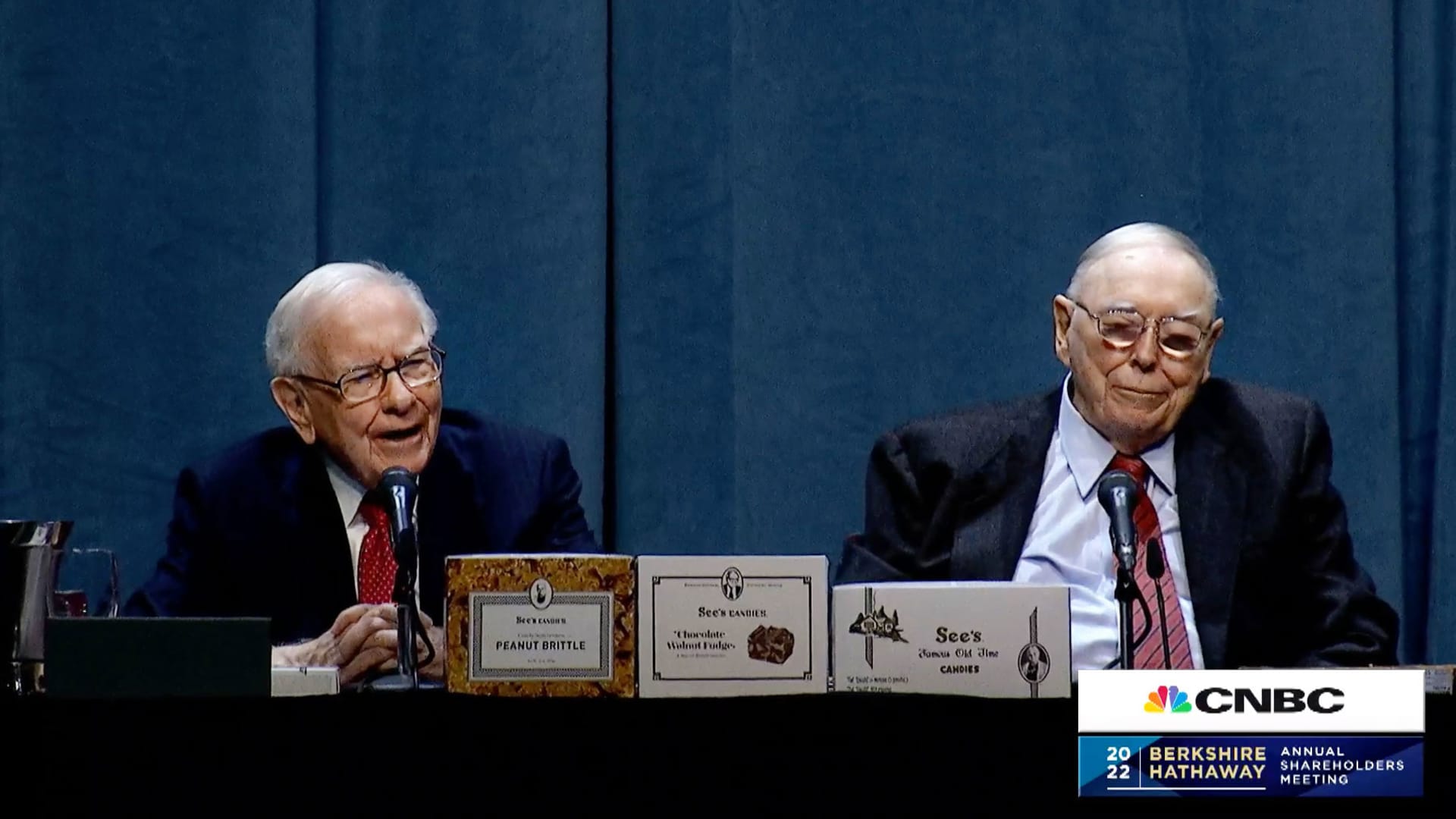

Warren Buffett and Charlie Munger at press meeting for the duration of the Berkshire Hathaway Shareholders Conference in Omaha, Nebraska, April 30, 2022.

CNBC

Berkshire Hathaway‘s Warren Buffett explained his sprawling conglomerate may possibly only a little bit outperform the common American company because of to its sheer size and the absence of obtaining prospects that could make an effects.

The Omaha-centered big — owner of almost everything from BNSF Railway to Dairy Queen and 6% of Apple — has by much the largest web value recorded by any American small business and now attained 6% of that of the complete S&P 500 companies, Buffett explained in his yearly letter produced Saturday.

“There stay only a handful of firms in this state capable of certainly transferring the needle at Berkshire, and they have been endlessly picked around by us and by other individuals,” Buffett wrote. “Some we can price some we cannot. And, if we can, they have to be attractively priced.”

The very last sizable deal Berkshire did was shopping for insurance company and conglomerate Alleghany for $11.6 billion in 2022. The “Oracle of Omaha” has also acquired a 28% stake in energy giant Occidental Petroleum, when ruling out purchasing the complete company. These moves, while important, did not dwell up to the expectation of an “elephant-sized” concentrate on that Buffett has been wanting to make for decades.

Berkshire held a document $167.6 billion in dollars in the fourth quarter.

“Outside the U.S., there are in essence no candidates that are significant solutions for money deployment at Berkshire. All in all, we have no possibility of eye-popping effectiveness,” Buffett reported.

Berkshire did construct a 9% stake in five Japanese trading companies — Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo, which Buffett intends to individual extensive time period.

The 93-yr-old Buffett explained Berkshire’s team of diversified, good quality enterprises ought to provide “marginally far better” efficiency than the ordinary U.S. corporation, but anything more than that is not likely.

‘With our existing combine of businesses, Berkshire really should do a little bit far better than the regular American corporation and, extra critical, need to also operate with materially much less hazard of long-lasting loss of capital,” Buffett claimed. “Something over and above ‘slightly improved,’ even though, is wishful thinking.”

Berkshire not long ago strike consecutive report highs, trading earlier mentioned $620,000 for Class A shares and boasting a current market worth above $900 billion.

The conglomerate’s stock has acquired about 16% in 2024, additional than double the S&P 500′s return, right after climbing 16% in all of 2023.