Republican presidential candidate businessman Vivek Ramaswamy speaks to attendees at the Iowa Religion & Flexibility Coalition Spring Kick-Off on April 22, 2023 in Clive, Iowa.

Scott Olson | Getty Photographs

Republican presidential hopeful Vivek Ramaswamy designed his White Property bid all-around urging firms to keep out of politics.

What he doesn’t convey to voters is the asset management business he co-founded has engaged more with Republican Occasion officials at the rear of the scenes than was earlier recognised, in accordance to private email correspondence reviewed by CNBC.

The e-mail clearly show how the firm, Try Asset Administration, grew to become a guide organizer and voice in opposition to environmental, social and governance, or ESG, investing, both of those right before and since Ramaswamy entered the presidential race in February.

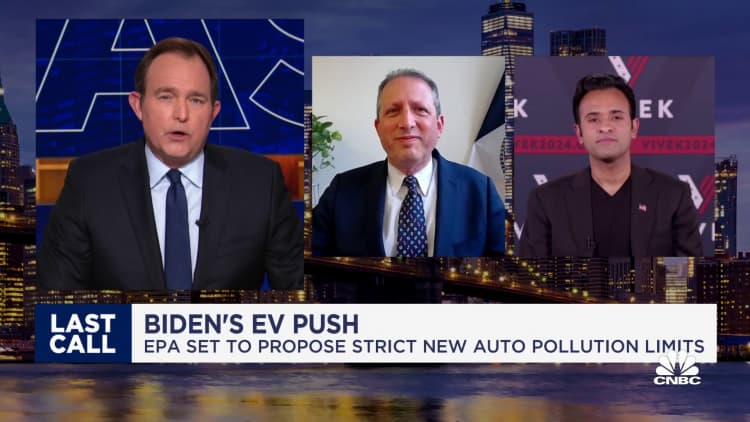

Ramaswamy instructed CNBC in an job interview Thursday that he stepped away from his position as executive chairman of the business and is no for a longer period on its board although he runs for president.

When he introduced his business very last calendar year, Ramaswamy advised CNBC that organizations really should “aim on excellence around politics.” He slammed ESG-design investing by BlackRock, Condition Road and Vanguard, and accused the corporations of utilizing “their clients’ cash to advocate for viewpoints in the boardrooms of corporate America that most of their individual consumers disagree with.”

Ramaswamy and his organization have due to the fact jumped into the political clash around ESG investing platforms, according to the e-mails, which were being attained by watchdog Documented and offered to CNBC. The messages display Ramaswamy’s company actively engaged with GOP state leaders who have defended the fossil gasoline industry and criticized environmentally mindful financial investment standards.

Ramaswamy on Thursday defended the firm’s engagement with GOP officials, indicating bigger firms BlackRock, Vanguard and Point out Road have conducted identical practices with condition officials throughout the place.

“The major asset allocators into the asset administration methods are state pension money and BlackRock, State Street, Vanguard, Invesco and other people, are routinely engaged,” Ramaswamy told CNBC. “It’s just a really hard truth that these institutions have for many years been educating, discussing with states and pension fund techniques, the merits of ESG primarily based financial investment framework. Try is bringing an option perspective to bear across the current market.”

Because he began his marketing campaign, Ramaswamy has deferred thoughts about Strive’s organization technique to the business.

Try CEO Matt Cole echoed Ramaswamy’s remarks in an job interview with CNBC.

“We’re just copying the playbook of BlackRock, Point out Street and Vanguard,” Cole said Thursday. When questioned about the e-mail exhibiting how the organization has become a top organizer from ESG investing, Cole said: “I imagine Attempt is the primary voice in The united states pushing in favor of shareholder capitalism.”

Attempt has develop into a single of the extra vocal opponents of ESG investing and has obtained more than enough notoriety to challenge the likes of fossil fuel giant ExxonMobil. Ramaswamy, as Strive’s executive chairman, sent a letter to Exxon in November declaring the company’s board “displays an overrepresentation of administrators whose principal focus appears to be on Exxon’s local climate modify technique.”

Ramaswamy later on secured a assembly with Exxon CEO Darren Woods. Attempt stated in a December push launch that the oil and gasoline govt “pushed back on particular details in Strive’s letter but fully commited to checking out appropriate administrators for Exxon’s board with appropriate sector knowledge.” A thirty day period following the assembly, Exxon announced it would insert Lawrence Kellner, a former CEO of Continental Airlines, and John Harris II, a previous CEO of Raytheon Global, to its board.

Ramaswamy’s organization at the exact same time targeted its financial commitment tactic on fossil fuels. Attempt introduced an ETF in 2022 named Strive U.S. Strength, which is stated on the New York Inventory Exchange as DRLL. The fund’s actuality sheet lists Exxon, Chevron and ConocoPhillips as its prime three holdings. It has web assets of above $300 million.

Ramaswamy instructed CNBC on the day the ETF introduced that Try “is providing a new mandate.”

“What I get in touch with the submit ESG mandate to the U.S. vitality sector to drill for far more oil,” he mentioned at the time. “To frack for much more pure fuel. To do whatsoever lets them to be most prosperous over the extensive run with no regard to political, social, cultural or environmental agendas.”

The firm’s overall assets below administration total above $520 million, in accordance to a regulatory filing signed in February and submitted by Strive to the Securities and Exchange Commission. The type was signed a 7 days soon after Ramaswamy announced he was running for president, and demonstrates that at that time his ownership stake in Attempt was at minimum 50%. Ramaswamy did not dispute in the CNBC job interview that he even now owns at the very least 50% of the enterprise.

Cole verified that the ownership construction outlined on the submitting has not modified due to the fact Ramaswamy introduced his operate for president. He added that Attempt, as of Wednesday, experienced about $680 million in assets beneath administration.

Attempt moves to organize ESG discussion board

Ramaswamy has solid himself for several years as a leading culture warrior towards significant organizations and prolonged his struggle to the marketing campaign trail. He co-started the anti-ESG company in 2022, a 12 months following he posted a ebook called “Woke, Inc.: Within Corporate America’s Social Justice Fraud,” which usually takes on the principle of stakeholder capitalism.

His declared and potential rivals, including former President Donald Trump and Florida Gov. Ron DeSantis, have typically attacked ESG investing specifications and organizations that assistance social results in — an significantly frequent chorus inside of the GOP.

The opposition to businesses expressing political views has served to propel Ramaswamy to the prime tier of the Republican main, according to early polls. 1 current Morning Consult study found him, in a hypothetical GOP main area, tied with previous Vice President Mike Pence for 3rd area with 5% of help. He trailed only Trump at 60% and DeSantis at 19%.

Trump has raved about Ramaswamy, stating his favourable reviews about the Trump administration are “the motive he is accomplishing so perfectly.”

The e-mail counsel that each right before and soon after Ramaswamy explicitly jumped into politics, his business had entered the fray by creating ties to anti-ESG Republican officers.

In March, one thirty day period after Ramaswamy declared his operate for president, Attempt arranged a phone showcasing what the email labeled as the “Professional-Fiduciary Traders Taskforce.”

The more than 30 individuals invited to participate incorporated at minimum 50 percent a dozen Republican point out fiscal officers who have either vehemently opposed ESG investment specifications, or in some situations, have applied their power to directly choose on Wall Avenue firms that adhere to the follow, the electronic mail displays. Ramaswamy was not on the invite checklist.

Matthew Kopko, a senior vice president at Strive, mentioned in 1 of the received e-mail that the “kick-off connect with” would target, in portion, on a Biden administration rule that lets businesses to pick ESG cash for their firm 401(k) designs. In March, days right before the assembly took spot, President Joe Biden vetoed a bill that would have rolled back the Labor Department conventional.

Cole verified to CNBC that the veto came up on the simply call.

“I imagine the huge bulk of individuals [at the meeting] believed the monthly bill need to not have been vetoed,” he mentioned. Cole included that “it was quite interesting I feel from our standpoint that the very first veto of Biden’s presidency was a bipartisan invoice that was concentrated on maximizing value, or forcing asset supervisors to concentration on maximizing value.”

An emailed invite to the Zoom connect with also demonstrates that Attempt executives ended up planning to manage a central discussion board to focus on ESG-related problems.

“As mentioned with quite a few of you across the nation, there is solid desire between state economical leaders to have a forum to share and master information and facts connected to rising developments in ESG, company governance, proxy voting, stewardship and other fiduciary issues,” Kopko said in another e mail to those people invited.

The officers invited incorporated Jimmy Patronis, Florida’s GOP main money officer, who in December said the point out treasury would pull out $2 billion in belongings previously managed by BlackRock. West Virginia point out Treasurer Riley Moore was also invited to choose part in the simply call. He announced in 2022 that the state will no extended use a BlackRock financial investment fund as component of its banking transactions. Associates for Moore and Patronis reported the two did not participate in the simply call.

Marlo Oaks, the Utah state treasurer who labeled ESG component of “Satan’s program” and moved about $100 million in point out dollars earlier managed by BlackRock to distinctive asset managers, is also stated as invited to the simply call. A representative for Oaks did not answer to a ask for for remark.

Derek Kreifels, the CEO of the conservative-leaning Point out Financial Officers Basis, which has structured conferences bashing ESG investing, was also invited to consider element in the phone. Ramaswamy was a keynote speaker at a single of the foundation’s meetings last yr and the condition main financial officers invited to just take part on the Strive connect with are publicly mentioned SFOF users. A consultant for Kreifels said the nonprofit CEO did not take part in the connect with.

Kopko despatched a observe-up e mail in May for what he explained as the “future job force get in touch with.” The email exhibits that the up coming celebration was established to just take place May well 3. While you will find no doc demonstrating who was invited to that Zoom accumulating, the itinerary for the connect with notes that ESG critic and Yale regulation college professor Jed Rubenfeld was envisioned to give a “presentation on state pension fiduciary responsibilities.”

Cole said Rubenfeld’s presentation on that connect with was about “very best methods for pensions.” He spelled out there have been about 30 people today on the call and most of the people today at the assembly have been “pension-connected staff members,” together with some point out attorneys general.

Cole stated he didn’t know all of the condition AGs who took part in the connect with and which political social gathering they have been affiliated with. But he also reported that “ordinarily Republican AGs have been far more intrigued in trying to pushback from asset managers pursuing non financial pursuits but the invite was not to any distinct political occasion.”

Finding access

Ramaswamy’s business obtained additional accessibility to anti-ESG Republican politicians ahead of he introduced a presidential bid than was formerly acknowledged, according to the email messages.

His firm’s leaders privately turned to anti-ESG Republican point out officers in both Texas and West Virginia to support obtain obtain to authorities officials to examine Strive’s organization ventures, either via in-man or woman or Zoom meetings, according to e-mails from September through March.

Cole said they have satisfied with leaders from much more than 20 states and have also engaged with big wealth administrators about their corporation. “To me these are just two meetings that we have on our calendar just about every working day,” he reported.

Strive President Anson Frericks, in a September e-mail to Texas Comptroller Glenn Hegar, reviewed a lunch he had in August with Hegar and one of his top rated donors, oil and gas developer Ben “Bud” Brigham. Frericks in the e-mail requested a “heat introduction” to a condition-based get in touch with for an “emerging professionals fund for new firms like Attempt.”

“At lunch with Bud Brigham, you outlined that TX has an emerging administrators fund for new companies like Try. Are you in a position to provide us with a call for that fund (I cc’d our Head of Institutional Investing, Rob Melton)? Or make a warm introduction?” Frericks requested Hegar in the e mail.

Hegar experienced argued in letters to funds supervisors in 2022 that companies this sort of as BlackRock, HSBC and UBS are boycotting the electricity field, indicating in a statement that he believes “environmental crusaders” have produced a “wrong narrative” that the financial system can transition away from fossil fuels.

Several hours just after Frericks sent his September e-mail, Hegar replied in an e-mail that he obliged the request for an introduction and forwarded Frericks’ e-mail to Mike Reissig, the CEO of the Texas Treasury Safekeeping Have faith in Firm. That entity was established by the Texas Legislature “as a particular function entity to proficiently and economically regulate, devote and safeguard resources for its customers: the condition and many subdivisions,” in accordance to its site.

Hegar is the chair of the Texas Treasury Safekeeping Have confidence in Organization.

That introduction led to a March assembly becoming scheduled in Austin between Reissig, Frericks and Kopko to examine Strive’s proxy voting expert services, in accordance to the email messages.

Representatives for Hegar and Reissig did not answer to requests for comment.

Federal Election Fee documents exhibit that Brigham, the similar oil and fuel government who had lunch with Frericks in August, donated $6,600 in March to Ramaswamy’s marketing campaign for president. That total represents the most an unique donor can give specifically to a campaign in the 2024 election cycle.