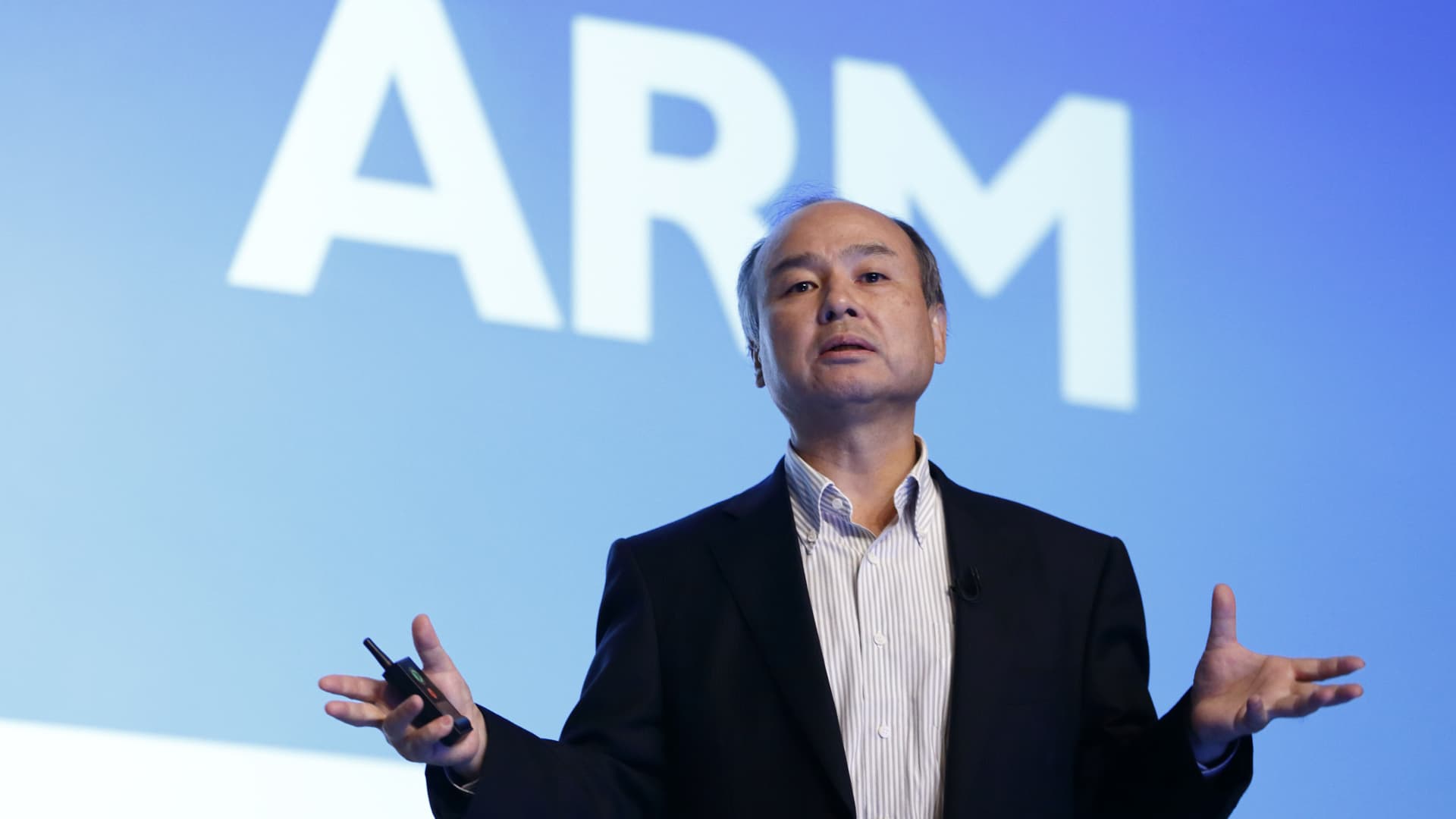

Billionaire Masayoshi Son, chairman and main executive officer of SoftBank Team Corp., speaks in front of a display exhibiting the ARM Holdings symbol all through a information meeting in Tokyo on July 28, 2016.

Tomohiro Ohsumi | Bloomberg | Getty Images

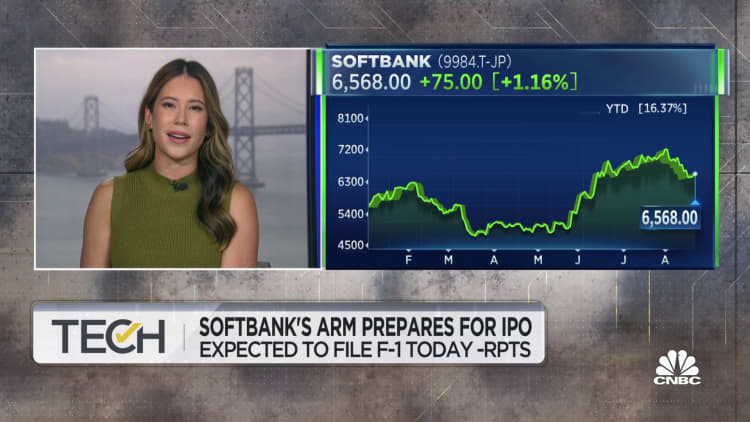

Arm, which is owned by SoftBank, is anticipated to file for its original public featuring as quickly as Monday, according to experiences. The firm’s inventory sector debut will be a significant take a look at for the IPO market place, which has far more or fewer closed off from new listings thanks to increasing fascination premiums which have hammered appetite for risky belongings in the very last yr or so.

Arm is a person of the most essential providers in technological innovation. Its chip styles uncovered in practically all the world’s smartphones, including Apple iPhones and most Android devices. Its debut will be a major offer for an IPO sector which is been in the doldrums considering that 2022, but the company’s listing has large implications for SoftBank as nicely.

SoftBank has been trying to bounce back again from a grim tech marketplace by reining in on its growth-centered investments and pivoting its target to artificial intelligence, the very hot topic of the hour in tech.

What is Arm?

Arm, which is headquartered in Cambridge, England, made the architecture of chips identified in 99% of all smartphones.

The business traces its background to an early computing organization known as Acorn Personal computers. In 1990, Acorn spun out a new firm named Superior RISC Devices, structured as a joint undertaking between Acorn, Apple and U.S. chipmaker VLSI Technological know-how.

Arm isn’t really a chipmaker alone. Relatively, the firm is dependable for coming up with the “architectures” — or total layouts, which includes components and programming language guidelines that other firms use to make chips. Its original value was coming up with chips with incredibly low strength consumption when compared with the X86 chips typical in personal computers at the time. It truly is witnessed as some thing of a neutral occasion or “Switzerland” in tech, due to the fact its styles are applied in almost smartphone processors, which includes these produced by Apple, and increasingly, server and laptop computer processors as properly.

It is really also usually considered the crown jewel of the U.K.’s technologies sector.

Speaking with CNBC at a developer conference in October 2022, Arm CEO Rene Haas reported that companies won’t be able to afford to pay for not to operate with the organization, specified its engineering is embedded in practically every single system out there.

“Given the point that we license the technological know-how to all the key gamers in the marketplace, no just one can truly afford to overlook a products cycle or scale back again on R&D or not do a product or service,” Haas reported at the time.

Arm’s organization product is to license the mental property for these architectures so that they can create methods all over them. In modern yrs, ARM has tried to promote its possess styles for processors, a far more profitable company than just licensing the underlying architecture technologies.

SoftBank agreed to purchase Arm in 2016 for $32 billion, which at the time was the major-ever order of a European technologies enterprise. SoftBank at the time claimed it was buying the business enterprise to gain a foothold in the expanding world-wide-web of items sector. IoT, is a compact component of the firm’s enterprise, but at the time it was a much-hyped portion of tech.

Not just for wearables or clever property appliances, Arm has been expanding its semiconductors to other uses these as connected automobiles.

For the quarter finished June 30, the business produced 88.5 billion Japanese yen ($605.5 million), in accordance to an earnings release from SoftBank.

But the organization is also going through headwinds from a slowdown in demand for solutions like smartphones, which has strike chip corporations throughout the board. Arm’s internet sales fell 4.6% yr-on-calendar year in the 2nd quarter.

The unit also swung to a 9.5 billion yen decline, obtaining produced a gain of 29.8 billion yen in the exact same period of time a year before.

Beleaguered sale to Nvidia

SoftBank at first tried out to promote Arm to chip large Nvidia, but the offer confronted pushback from regulators, who raised considerations above levels of competition and countrywide stability. Nvidia is a behemoth in the planet of semiconductors, and the firm is now benefiting heavily from the increase in AI apps as demand from customers for its GPUs soars.

Considering the fact that then, SoftBank has opted to listing Arm as an unbiased business. The Japanese tech investing large is reportedly looking to order the remaining 25% stake in Arm that it does not at the moment have from its significant $100 billion Eyesight Fund.

In the U.K., which has sought to strengthen its domestic chip industry via up to £1 billion ($1.3 billion) in investments, Arm is observed as strategically crucial.

The improve of the company’s ownership to overseas arms is found as a thorny subject matter for the domestic tech field, not minimum owing to fears that it undermines the U.K.’s “tech sovereignty,” an issue that has cropped up during Europe as officials appear to decrease dependence on technological innovation from the U.S. and other nations.

The govt experienced pushed aggressively for Arm to checklist in London, on the other hand the company opted to go with New York for its debut as an alternative, working a blow to the London stock exchange.

Testing a choppy IPO market place

SoftBank is pushing in advance with a listing of Arm even as U.S. markets have been in an unsteady point out. Technology valuations have fallen sharply from the peak of the 2021 tech boom.

That calendar year, shares of newly minted community firms this sort of as Palantir and UiPath rose to seismic ranges as buyers grew psyched by their advancement potential customers in the boom moments.

Arm submitted confidentially for a listing in the U.S. earlier this calendar year. It is not still apparent what valuation SoftBank is looking for for Arm, nevertheless stories have pegged the possible sector price at in between $60 billion and $70 billion.

As perfectly as staying a bellwether for the chip industry, Arm plays a part in the AI space — and is increasingly touting by itself as an AI corporation. Buyers will be observing out for the company’s S-1 filing to see how it sees the technologies benefiting its business more than time.

In May well, Arm unveiled two new chipsets specific at device studying purposes. Just one, a new CPU referred to as Cortex-4, is a chipset that delivers more rapidly equipment-studying overall performance and consumes 40% fewer electricity than its predecessor, according to Arm. The other, a GPU known as G720, provides superior overall performance and takes advantage of up 22% less memory bandwidth than its predecessor, Arm said.

“Arm remains committed to establishing and screening our GPUs towards new applications for device discovering (ML),” the business stated in a Might 29 website article asserting the products.

Higher-run chips this sort of as people available by Nvidia and AMD are vital to AI applications, which have to have loads of computing electric power to run smoothly. Before this month, Nvidia unveiled its new Grace Hopper chip for generative AI applications, which is dependent on Arm architecture.

SoftBank is banking on the progress in AI to raise the prospects of its Eyesight Fund, which has flagged in tandem with souring bets on companies like WeWork, China’s experience-hailing huge Didi World-wide, and Uber, the latter of which the Vision Fund has since drop its holdings.

SoftBank’s CFO Yoshimitsu Goto stated in the course of the firm’s June quarter earnings contact that the enterprise has been “thoroughly and slowly and gradually emerging again to investment exercise,” with a concentration on AI investments.

SoftBank explained its Vision Fund booked an expenditure obtain of 159.8 billion yen, its 1st achieve in 5 consecutive quarters. SoftBank explained the fund predominantly benefited from investments in its individual subsidiaries — together with Arm.

That nevertheless arrived soon after SoftBank’s Eyesight Fund noted a record 4.3 trillion yen loss in the fiscal 12 months ending Mar. 31.

The Japanese tech large has been beginning to communicate up its investments in AI not too long ago. In July, the organization led a $65 million expenditure in U.K. coverage know-how company Tractable.

– CNBC’s Kif Leswing contributed to this tale.