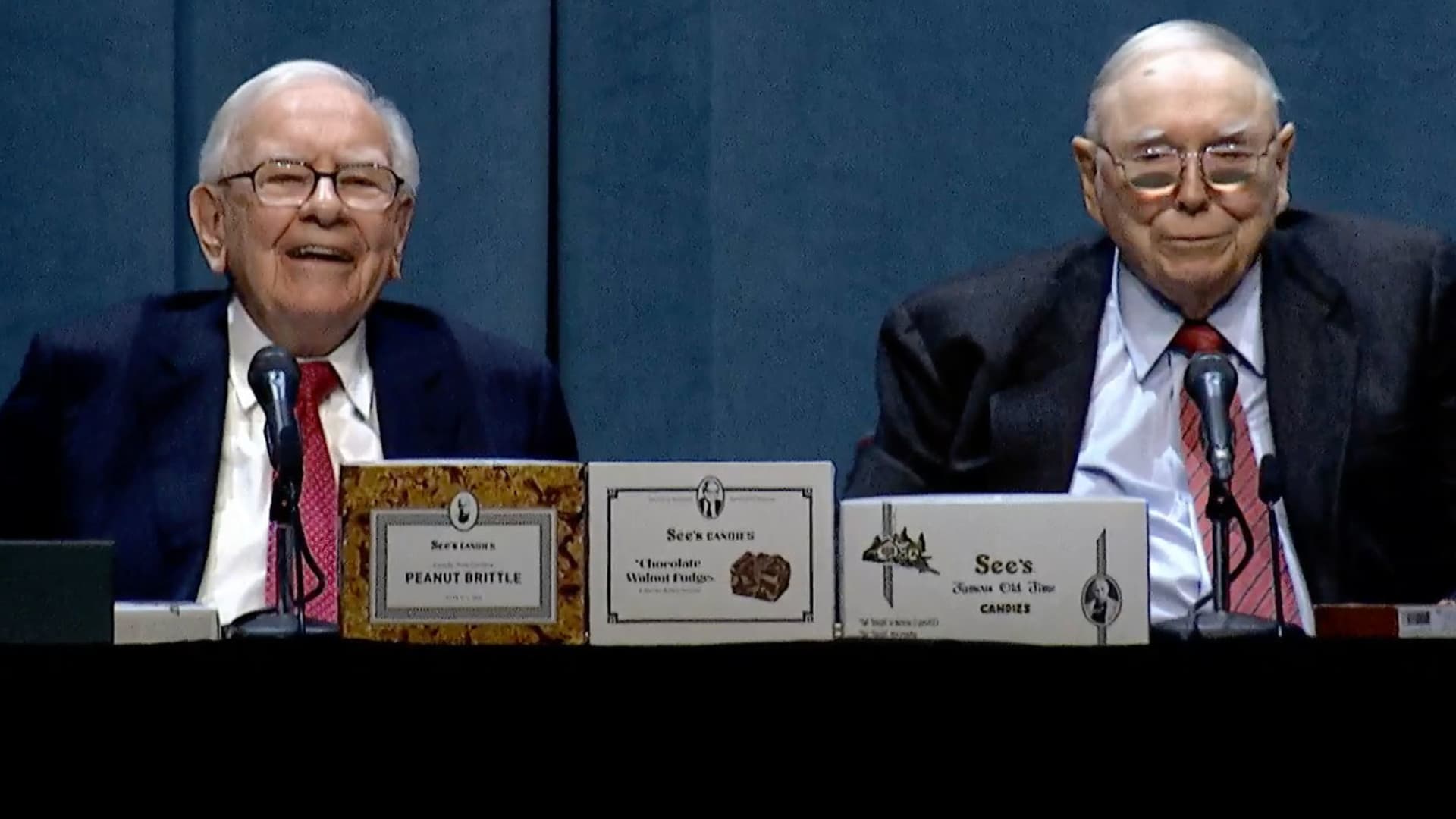

Comply with our dwell coverage of Warren Buffett at Berkshire Hathaway assembly.

OMAHA, Neb. — Warren Buffett said Saturday that Berkshire Hathaway will not approach on taking entire manage of Occidental Petroleum, an oil big exactly where it has amassed a stake north of 20%.

“There is certainly speculation about us buying control, we are not likely to obtain control,” the ‘Oracle of Omaha’ said at Berkshire’s yearly shareholder meeting. “We would not know what to do with it.”

In August very last calendar year, Berkshire obtained regulatory approval to obtain as a great deal as a 50% stake. Because then, Buffett has been steadily incorporating to his bet, together with this year, boosting the conglomerate’s stake in the Houston-dependent energy producer to 23.5%. The moves experienced fueled speculation that the 92-yr-old investor could get the total enterprise.

“We will not be earning any provide for control of Occidental, but we really like the shares we have,” Buffett reported. “We may or may possibly not have additional in the long run but we surely have warrants on what we obtained on the first deal on a quite sizeable volume of inventory around $59 a share, and warrants very last a very long time, and I’m happy we have them.”

Berkshire owns $10 billion of Occidental most popular inventory, and has warrants to invest in yet another 83.9 million widespread shares for $5 billion, or $59.62 each. The warrants were being received as part of the company’s 2019 deal that helped finance Occidental’s acquire of Anadarko.

Shares of Occidental had been down about 3% this yr, just after more than doubling in 2022. The stock was the finest-executing identify in the S&P 500 very last 12 months.

— CNBC’s Sarah Min contributed reporting.