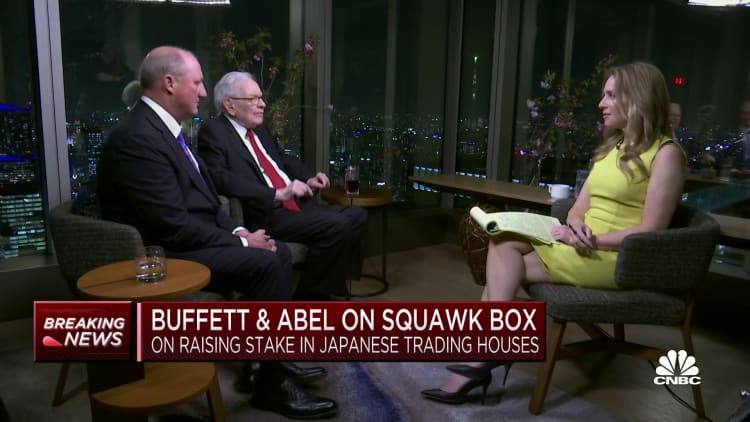

Warren Buffett, chairman and chief executive officer of Berkshire Hathaway Inc., in Fukushima Prefecture, Japan, on Monday, Nov. 21, 2011.

Bloomberg | Bloomberg | Getty Photos

Berkshire Hathaway‘s Warren Buffett is in Japan and not long ago uncovered that he lifted his stakes in the country’s best investing homes, stating he was “confounded” by the opportunity to get them two decades in the past.

The 5 companies — Mitsubishi Corp., Mitsui & Co., Itochu Corp, Marubeni Corp., Sumitomo Corp. noticed two consecutive days of gains as Buffett verified he extra about one more proportion place to his holdings. Berkshire Hathaway’s stakes in all five trading residences is now 7.4%.

related investing information

On Thursday, the shares ongoing to trade mostly increased for a 3rd day, paring earlier losses immediately after Federal Reserve minutes confirmed anticipations for a economic downturn in the U.S. in the fallout of the regional banking disaster. Sumitomo shares fell .5%.

Buffett’s journey is a “stamp of approval” — specially for domestic buyers in Japan, according to Monex Group’s Jesper Koll.

“For Japanese institutional investors, this definitely is now the stamp of approval that Japan can produce excellent returns,” Koll informed CNBC’s “Avenue Indicators Asia.”

He emphasized Buffett’s excursion has the opportunity to enhance self-confidence amid Japanese investors as the country proceeds to grapple with low consumption.

“The serious concentrate is confidence for Japanese buyers, and that’s where Warren Buffett’s take a look at was extremely, pretty critical,” Koll claimed. “He’s got the track document globally, but now he’s acquired a extremely constructive observe file in investing in Japan.”

Household paying in Japan marginally elevated by 1.6% in February, the most current government facts confirmed.

That also marked the first progress in intake that the overall economy has witnessed in fourth months, with expending outside of seasonal elements led by recreation, leisure and travel.

Non-public usage is a important indicator for Japan, accounting for additional than fifty percent of the nation’s gross domestic solution.

‘Unique antenna’

Monex’s Koll included that Buffett will benefit from the higher hand the buying and selling houses hold.

The investing corporations, also referred to as sogo shosha, are conglomerates that import almost everything from strength and metals to food items and textiles into Japan. They also offer companies to makers. The buying and selling residences have helped develop the Japanese financial system and contributed to the globalization of its enterprise.

“Any new venture, any new business that is being formed, the Japanese trading homes will have top-quality intelligence and remarkable entry to the offer, and which is some thing that Berkshire Hathaway is going to be able to leverage in a distinctive antenna into the future check out in Japan as well as the Asia-Pacific,” Koll reported.

Earlier this week, the Bank of Japan’s new governor Kazuo Ueda reiterated that he intends to sustain the central bank’s accommodative monetary plan, which supplies even further aid for the Japanese fairness market place and retail buyers.

Ueda emphasised that the central bank’s generate curve management and negative interest fee insurance policies will most likely be sustained until the economy reaches its goal of 2% in inflation.