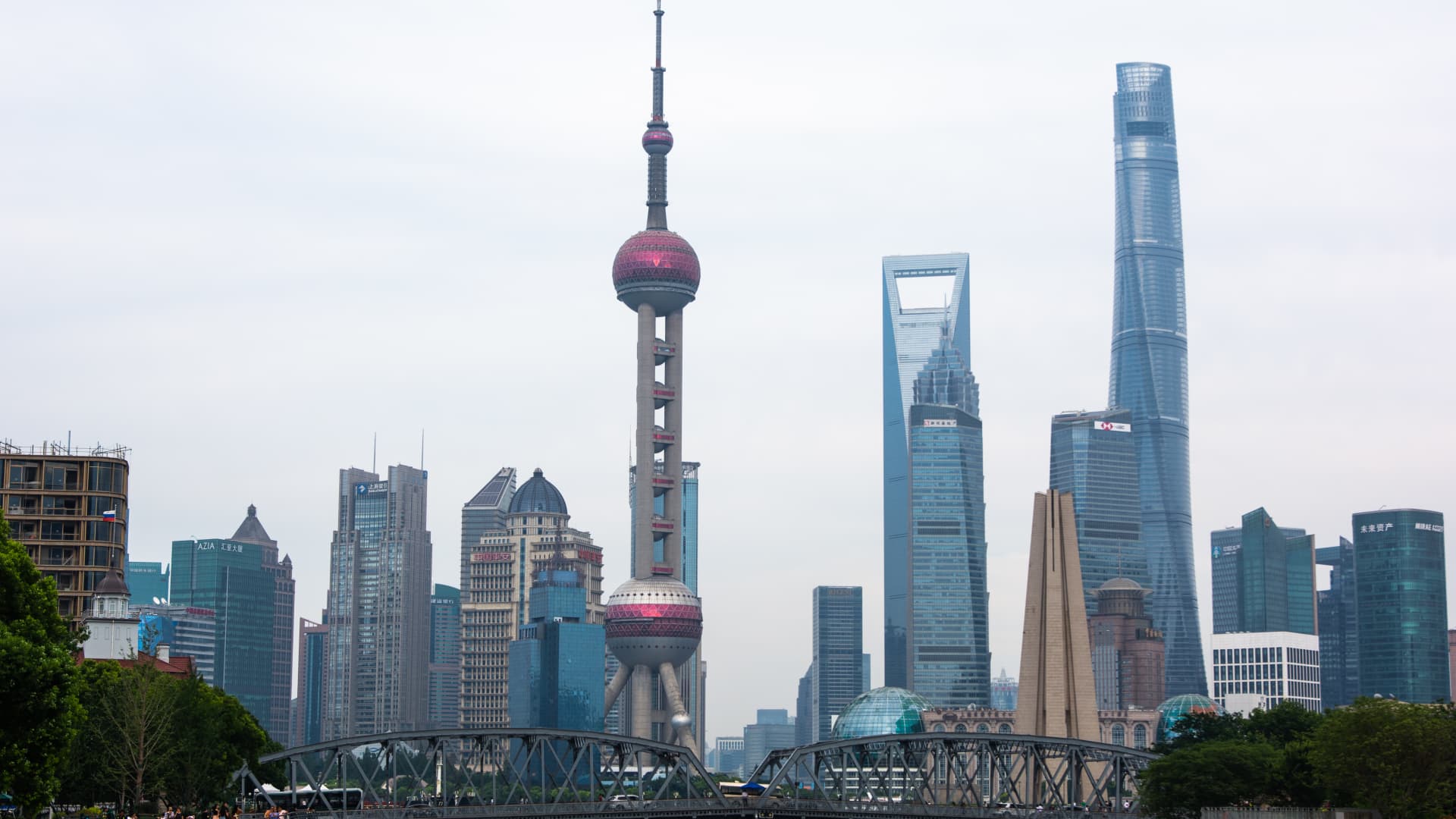

A check out of substantial-rise properties is viewed along the Suzhou Creek in Shanghai, China on July 5, 2023.

Ying Tang | NurPhoto | Getty Visuals

The Chinese financial system could be dealing with a prolonged time period of decrease advancement, a prospect which may possibly have world-wide ramifications after 45 many years of quick expansion and globalization.

The Chinese govt is ramping up a host of actions aimed at boosting the economic system, with leaders on Monday pledging to “adjust and enhance insurance policies in a timely fashion” for its beleaguered house sector, when pushing stable work to a strategic intention. The Politburo also introduced pledges to boost domestic intake need and solve regional personal debt dangers.

associated investing information

Chinese gross domestic solution grew by 6.3% calendar year-on-year in the 2nd quarter, Beijing declared Monday, below market anticipations for a 7.3% expansion following the world’s 2nd-most significant economy emerged from strict Covid-19 lockdown steps.

On a quarterly basis, economic output grew by .8%, slower than the 2.2% quarterly enhance recorded in the initially 3 months of the 12 months. In the meantime, youth unemployment hit a document high 21.3% in June. On a a little much more positive observe, the speed of industrial creation progress accelerated from 3.5% year-on-year in May well to 4.4% in June, comfortably surpassing anticipations.

The ruling Chinese Communist Celebration has set a advancement goal of 5% for 2023, reduced than regular and notably modest for a state that has averaged 9% once-a-year GDP expansion due to the fact opening up its economic system in 1978.

More than the earlier couple months, authorities announced a collection of pledges targeted at certain sectors or designed to reassure private and overseas traders of a more favorable financial investment natural environment on the horizon.

Having said that, these ended up mainly wide measures lacking some main details, and the hottest readout of the Politburo’s quarterly meeting on financial affairs struck a dovish tone but fell short of significant new bulletins.

Julian Evans-Pritchard, head of China economics at Funds Economics, mentioned in a note Monday that the country’s management is “obviously concerned,” with the readout calling the financial trajectory “tortuous” and highlighting the “numerous problems facing the overall economy.”

These consist of domestic desire, economic troubles in vital sectors this kind of as assets, and a bleak exterior setting. Evans-Pritchard pointed out that the most current readout mentions “pitfalls” seven times, versus three periods in the April readout, and that the leadership’s priority seems to be to extend domestic demand.

“All explained to, the Politburo conference struck a dovish tone and manufactured it crystal clear the leadership feels far more do the job requirements to be carried out to get the restoration on track. This implies that some further more coverage guidance will be rolled out above the coming months,” Evans-Pritchard claimed.

“But the absence of any major announcements or plan details does recommend a lack of urgency or that policymakers are having difficulties to appear up with suitable steps to shore up growth. Either way, it is not particularly reassuring for the around-phrase outlook.”

Triple shock

The Chinese economy is nevertheless suffering from the “triple shock” of Covid-19 and prolonged lockdown measures, its ailing house sector and a swathe of regulatory shifts associated with President Xi Jinping’s “popular prosperity” vision, in accordance to Rory Eco-friendly, head of China and Asia exploration at TS Lombard.

As China is still in just a 12 months of reopening right after the zero-Covid actions, significantly of the present weak point can nevertheless be attributed to that cycle, Inexperienced recommended, but he additional that these could come to be entrenched with no the acceptable coverage reaction.

“There is a prospect that if Beijing isn’t going to stage in, the cyclical aspect of the Covid cycle destruction could align with some of the structural headwinds that China has — notably around the sizing of the property sector, decoupling from global financial system, demographics — and push China on to a a great deal, a great deal slower development price,” he instructed CNBC on Friday.

TS Lombard’s foundation situation is for a stabilization of the Chinese economy late in 2023, but that the economy is moving into a more time-term structural slowdown, albeit not nevertheless a Japan-design and style “stagflation” circumstance, and is very likely to typical nearer to 4% yearly GDP expansion due to these structural headwinds.

Although the have to have for publicity to China will nevertheless be essential for global providers as it continues to be the major purchaser industry in the globe, Green claimed the slowdown could make it “somewhat considerably less enticing” and speed up “decoupling” with the West in terms of expense flows and producing.

For the world wide economic climate, however, the most quick spillover of a Chinese slowdown will probable occur in commodities and the industrial cycle, as China reconfigures its economic system to minimize its reliance on a residence sector that has been “absorbing and driving commodity costs.”

“Those days are absent. China is nevertheless likely to devote a whole lot, but it can be heading to be kind of much more innovative production, tech components, like electric powered motor vehicles, solar panels, robotics, semiconductors, these varieties of places,” Environmentally friendly reported.

“The home driver — and with that, that pool of iron ore from Brazil and/or Australia and devices from Germany or appliances from all above the earth — has long gone, and China will be a a lot considerably less crucial issue in the global industrial cycle.”

2nd order impacts

The recalibration of the economic climate away from house and towards far more highly developed producing is apparent in China’s massive thrust into electrical motor vehicles, which led to the state overtaking Japan before this 12 months as the world’s greatest vehicle exporter.

“This shift from a complementary financial system, where by Beijing and Berlin form of benefit from every other, to now getting competitors is one more big consequence of the structural slowdown,” Green claimed.

He mentioned that further than the rapid reduction of need for commodities, China’s response to its shifting financial sands will also have “second get impacts” for the global overall economy.

“China is nevertheless earning a large amount of things, and they can’t eat it all at dwelling. A whole lot of the things they are earning now is substantially greater excellent and that will continue on, primarily as you will find a lot less revenue heading into real estate, and trillions of renminbi likely into these highly developed tech sectors,” Inexperienced mentioned.

“And so the second buy impression, it really is not just a lot less demand from customers for iron ore, it really is also much larger global levels of competition throughout an array of sophisticated created merchandise.”

While it is not but apparent how Chinese households, the private sector and point out-owned enterprises will look right after the changeover from a assets and financial investment-pushed model to one particular run by state-of-the-art manufacturing, Inexperienced said the state is at present at a “pivotal position.”

“The political financial state is altering, partly by style, but also partly by the reality that the residence sector is proficiently dead or if not dying, so they have to transform and there’s rising a new progress model,” he stated.

“It would not just be a slower variation of the China we had in advance of Covid. It can be going to be a new version of the Chinese economic climate, which will also be slower, but it’s heading to be 1 with new motorists and new forms of idiosyncrasies.”