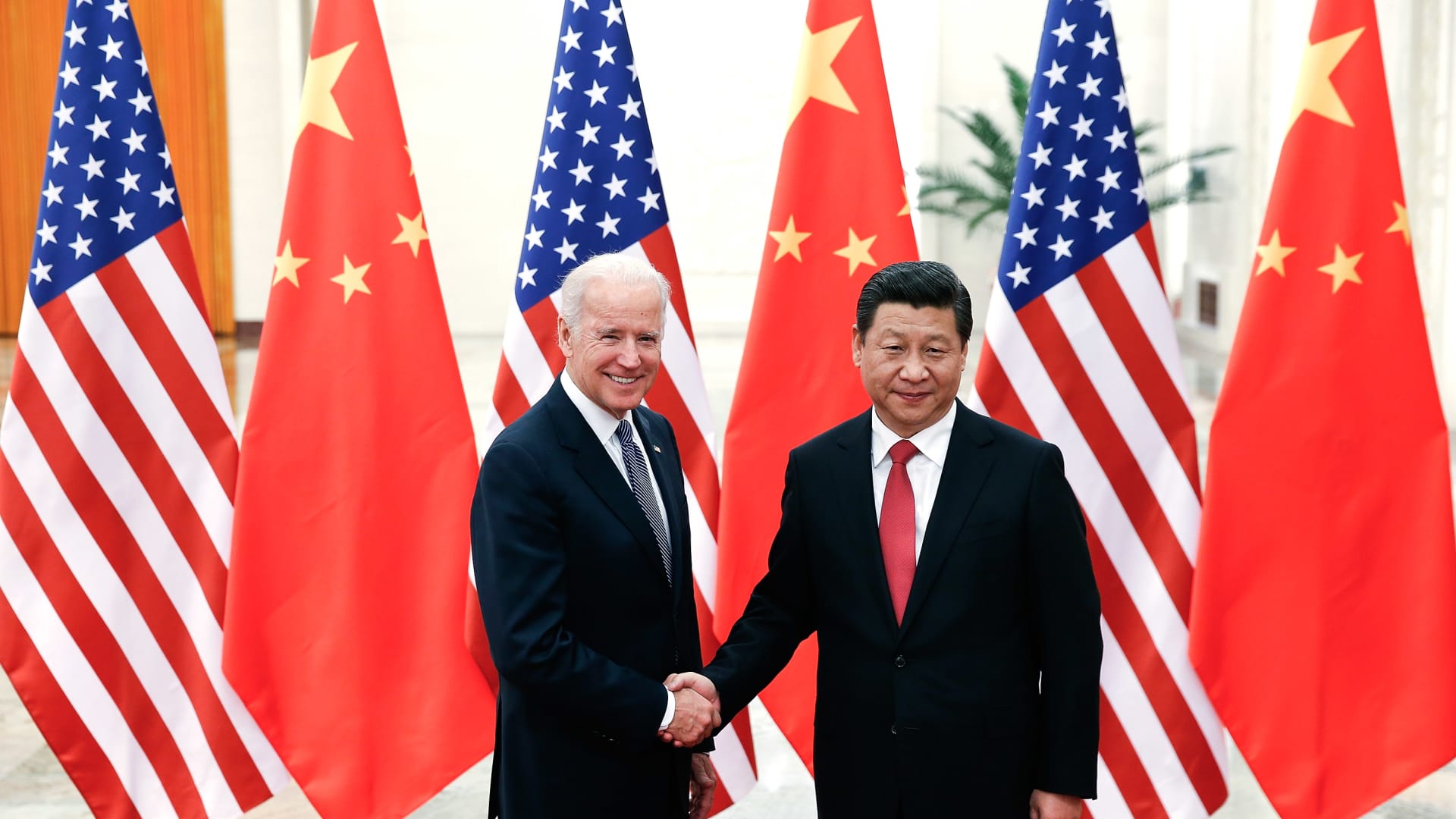

Chinese President Xi Jinping and fingers with then U.S Vice President Joe Biden inside the Good Hall of the People today on December 4, 2013 in Beijing, China.

Lintao Zhang | Getty Visuals News | Getty Pictures

Leaders of the Team of 7 agreed there’s a require to de-hazard, not decouple from China, and acknowledged challenges posed by the mainland’s methods which “distort the international financial state.”

“We are not decoupling or turning inwards,” the G-7 said in a joint statement produced over the weekend as leaders achieved in Hiroshima, Japan. “At the exact same time, we realize that financial resilience needs de-risking and diversifying.”

Leaders additional, “We will seek to tackle the problems posed by China’s non-market place procedures and tactics, which distort the international economic climate. We will counter malign practices, these types of as illegitimate know-how transfer or details disclosure.”

Reiterating the stance, President Joe Biden mentioned at a push convention on Sunday: “We’re not wanting to decouple from China, we are hunting to de-risk and diversify our romantic relationship with China.

He spelled out suggests using techniques to diversify supply chains, “so we’re not dependent on any a single country for important product. It implies resisting economic coercion alongside one another and countering damaging practices that damage our workers. It indicates preserving a narrow set of superior technologies critical for our nationwide security.”

Talking immediately after the G-7 finance ministers and central bank governors’ assembly previously this thirty day period, U.S. Treasury Secretary Janet Yellen said China’s habits is “a make any difference that need to be of worry to all of us.”

“There have been illustrations of China working with economic coercion on nations that acquire steps that China’s not satisfied with from a geopolitical point of view,” she said, citing China’s trade disputes with Australia and Lithuania as illustrations.

In their statement the G-7 leaders mentioned, “We will foster resilience to financial coercion. We also understand the requirement of safeguarding certain sophisticated technologies that could be used to threaten our nationwide security devoid of unduly limiting trade and investment decision.”

The world’s top democracies said the team will “minimize excessive dependencies in our important supply chains” when emphasizing the require to cooperate with China, citing its role in the worldwide group and the dimensions of its financial state.

“We stand well prepared to construct constructive and steady relations with China, recognizing the importance of engaging candidly with and expressing our issues instantly to China. We act in our national fascination,” the statement claimed.

President Joe Biden’s administration beforehand briefed marketplace teams these types of as the Chamber of Commerce on steps trying to get to curb American investments into China, according to media stories.

This kind of principles would indicate stricter guidelines for U.S. providers that will be necessary to inform the governing administration of new investments in Chinese engineering firms, in accordance to Politico. Promotions in essential sectors these as microchips will also be banned, in accordance to the publication.

U.K. Prime Minister Rishi Sunak also instructed journalists that London was open to adhering to the U.S. guide over curbs on Chinese expense, the Financial Times noted.

Decoupling pitfalls ahead?

Forward of the weekend’s G-7 summit, Goldman Sachs economists Hui Shan and Andrew Tilton said they expected ways to be taken by the Committee on Overseas Expenditure in the United States, or CFIUS — a U.S. governing administration agency that critiques deals involving overseas financial investment in the U.S. to see if the transaction infringe on the country’s nationwide security.

In a notice previewing the established of actions before this thirty day period, they said there may possibly be “far more target on refining the present tariff, export handle, and expenditure regimes when primary frameworks are in area.”

“We hope them to be reasonably narrowly-focused on sophisticated semiconductors and associated technologies, paralleling previous autumn’s export controls, and do not foresee considerable limits on secondary market place portfolio investments.”

‘Far-reaching’ damages

The effect of a widening rift involving the U.S. and China could guide to even more hurt, economists at Allianz stated in a notice las Wednesday.

“The financial implications of a even further decoupling between the West and China could be significantly-reaching,” they wrote, incorporating the problems to the Chinese economy could be “much from negligible.”

“China could retaliate by curtailing the source of crucial uncooked resources in which it has a dominant situation, which could severely disrupt world wide provide chains,” they mentioned.

“But this is unlikely as it now applies some varieties of outbound financial commitment limitations and is however wanting in direction of economic pragmatism.”

The Taiwan element

Even more escalations could potentially lie forward for U.S.-China relations just after Washington concluded negotiations with Taiwan on a amount of trade objects on Friday, marking a prospective deal on the initially aspect of the bilateral “21st Century Trade” initiative.

The first settlement below the initiative incorporates: customs administration and trade facilitation, fantastic regulatory tactics, services domestic regulation, anticorruption, and smaller and medium-sized enterprises, the place of work of the United States Trade Representative mentioned in a launch.

U.S. trade representative Katherine Tai reported of the arrangement, “This accomplishment represents an essential step forward in strengthening the U.S.-Taiwan economic romantic relationship.”

China has consistently warned versus deepening bilateral engagement in between the U.S. and Taiwan.

Goldman Sachs argued that with the Taiwan aspect, the emphasis of U.S.-China tensions might shift from trade to armed forces.

“The more rapid aim has been on building Taiwan’s army capabilities to deter a conflict,” U.S. political economists Alec Phillips and Tim Krupa wrote previously this thirty day period, including that they see “fantastic odds” that the U.S. Congress passes supplemental assist to presently existing strategies.