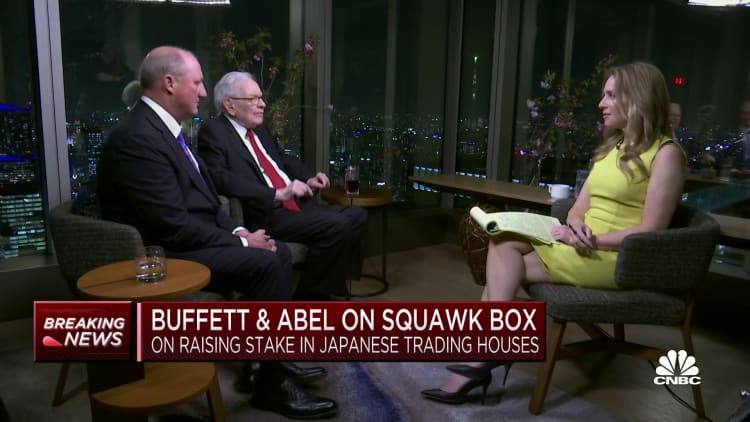

Warren Buffett claimed he was “confounded” by the possibility to obtain into five Japanese trading residences two a long time in the past.

“I was confounded by the actuality that we could invest in into these providers,” Buffett instructed CNBC’s Becky Quick on “Squawk Box” in an interview from Tokyo Wednesday. They experienced in result “an earnings produce maybe 14% or something like that, but dividends would mature.”

The Berkshire Hathaway chairman and CEO revealed this week that he had elevated his stakes in each of the five important Japanese firms to 7.4%, and additional that he may perhaps take into consideration further investments. Buffett’s vacation to Japan is meant to display support to the companies.

Earnings produce is defined as the gain for each share divided by the share cost and is a typical measure utilized by worth traders like Buffett. The larger the number, the more price investors are acquiring for every share.

“I just imagined these had been big firms. They were being corporations that I normally comprehended what they did. Rather identical to Berkshire in that they owned plenty of distinct passions,” Buffett reported. “And they were providing at what I imagined was a ridiculous rate, notably the price tag in contrast to the curiosity rates prevailing at that time.”

Buffett, 92, explained on Wednesday that Berkshire ideas to maintain the investments for 10 to 20 a long time. Berkshire earlier explained it could raise its stakes in every of the investing houses up to 9.9% — although not without the need of the approval of the firms’ boards of administrators.

Dealmaking?

Berkshire’s vice chairman of non-insurance plan operations and Buffett’s heir clear Greg Abel added that conglomerate is also fascinated in any even further “incremental possibility” with each individual of the companies in terms of dealmaking.

“We would pretty substantially appraise it speedily. Warren highlighted the bigger the superior, and that he’ll respond to the cellphone on the to start with ring. And we will never ever operate out of dollars. They can connect with us whenever,” mentioned Abel.

The “Oracle of Omaha” very first obtained stakes in these companies in August 2020 for his 90th birthday, in an first purchase truly worth roughly $6 billion. The firms are Mitsubishi Corp., Mitsui & Co., Itochu Corp., Marubeni and Sumitomo.

Regarded as sogo shosha, Japan’s buying and selling residences are akin to conglomerates and trade in a huge assortment of products and components. With the import of metals, textiles, meals and other merchandise, they served vaunt the Japan’s economic climate to the international stage.

They have been criticized by some investors for their elaborate operations, as properly as for their increasing publicity to risks abroad as they expanded internationally. Even so, for Buffett, all those diversified operations could be element of the draw. They also boast significant dividend yields and cost-free dollars circulation.