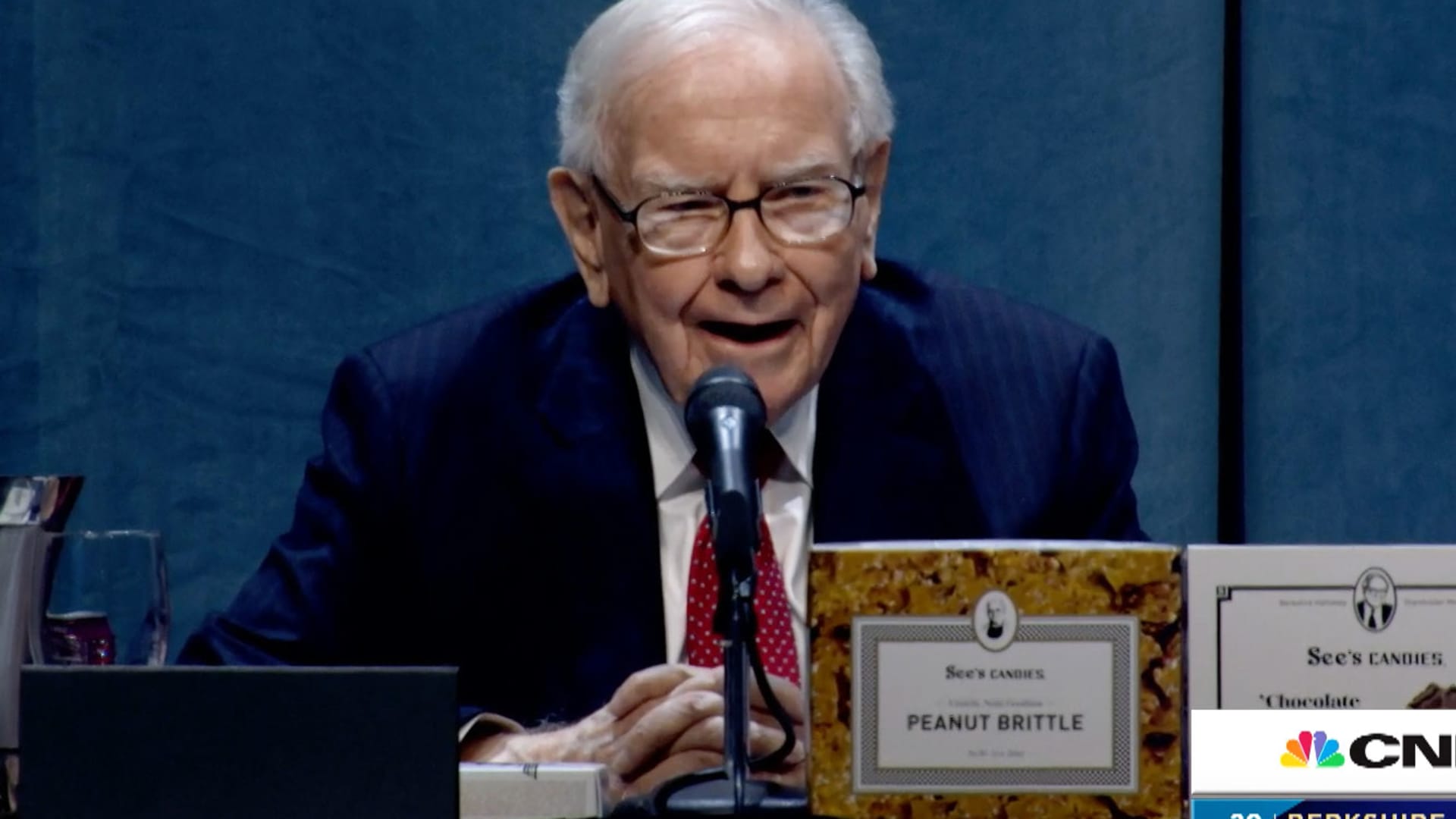

Warren Buffett at press convention during the Berkshire Hathaway Shareholders Meeting, April 30, 2022.

CNBC

Warren Buffett’s Berkshire Hathaway on Friday obtained regulatory approval to acquire up to 50% of oil huge Occidental Petroleum.

Shares of Occidental jumped 10% on the news to higher than $70 apiece, pushing their 2022 gains to far more than 140%.

On July 11, Berkshire filed an application with the Federal Energy Regulatory Fee to acquire extra of the oil company’s frequent inventory in secondary current market transactions. The conglomerate argued that a maximum 50% stake wouldn’t damage levels of competition or diminish regulatory authority.

Carlos Clay, acting director of division of electric energy regulation, granted the permission Friday, saying authorization was “steady with the public curiosity.”

The conglomerate has currently greater its Occidental stake greatly this 12 months. Berkshire now owns 188.5 million shares of Occidental, equivalent to a 20.2% posture. It surpassed a crucial threshold exactly where Berkshire could history some of the oil company’s earnings with its very own, likely adding billions of pounds in earnings.

Berkshire also owns $10 billion of Occidental desired inventory, and has warrants to buy a further 83.9 million prevalent shares for $5 billion, or $59.62 every single. The warrants had been received as component of the company’s 2019 deal that served finance Occidental’s buy of Anadarko. The stake would increase to practically 27% if Berkshire physical exercises individuals warrants.

Friday’s news fueled speculations that Buffett will be fascinated in getting the total enterprise eventually immediately after ramping up his stake further more at comparatively minimal selling prices.

“He will likely continue to invest in as a great deal as he can get beneath $70 or $75. If you own 30% or 40% and would like to buy it out at $95 or $100, you saved a great deal of cash,” mentioned Cole Smead, president of Smead Funds Administration and a Berkshire shareholder. “This inventory trades like a casino. The market place is offering him all the stock he needs.”

Some speculated that Berkshire and Occidental had been in conversation about the likely go to increase the stake to up to 50%.

“He has constantly reported he would only do friendly discounts, so that he may possibly have agreed with the OXY board on that limit,” said Monthly bill Stone, CIO of The Glenview Trust Company and a Berkshire shareholder.

The “Oracle of Omaha” commence getting the inventory soon after reading by means of Occidental’s once-a-year report and received assurance in the company’s progress and its leadership.

“What Vicki Hollub was declaring produced nothing but perception. And I made the decision that it was a fantastic area to set Berkshire’s cash,” Buffett reported all through Berkshire’s once-a-year conference in April. “Vicki was expressing what the enterprise had gone as a result of and exactly where it was now and what they prepared to do with the cash.”

Occidental has been the most effective-doing stock in the S&P 500, benefitting from surging oil rates.

Buffett’s increasing wager on Occidental has influenced a legion of modest traders to abide by suit, building it a favorite retail inventory this 12 months, according to details from VandaTrack.