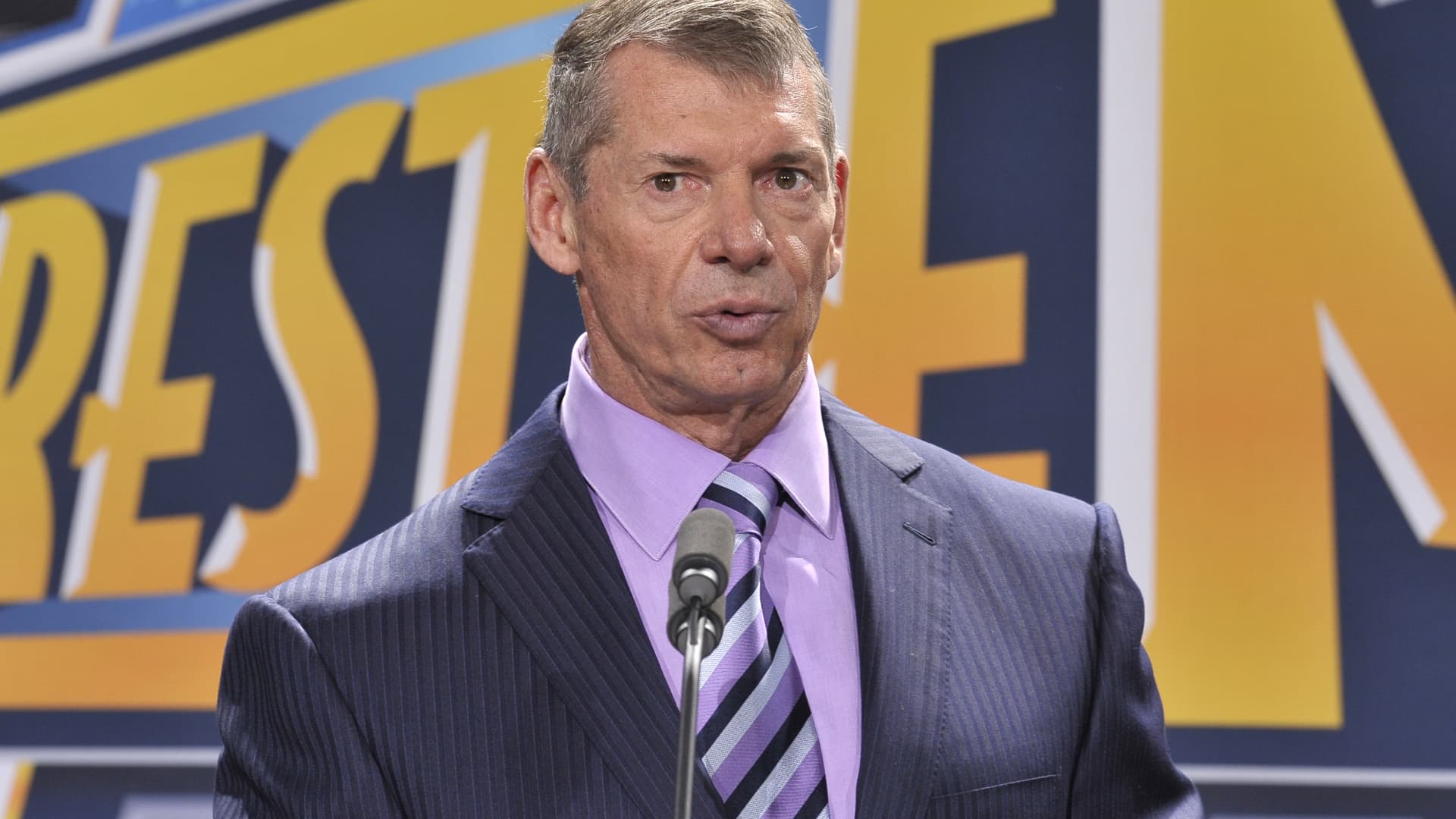

Vince McMahon attends a press conference at MetLife Stadium on February 16, 2012 in East Rutherford, New Jersey.

Michael N. Todaro | Getty Images

World Wrestling Entertainment Executive Chairman Vince McMahon is open to stepping away from the company “if it’s the right deal,” according to WWE CEO Nick Khan.

Shares of the company closed more than 5% higher Friday.

related investing news

McMahon’s potential future involvement in WWE has become an early sticking point in preliminary talks with various buyers, according to people familiar with the matter, who asked not to be named because the discussions are private.

McMahon is WWE’s controlling shareholder. He developed the creative storylines for the professional wrestling league for decades, often taking part in narratives himself. Earlier this year, he stepped down as head of creative, handing the reigns to his son-in-law, former WWE superstar Paul “Triple H” Levesque. Khan took over as sole CEO in January when Levesque’s wife and McMahon’s daughter, Stephanie, stepped down as co-CEO.

“Vince has declared to the board he’s 100% open to transactions where he’s not included in the company moving forward,” Khan said in a CNBC interview Friday.

McMahon stepped away from his CEO role in June amid accusations of sexual misconduct from former female WWE employees. A month later, he announced he announced he would retire from the wrestling company he bought from his father over four decades ago. Last month, however, McMahon returned to the board to be directly involved in sale negotiations with potential buyers.

WWE has hired financial advisors to proceed with a sale process, which Khan predicted would last about three months. Khan emphasized WWE could be appealing to a large media company with a streaming platform that could increase subscribers by exclusively owning WWE’s monthly live events, along with its historical library of past matches.

“We feel the marketplace is robust for our product,” Khan said. “It’s in essence it’s own sports league. Someone can buy it and put it on their platform.”

Potential buyers for WWE include Comcast, Netflix, Liberty Media and Endeavor, which already owns UFC.

Khan acknowledged “it’s tough to take control” from McMahon, who has owned and run WWE (previously WWF) for more than 40 years. Still, he reiterated that McMahon would prioritize shareholder value and step away “if it’s the right deal — and we will take a look at all of the factors that make it the right deal.”

Disclosure: Comcast is the parent company of NBCUniversal, which owns CNBC.