A Volvo C40 Recharge electric powered SUV is on show during the Volvo “A New Era of Volvo Vehicles” push conference at The Shilla Seoul on March 14, 2023 in Seoul, South Korea.

Han Myung-gu | Wireimage | Getty Pictures

Volvo Cars shares surged extra than 21% on Thursday after the Swedish automaker announced that it will prevent funding subsidiary Polestar Automotive.

Volvo previously in the working day claimed a 10% year-on-yr raise in fourth-quarter net income to 148.1 billion Swedish krona ($14.16 billion), bringing its whole-12 months 2023 overall to 552.8 billion krona.

The group might hand stewardship of the ailing luxurious car or truck model above to majority Volvo shareholder Geely Keeping, Volvo Vehicles said on Thursday, in accordance to Reuters.

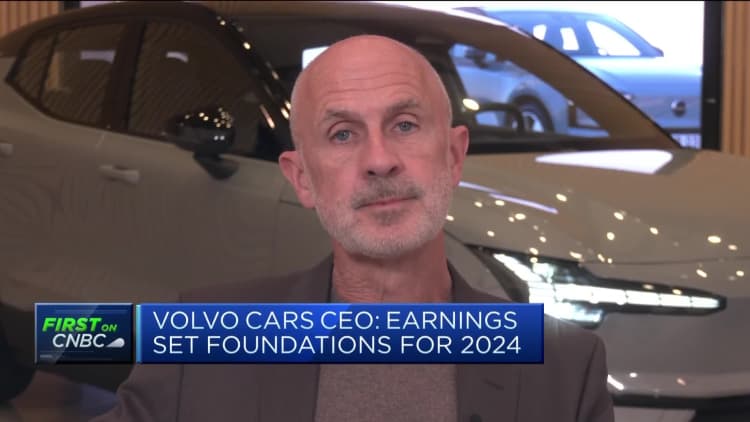

“This is a all-natural evolution, I feel, concerning the romance amongst Polestar and Volvo. Certainly, we spun out Polestar as a different enterprise a extended time back, and given that then we have been incubating and doing the job with Polestar for a quantity of a long time,” Volvo Cars and trucks CEO Jim Rowan advised CNBC’s Silvia Amaro on Thursday.

“Now, Polestar … they have have bought a very enjoyable foreseeable future in advance of them, they have moved from getting a a single-vehicle firm to a a few-vehicle corporation, they’ve obtained two brand name new cars coming out extremely soon, in fact in the first 50 % of this year, and that’s likely to consider them to a new growth trajectory.”

He mentioned this felt like the ideal time for Volvo Cars and trucks to begin lowering its shareholding of Polestar and for the business to “search for funding outdoors of Volvo.”

“That lets us and Volvo as very well to totally target on our expansion journey, in particular some of the technology investments that we need to have to make in the next two-three a long time.”