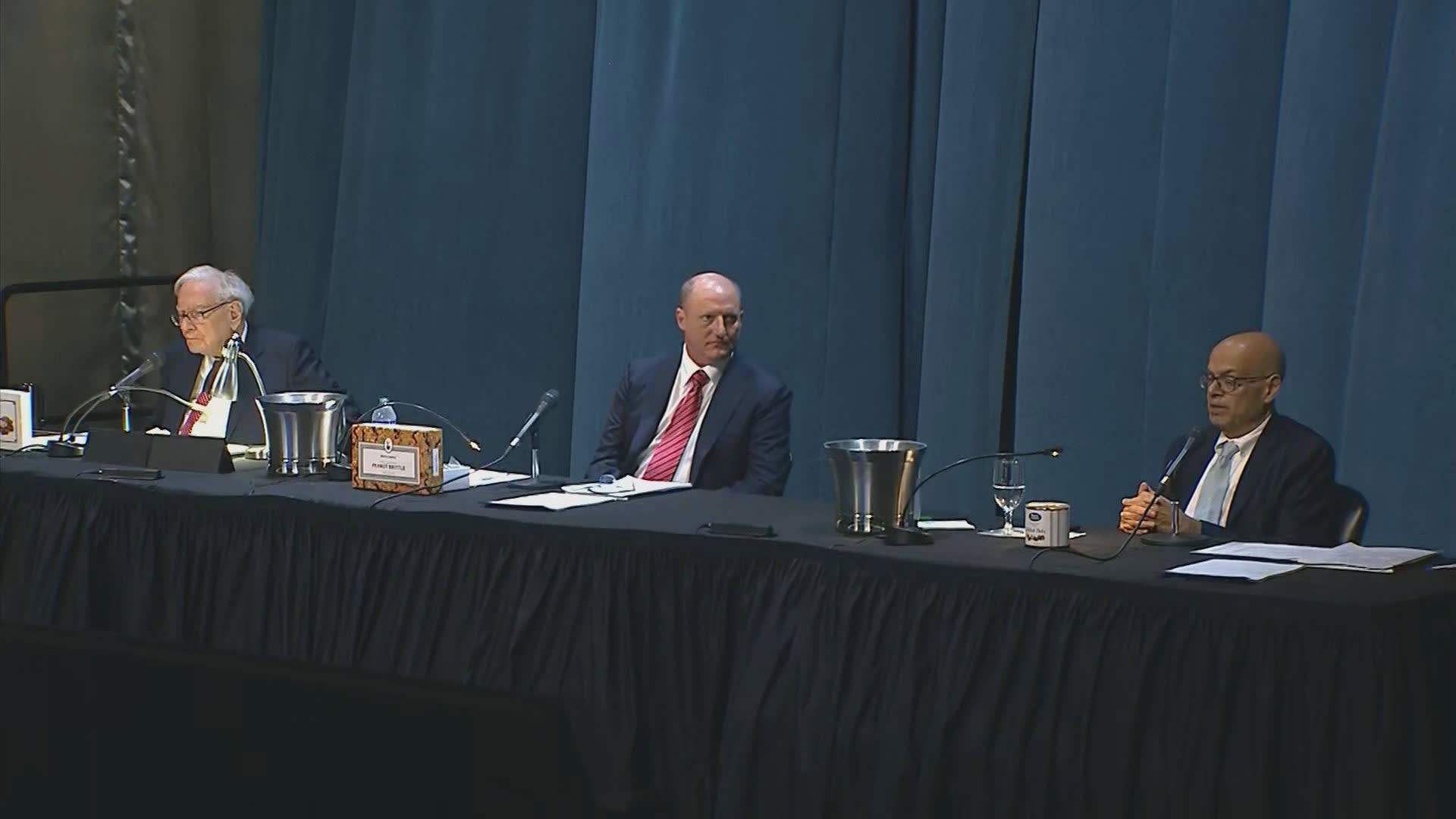

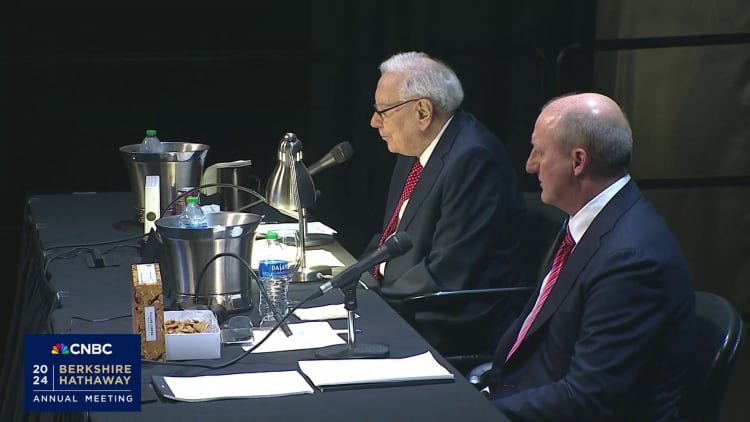

OMAHA, Nebraska — Warren Buffett claimed Saturday his selected successor Greg Abel will have the final say on Berkshire Hathaway’s investing decisions when the Oracle of Omaha is no for a longer time at the helm.

“I would go away the capital allocation to Greg and he understands companies incredibly well,” Buffett explained to an arena entire of shareholders at Berkshire’s annual assembly. “If you comprehend firms, you’ll comprehend prevalent stocks.”

Abel, 61, grew to become identified as Buffett’s heir evident in 2021 after Charlie Munger inadvertently manufactured the revelation at the shareholder assembly. Abel has been overseeing a main portion of Berkshire’s sprawling empire, together with electrical power, railroad and retail.

Buffett offered the clearest insight into his succession plan to day just after a long time of speculation about the correct roles of Berkshire’s top rated executives right after the eventual changeover. The investing icon, who’s turning 94 decades previous in August, mentioned his selection is affected by how significant Berkshire’s belongings have developed.

“I applied to assume otherwise about how that would be managed, but I imagine that obligation should really be that of the CEO and whichever that CEO decides may be handy,” Buffett said. “The sums have developed so huge at Berkshire and we do not want to try and have two hundred individuals about that are managing a billion every single. It just would not work.”

Berkshire’s hard cash pile ballooned to approximately $189 billion at the conclude of March, whilst its gigantic fairness portfolio has shares well worth a whopping $860 billion centered on modern sector costs.

“I consider what you happen to be dealing with the sums that we will have, you have got to consider quite strategically about how to do very significant points,” Buffett additional. “I imagine the responsibility should to be fully with Greg.”

When Buffett has made distinct that Abel would be using above the CEO work, there have been still issues about who would control the Berkshire general public stock portfolio, wherever Buffett has garnered a huge pursuing by racking up huge returns via investments in the likes of Coca-Cola and Apple.

Berkshire investing administrators, Todd Combs and Ted Weschler, both of those previous hedge fund managers, have helped Buffett regulate a tiny part of the stock portfolio (about 10%) for about the previous ten years. There was speculation that they may well choose around that portion of the Berkshire CEO purpose when he is no more time capable.

But it appears to be by Buffett’s most up-to-date reviews that Abel will have remaining selections on all funds allocation, which include stock picks.

“I feel the main government really should be any individual that can weigh getting organizations, obtaining shares, carrying out all forms of matters that could possibly appear up at a time when no one else is prepared to go,” Buffett reported.

Abel is known for his solid abilities in the strength market. Berkshire acquired MidAmerican Vitality in 1999 and Abel grew to become CEO of the company in 2008, six decades before it was renamed Berkshire Hathaway Power in 2014.