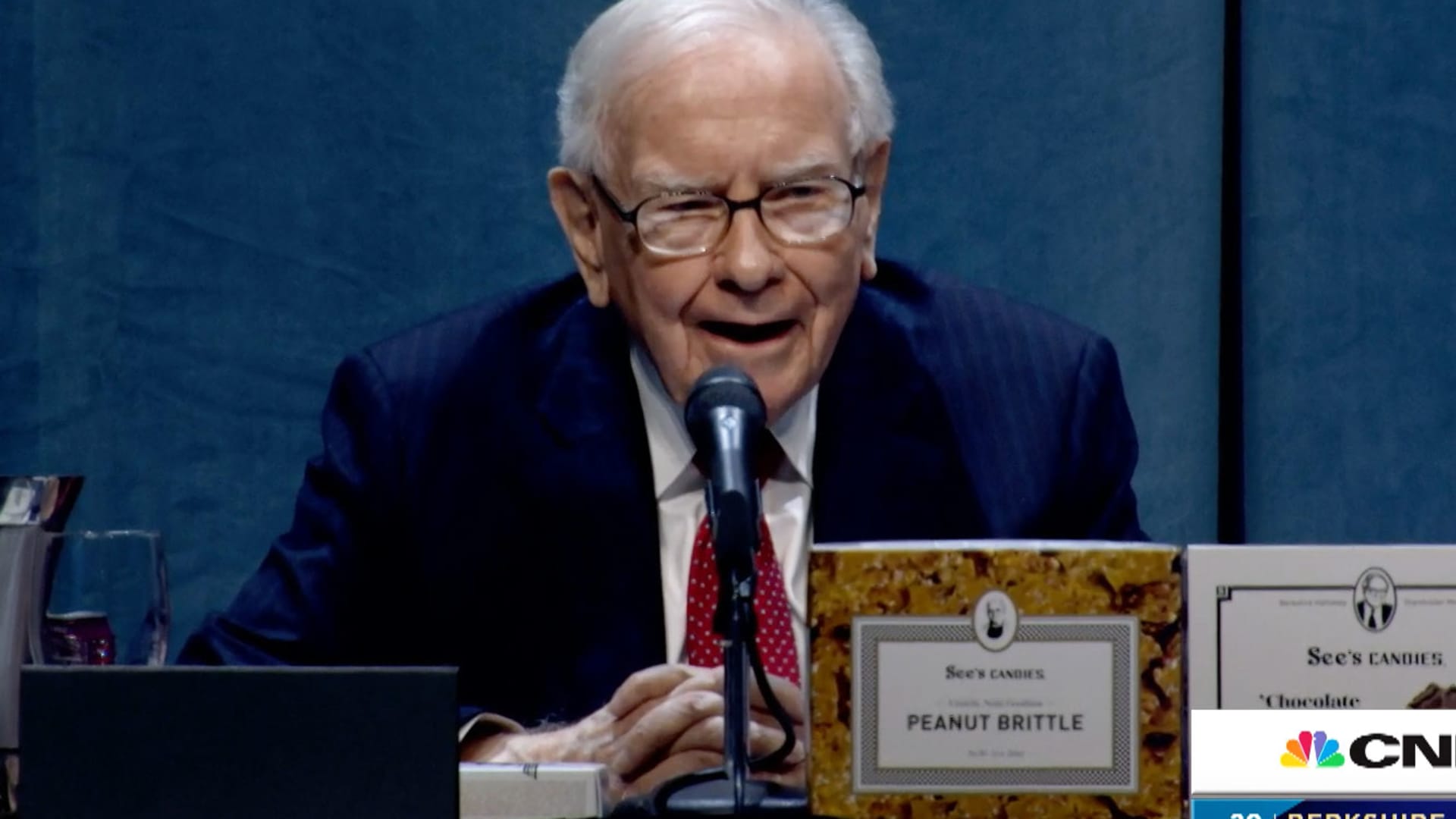

Warren Buffett’s Berkshire Hathaway made a few changes to its equity portfolio in the first quarter, including adding a big stake in Citigroup , according to a regulatory filing. The conglomerate bought more than 55 million shares of Citigroup to build a stake worth $2.95 billion as of the end of March, the filing showed. Another financial name that the longtime value investor bought was Ally Financial , which has fallen more than 18% this year. His stake was worth about $400 million at the end of March. The “Oracle of Omaha” also picked up chemicals company Celanese Corp (worth $1.1 billion), insurer Markel ($620 million), health-care name McKesson (nearly $900 million) and media firm Paramount Global ($2.6 billion) last quarter. Buffett has been on a buying spree lately as the 91-year-old investor saw value in a market that has declined significantly in the face of surging inflation, geopolitical risks and rising rates. On the selling side, Berkshire almost dumped all of its Verizon stock which was worth more than $8 billion at the end of 2021. The conglomerate also exited its small position in Wells Fargo after trimming the bet last year. Here are Berkshire’s top 10 holdings as of the end of March. It was previously revealed in Berkshire’s earnings report that the conglomerate added to its Chevron bet significantly during the first quarter, to a stake worth $25.9 billion at the end of March. Meanwhile, Buffett told CNBC’s Becky Quick last month that he scooped up $600 million worth of Apple shares following a three-day decline in the stock last quarter. Apple is the conglomerate’s single largest stock holding with a value of $159.1 billion at the end of March, taking up about 40% of its equity portfolio. It was also previously reported that Buffett ramped up its Occidental investment. At the annual shareholder meeting, Buffett broke down how he took advantage of the trading mania to scoop up 14% of Occidental in just two weeks.