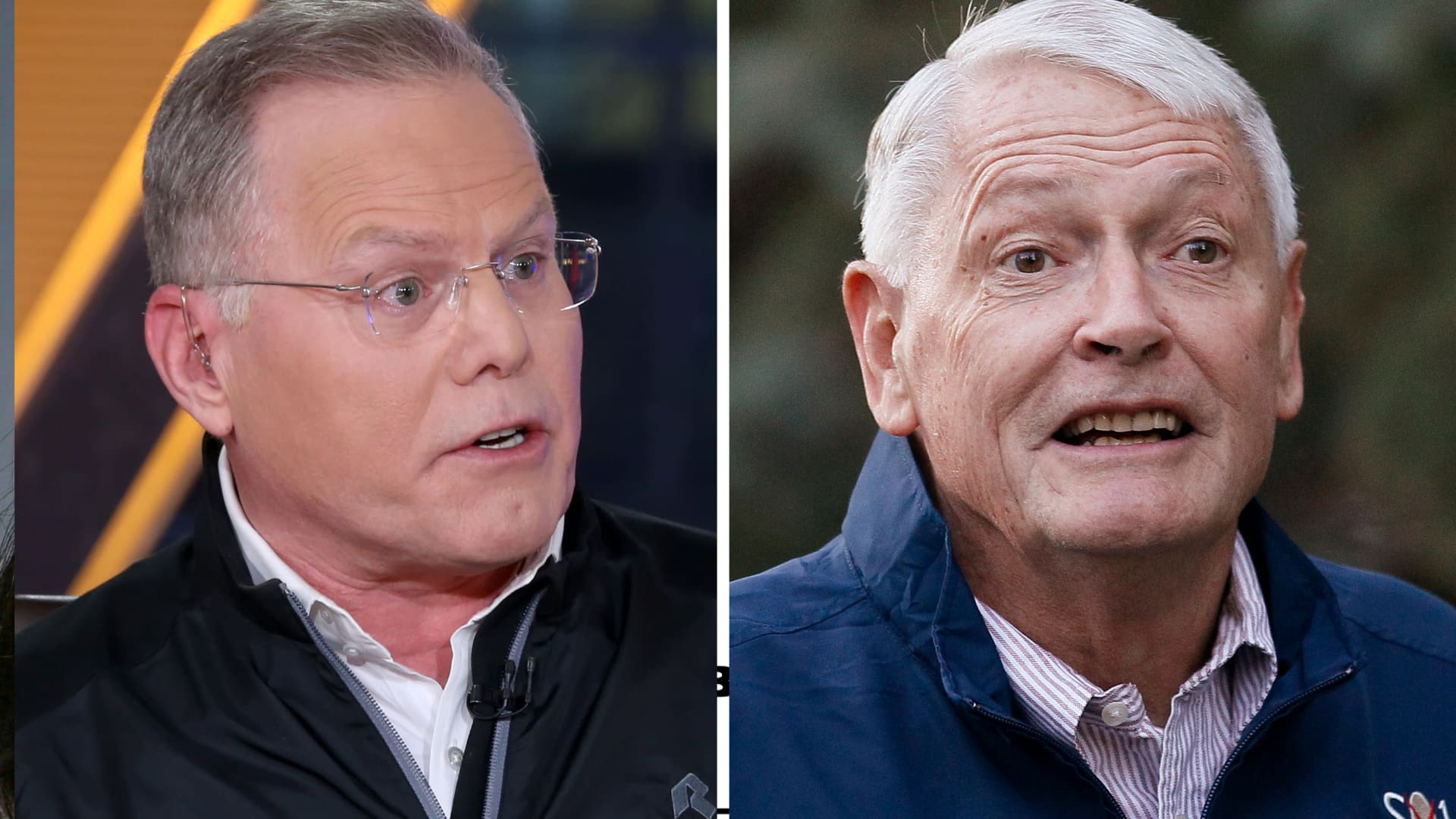

David Zaslav, CEO and president of Warner Bros. Discovery (L), and John Malone, chairman of Liberty Media, Liberty International, and Qurate Retail Team.

CNBC | Reuters

Warner Bros. Discovery‘s future stage to obtain scale may possibly be on the lookout at distressed belongings.

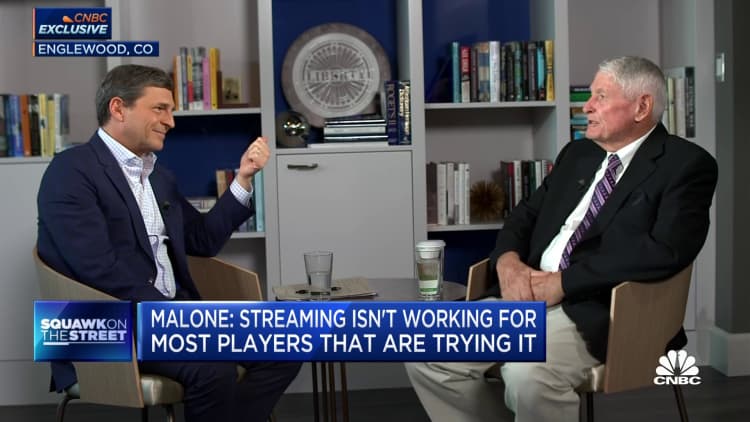

Chief Executive David Zaslav and board member John Malone both created opinions this 7 days suggesting the organization is paying down debt and building up free of charge income circulation to set up acquisitions in the up coming two a long time of media organizations suffering from diminished valuations.

The targets could be firms flirting with or filing for bankruptcy, Malone stated in an exceptional job interview with CNBC on Thursday. Even though U.S. regulators could frown at substantial media corporations coming jointly because of overlaps with studio, cable or broadcasting property, they’re going to be a great deal much more forgiving if the companies are having difficulties to endure, Malone advised David Faber.

“I consider we are heading to see really serious distress in our sector,” Malone mentioned. “There is an exemption to the antitrust legislation on a failing enterprise. At some place of distress, ideal, then some of the restrictions, they glance the other way.”

Media organization valuations have been plummeting amid streaming online video losses, standard Tv set subscriber defections, and a down promotion market. This has afflicted Warner Bros. Discovery as significantly as its peers. The firm’s sector valuation not too long ago fell beneath $23 billion, its cheapest place because WarnerMedia and Discovery merged final yr. The organization finished the third quarter with about $43 billion in internet personal debt.

Warner Bros. Discovery is trying to situation alone to be an acquirer, relatively than a distressed asset, alone, by paying out down financial debt and escalating hard cash movement, Zaslav reported in the course of his company’s earnings conference contact this 7 days. Warner Bros. Discovery has paid out down $12 billion and expects to deliver at the very least $5 billion in totally free money movement this yr, the corporation stated.

“We’re surrounded by a great deal of corporations that are – will not have the geographic range that we have, aren’t creating actual cost-free money movement, have personal debt that are presenting problems,” Zaslav mentioned Thursday. “We’re de-levering at a time when our peers are levering up, at a time when our friends are unstable, and there is a good deal of excess aggressive – surplus players in the market. So, this will give us a likelihood not only to combat to grow in the up coming yr, but to have the type of equilibrium sheet and the kind of balance … that we could be actually opportunistic over the subsequent 12 to 24 months.”

Even now, Warner Bros. Discovery also acknowledged it will pass up its very own year-close leverage goal of 2.5 to 3 times modified earnings as the Television set ad marketplace struggles and linear Television membership earnings declines.

Purchasing from distress

Malone has some experience with profiting from moments of distress.

His Liberty Media acquired a 40% stake in Sirius XM in excess of numerous decades much more than a ten years in the past, saving it from bankruptcy. Since then, the fairness worth of the satellite radio business has bounced again from just about zero to about $5 for each share. Sirius XM at the moment has a industry capitalization of about $18 billion.

“It made us a ton of revenue with Sirius,” Malone informed Faber.

Whilst Malone failed to title a distinct company as a concentrate on for Warner Bros. Discovery, he talked over Paramount Global as an example of a firm whose prospects appear shaky. Paramount Global’s market valuation has slumped underneath $8 billion while carrying about $16 billion in debt.

Malone noted that Paramount’s debt was not long ago downgraded. “I feel that they are running almost certainly destructive totally free cash move,” he said.

While Paramount World-wide shares have fallen precipitously because Viacom and CBS merged in 2019, there are signals the enterprise is shoring up its harmony sheet. CEO Bob Bakish said previously this month Paramount Global’s streaming losses will be lessen in 2023 than 2022, and the business expects further more advancement to losses in 2024. The company shut a sale for reserve publisher Simon & Schuster for $1.6 billion and will use the proceeds to fork out down credit card debt.

Paramount Global’s destiny

Shari Redstone, chair of Paramount International, attends the Allen & Co. Media and Technological innovation Conference in Sunlight Valley, Idaho, on Tuesday, July 11, 2023.

David A. Grogan | CNBC

Paramount World-wide is 1 of the couple of belongings that logically suits Malone’s vision of a media asset that would have regulatory difficulties as an acquisition with opportunity distress concerns. Comcast‘s NBCUniversal, an additional possible merger husband or wife, will get rid of much more than $2 billion this year on its streaming service, Peacock, but the media giant is shielded by its mum or dad enterprise, the most significant U.S. broadband company.

“Warner Bros. [Discovery] now is producing income. Not a great deal, but they are generating cash,” Malone claimed. “Peacock is getting rid of a great deal of dollars. Paramount is losing a ton of money that they are unable to pay for. At the very least [Comcast CEO] Brian [Roberts] can afford to pay for to eliminate the dollars.”

Paramount Global’s managing shareholder Shari Redstone is open up to a transformative transaction, CNBC documented last month. Puck’s Dylan Byers a short while ago documented that business insiders have speculated Warner Bros. Discovery might pursue an acquisition of Paramount World following the 2024 U.S. presidential election.

A blend of NBCUniversal and Paramount World also has strategic logic, but the combination of two national broadcast networks — Comcast’s NBC and Paramount Global’s CBS — would current a substantial regulatory hurdle. Warner Bros. Discovery would not very own a broadcast community, generating an acquisition of CBS less complicated.

Spokespeople for Paramount World wide and Warner Bros. Discovery declined to remark.

Whilst Malone explained all legacy media businesses really should be conversing to every single other about merger synergies, he acknowledged valuations may have to drop farther to get regulators on board with even more consolidation. Malone predicted that could materialize in the same timeline Zaslav gave — in the future two a long time.

“Inevitably maybe there’ll be regulatory reduction,” Malone stated. “Out of distress generally arrives the reduction in levels of competition, elevated pricing electricity, and the chance to buy assets at a deep discounted.”

Disclosure: Comcast owns NBCUniversal, the father or mother corporation of CNBC.

Tune in: CNBC’s whole interview with John Malone will air 8 p.m. ET Thursday.