Selling prices at a Chevron Corp. fuel station in Fontana, California, on Thursday, July 8, 2021.

Kyle Grillot | Bloomberg | Getty Visuals

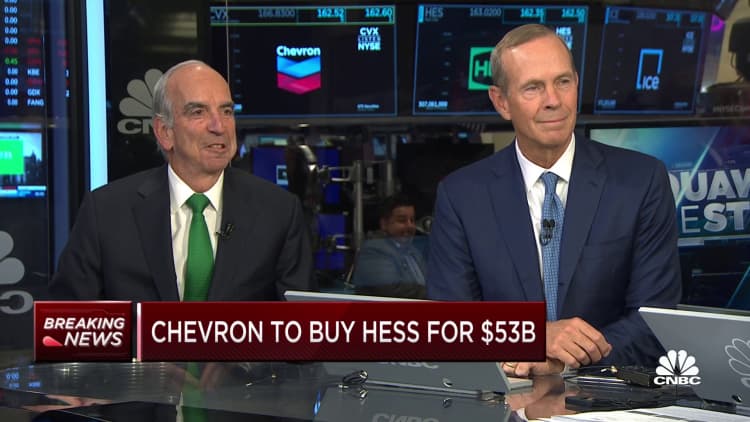

On Monday, Chevron introduced plans to purchase oil and gasoline business Hess for $53 billion in inventory.

Fewer than two weeks prior, Exxon Mobil announced it is buying oil company Pioneer Organic Methods for $59.5 billion in inventory.

On Tuesday, the Global Electricity Company released its yearly world power outlook report that tasks international demand for coal, oil and organic fuel will hit an all-time higher by 2030, a prediction the IEA’s government director Fatih Birol experienced telegraphed in September.

“The changeover to clean electrical power is taking place around the globe and it is unstoppable. It truly is not a question of ‘if,’ it is just a issue of ‘how soon’ — and the sooner the much better for all of us,” Birol stated in a penned statement printed along with his agency’s planet outlook. “Using into account the ongoing strains and volatility in regular power marketplaces right now, promises that oil and fuel signify protected or protected selections for the world’s vitality and climate long run glance weaker than at any time.”

But centered on their acquisitions, Chevron and Exxon are seemingly making ready for a different environment than the IEA is portending.

“The massive providers — nongovernment businesses — do not see an end to oil demand from customers any time in the in the vicinity of upcoming. Which is one of the messages you have to get from this. They are fully commited to the business, to output, to reserves and to expending,” Larry J. Goldstein, a former president of the Petroleum Market Exploration Basis and a trustee with the not-for-gain Strength Coverage Study Foundation, told CNBC in a telephone discussion Monday.

“They are in this in the prolonged haul. They will not see oil demand from customers declining at any time in the close to time period. And they see oil desire in pretty massive volumes existing for at the very least the subsequent 20, 25 years,” Goldstein explained to CNBC. “There is a important distinction among what the major oil companies believe that the potential of oil is and the governments close to the world.”

So, way too, suggests Ben Cahill, a senior fellow in the power safety and local weather transform method at the bipartisan, nonprofit policy study corporation, Middle for Strategic and Intercontinental Experiments.

“There are countless debates about when ‘peak demand’ will arise, but at the moment, global oil intake is near an all-time significant. The premier oil and fuel producers in the United States see a lengthy pathway for oil demand from customers,” Cahill explained to CNBC.

Pioneer Normal Means crude oil storage tanks close to Midland, Texas, on Oct. 11, 2023.

Bloomberg | Bloomberg | Getty Photos

Africa, Asia driving demand from customers

Globally, momentum driving and financial investment in cleanse electrical power is growing. In 2023, there will be $2.8 trillion invested in the international electrical power marketplaces, according to a prediction from the IEA in May, and $1.7 trillion of that is envisioned to be in thoroughly clean systems, the IEA explained.

The remainder, a little bit additional than $1 trillion, will go into fossil fuels, these types of as coal, fuel and oil, the IEA reported.

Ongoing demand from customers for oil and gasoline regardless of growing momentum in clean up vitality is because of to populace development all-around the globe and in distinct, expansion of populations “ascending the socioeconomic ladder” in Africa, Asia and to some extent Latin The united states, in accordance to Shon Hiatt, director of the Organization of Vitality Changeover Initiative at the USC Marshall Faculty of Organization.

Oil and gasoline are relatively low-priced and effortless to go close to, notably in comparison with building new cleanse energy infrastructure.

“These providers consider in the extended-time period viability of the oil and gasoline sector simply because hydrocarbons keep on being the most charge-helpful and effortlessly transportable and storable power resource,” Hiatt told CNBC. “Their technique implies that in rising economies marked by inhabitants and economic growth, the adoption of low-carbon vitality resources may be prohibitively high-priced, though hydrocarbon desire in European and North American marketplaces, while possibly minimized, will stay a sizeable variable.”

Also, even though electric powered automobiles are developing in reputation, they are just just one part of the transportation pie, and a lot of of the other sections of the transportation sector will keep on to use fossil fuels, explained Marianne Kah, senior investigate scholar and board member at Columbia University’s Centre on Worldwide Power Coverage. Kah was formerly the chief economist of ConocoPhillips for 25 several years.

“Although there is a ton of media notice specified to the expanding penetration of electric powered passenger vehicles, international oil desire is nevertheless predicted to expand in the petrochemical, aviation and hefty-obligation trucking sectors,” Kah advised CNBC.

Geopolitical pressures also participate in a purpose.

Exxon and Chevron are growing their holdings as European oil and fuel majors are more probably to be topic to demanding emissions polices. The U.S. is unlikely to have the political will to power the same type of stringent laws on oil and gasoline businesses in this article.

“1 may speculate that Exxon and Chevron are anticipating the European oil majors divesting their world wide reserves around the future 10 years because of to European coverage adjustments,” Hiatt explained to CNBC.

“They are also betting domestic politics will not enable the U.S. to get sizeable new climate policies directed exclusively to restrain or limit or ban the stage of U.S. oil and gas domestic creation,” Amy Myers Jaffe, a investigate professor at New York College and director of the Electrical power, Weather Justice and Sustainability Lab at NYU’s School of Professional Reports, advised CNBC.

Goldstein expects the ever-increasing U.S. national financial debt will finally set all forms of govt subsidies on the chopping block, which he suggests will also profit firms these as Exxon and Chevron.

“All subsidies will be underneath tremendous tension,” Goldstein explained, the depth of that strain dependent on which occasion is in the White Home at any given time. “By the way, that signifies the substantial fiscal oil companies will be equipped to temperature that atmosphere far better than the more compact providers.”

Also, sanctions of state-controlled oil and gas organizations in nations like individuals in Russia, Venezuela and Iran are delivering Exxon and Chevron a geopolitical opening, Jaffe claimed.

“They probable hope that any geopolitically driven market shortfalls to occur can be loaded by their personal manufacturing, even if demand from customers for oil all round is reduced by way of decarbonization procedures close to the earth,” Jaffe told CNBC. “If you imagine oil like the recreation of musical chairs, Exxon Mobil and Chevron are betting that other nations around the world will drop out of the sport regardless of the quantity of chairs and that there will be sufficient chairs left for the American firms to sit down, every time the songs stops.”

An oil pumpjack pulls oil from the Permian Basin oil industry in Odessa, Texas, on March 14, 2022.

Joe Raedle | Getty Illustrations or photos Information | Getty Photos

Oil that can be tapped immediately is a priority

Identified oil reserves are progressively precious as European and American governments seem to restrict the exploration for new oil and gasoline reserves, according to Hiatt.

“Notably, both equally Pioneer and Hess have attractive, properly-proven oil and fuel reserves that supply the probable for sizeable growth and diversification for Exxon and Chevron,” Hiatt advised CNBC.

Oil and gas reserves that can be brought to market comparatively immediately “are the best candidates for generation when there is uncertainty about the tempo of the power transition,” Kah explained to CNBC, which clarifies Exxon’s acquisition of Pioneer, which gave Exxon a lot more accessibility to “limited oil,” or oil observed in shale rock, in the Permian basin.

Shale is a sort of porous rock that can keep purely natural gasoline and oil. It is accessed with hydraulic fracking, which requires capturing water blended with sand into the ground to launch the fossil gas reserves held therein. Hydrocarbon reserves discovered in shale can be brought to market amongst 6 months and a calendar year, wherever discovering for new reserves in offshore deep h2o can choose 5 to seven decades to tap, Jaffe explained to CNBC.

“Chevron and Exxon Mobil are searching to cut down their fees and decrease execution risk by way of rising the share of brief cycle U.S. shale reserves in their portfolio,” Jaffe claimed. Owning reserves that are less complicated to bring to market place offers oil and fuel firms amplified skill to be responsive to swings in the selling price of oil and gasoline. “That overall flexibility is eye-catching in today’s risky price local climate,” Jaffe explained to CNBC.

Chevron’s order of Hess also provides Chevron obtain in Guyana, a nation in South The us, which Jaffe also suggests is attractive simply because it is “a very low value, close to house prolific output area.”

Really don’t skip these CNBC Professional tales: