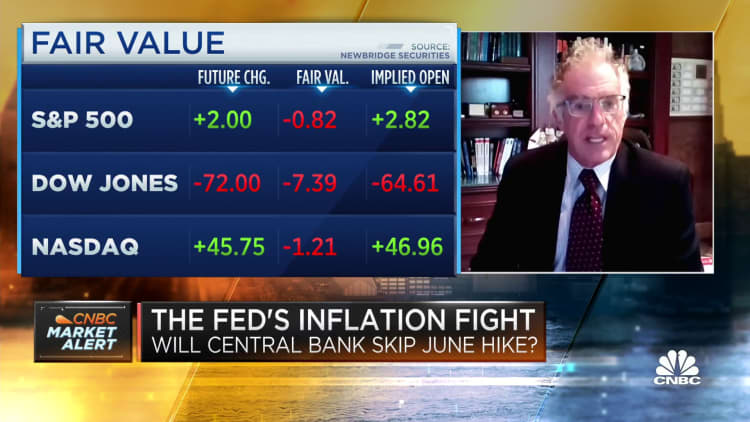

Traders are signaling that a pause in desire charge hikes is the most probably final result of this week’s Federal Open up Current market Committee conference of the Federal Reserve, and that comes at a time when some strategists are stating a new bull marketplace is underway. The Dow Jones Industrial Typical posted three successful classes in a row to conclude final week, the NASDAQ Composite noticed its sixth-consecutive constructive week for the initially time due to the fact November 2019, and all major indices shut previously mentioned their 50-working day and 200-day shifting averages on Friday.

“The bear market is officially more than,” Bank of America equity strategist Savita Subramanian a short while ago stated, noting that the S&P 500 has risen 20% previously mentioned its Oct 2022 reduced.

Some question the new bull industry connect with centered on how slender market management has been — a handful of the most significant tech stocks liable for significantly of the rebound in sector indexes. But there is one more significant rationale buyers should not turn out to be overconfident. Even if the Federal Reserve decides to pause when it announces its most up-to-date FOMC decision on Wednesday, a more time-lasting shift by the Fed in its most aggressive period of financial coverage due to the fact the 1980s is by no suggests sure, or warranted.

Which is according to previous Federal Reserve vice chair Roger Ferguson.

Final month, the Fed authorized the tenth desire level hike in just over a calendar year, the swiftest financial coverage tightening that the central bank has carried out since the 1980s, with substantial repercussions not only for the stock and bond markets, but for the economic system and buyers. In its May well FOMC meeting statement, the Fed taken off language about the will need for “further policy firming” in order to realize inflation targets. That is aided sustain the bulk view in the market that a pause will be declared this week.

But Ferguson stays unconvinced.

“I think the pause here is genuinely a closer simply call than the sector now expects,” he claimed in an interview with CNBC’s “Squawk Box” on Friday. And even if the Fed does pause, Ferguson suggests it isn’t going to necessarily mean that far more level hikes aren’t coming above the rest of the calendar year.

“The market should really brace itself for a Fed that is heading to proceed to be hiking even if this a single transpires to be a pause,” Ferguson claimed.

He is just not by yourself in the view that a Fed pause will never previous lengthy. “We consider the Fed ends up skipping this month, but location the desk for steps in July,” said Michelle Girard, head of U.S. at NatWest Marketplaces, in an interview with CNBC’s senior economics reporter Steve Liesman previous 7 days.

A pause is remarkably likely, according to previous Atlanta Fed President Dennis Lockhart. However, he pointed out in an interview with CNBC’s “Closing Bell Overtime” that inflation will proceed to pose an concern for the Fed. “There are some signs that can be grasped of declining inflation, but it is incredibly gradual. I assume the committee nevertheless has a huge obstacle, particularly with a 2% focus on,” Lockhart reported, referring to the Fed’s stated intention of bringing inflation back down to a focus on assortment of 2% in excess of the more time term.

On an yearly basis, the inflation fee was 4.9% in April, a little bit much less than the sector estimate, but it stays “sticky,” equally as noticed in price ranges all through the economic system, and in the expectations of lots of CEOs on the history as expressing inflation will persist. This upcoming week will include the hottest go through on the once-a-year and every month inflation pattern with the Might purchaser rate index report owing on Tuesday, the first working day of the Fed’s two-day FOMC conference.

Traders react as Federal Reserve Chair Jerome Powell is seen providing remarks on a screen, on the flooring of the New York Stock Exchange (NYSE), May possibly 3, 2023.

Brendan McDermid | Reuters

Ongoing concern about inflation is 1 of the factors that qualified prospects Ferguson to see a greater possibility of a hike appear Tuesday. This check out is underpinned by, amongst other factors, a labor industry that proceeds to be tight. Wage progress has cooled, and unemployment is growing. But Ferguson cited the close to 1.7-1.8 positions for every unemployed man or woman, far higher than the norm and wages that have continued to go up, not only in the the latest countrywide data but also in conditions of what he is hearing anecdotally from CEOs — Ferguson is on the board of administrators for a number of big businesses, together with Alphabet and Corning.

“I consider total the photo is 1 of inflation and inflation pressures that are greater and stickier than the 2% variety that the Fed has been aiming for. So I feel it is the data which is previously here which is telling us additional hikes on the way,” he stated.

Other individuals see modern cooling the labor current market as a signal the Fed may well before long have much more need to have to reasonable its fee hike method. Wharton professor Jeremy Siegel just lately advised CNBC that when the Fed has expressed strong commitment to reducing inflation, the central bank’s twin mandate is acquiring its concentrate on inflation level and marketing maximum employment. On a historic basis, unemployment remains particularly minimal — underneath 4% —but jobless claims just lately hit the optimum amount since October 2021.

“I am talking about development listed here,” Siegel mentioned.

For now, the Fed can be “as aggressive and hawkish as they are,” Siegel said, due to the fact there has not been much of a pickup in unemployment, and employees proceed to truly feel self-assured about their task market prospects. There are some indications that employee self-confidence is on the decline. The most up-to-date shopper self-assurance index examining from the Convention Board confirmed that buyer assessment of present-day employment ailments seasoned “the most significant deterioration” in May perhaps among shopper sentiment knowledge it tracks. Labor economists have explained to CNBC that on balance the most recent details from the labor sector supports Fed Chair Jerome Powell’s perspective that the central financial institution can engineer a soft landing for the economy.

“There is practically nothing below that makes me think we are not in a comfortable-landing situation,” said Rucha Vankudre, senior economist at labor market place marketing consultant Lightcast in a latest interview soon after the May perhaps nonfarm payrolls report. “I wouldn’t be astonished if the Fed decides to maintain fees the place they are. All indicators are the financial state is going in the correct path.”

Nick Bunker, director of economic investigate at Without a doubt Using the services of Lab, says all the the latest information details are broadly in line with the comfortable-landing speculation. “The broad photo below is the labor current market is cooling in a sustainable way. There are signals of moderation and not a ton of pink flags,” Bunker stated.

But there is an old indicating on Wall Road that the position current market is usually the very last to know when a economic downturn hits.

“Let me say one thing,” Siegel advised CNBC. “If we get a damaging occupation report within the upcoming month, upcoming two months, it really is heading to strike headlines, very first time considering that Covid. And then people are going to say, ‘Oh, can I be assured that I’m likely to get yet another task?’ And that is heading to play into politics and I believe is likely to stress the Fed on the other aspect, and then they’re going to start off to say, ‘Okay, perhaps inflation is going to get improved.”

Goldman Sachs a short while ago reduced its household view on the odds that the U.S. financial state enters a recession, but its own CEO David Solomon — who remains confident increased inflation will be persistent — and Ferguson, continue being uncertain about how long term Fed choices will condition the economic outlook. Solomon stated at the current CNBC CEO Council Summit that “some structural factors heading on” related to inflation will make it tricky to “very easily” get back again to the Fed’s 2% target, and even if the Fed pauses, based mostly on what he sees now in the economic climate there is no expectation of level cuts by the stop of the year — an outcome bond traders have been betting on.

Ferguson fears that high concentrations of inflation may force the Fed to maximize costs to a amount that properly pressure the U.S. into a recession. “I am still in the camp that economic downturn is a true probability. Limited and shallow a single hopes, but you know, let us see, and let us hope Goldman is ideal,” Ferguson said.

Former Fed Governor Frederic Mishkin shares issues about inflation, and thinks the correct Fed class is to not pause in June.

“I can comprehend why [the Fed] could want to [pause], it is not terrible if they do it,” Mishkin reported in a modern CNBC job interview. “But I consider that we’re in a situation wherever inflation numbers are still significant, pretty sluggish to arrive down to the 2% target.”

Mishkin is extra fearful, he claimed, about the fundamental inflation, which is a variety that is responsible in predicting what the future path of inflation will be. “The overall economy and labor marketplace is nonetheless powerful, there is some weakening but we have got a very long way to go before we incorporate inflationary pressures and therefore I imagine that the Fed is likely to have to raise premiums, and improved off carrying out it now to show their powerful commitment to keeping inflation less than regulate,” he mentioned.

A pause would be not likely to pose sizeable damage to the financial system, even if subsequent charge hikes are wanted, Ferguson mentioned, pointing to examples of “early pausers” — the Lender of Canada and Reserve Lender of Australia. “Both equally took a pause and now have returned to a climbing approach,” he said.