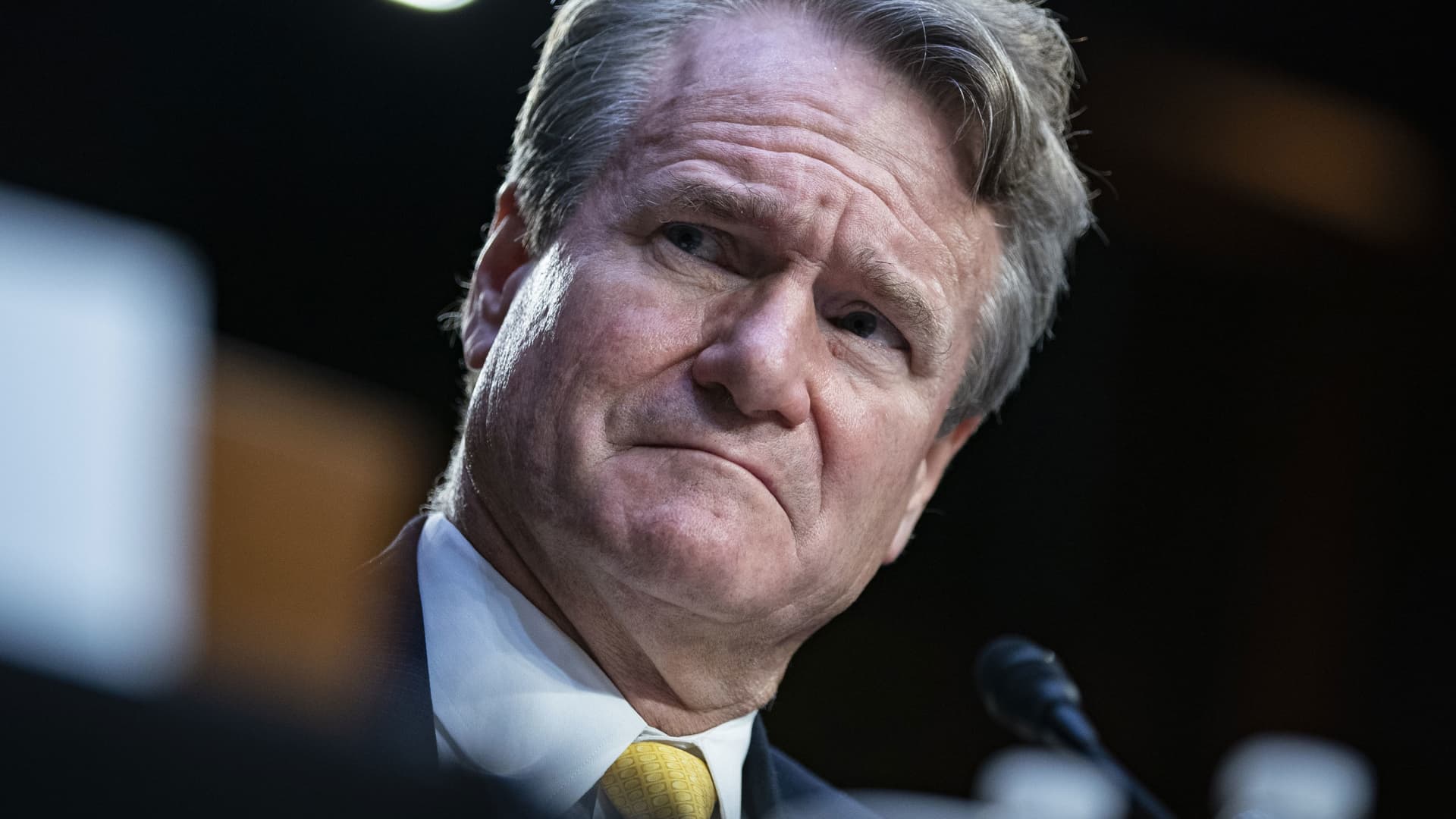

The U.S. economy is suffering from a “mitigation of advancement” but not a slowdown, Bank of The usa CEO Brian Moynihan claimed Friday.

Curiosity amount hikes by the Federal Reserve are starting up to be felt in the housing and vehicle marketplaces, and renters will see their budgets squeezed as landlords pass on greater charges, he instructed CNBC’s “Squawk Box Europe.” But he stressed that consumer paying out stays solid.

“If you raise rates and gradual down the financial system to combat inflation, the expectation is you have a slowdown in consumer paying out. It hasn’t happened nevertheless. So it could happen, but it has not took place nevertheless,” Moynihan said.

“You’re seeing a mitigation of the price of expansion, not a slowdown. Not adverse advancement.”

Lender of America expects the Fed to hike prices by 75 basis points and 50 foundation details at its two remaining meetings this calendar year, adopted by two 25 basis point hikes upcoming yr.

That will consider the resources amount to all-around 5% and the Fed can then “enable it work,” Moynihan mentioned.

The present amount of 3%-3.25% is the maximum it can be been considering that early 2008 and follows a few 75-foundation-level rises in a bid to battle inflation, which was operating at 8.2% on an annual foundation in September.

Economists, politicians and company leaders are break up on whether or not the U.S. overall economy is heading for a economic downturn or is presently in just one. U.S. gross domestic product grew for the first time this calendar year in the third quarter, expanding at a greater-than-anticipated 2.6% annually.

JP Morgan manager Jamie Dimon informed CNBC he expects a economic downturn in six to nine months specified quantitative tightening and the unknown effects of Russia’s war in Ukraine.

But for now, people however have powerful credit score, unemployment is low, wage expansion is powerful, and companies are in good condition with powerful fundamental credit — even if growth and earnings are slowing, Moynihan said. Even so he did concede there ended up challenges from unforeseen gatherings with “small likelihood and higher impact.”

“You don’t see people risks evidencing in actions alter of organizations and buyers nevertheless. People today usually are not laying off massive amounts of folks, they are not employing as quite a few,” he mentioned.

Questioned irrespective of whether the corporate credit score sector was flashing any warning signs, he mentioned: “I would not confuse credit history threat with pricing chance.”

“Advancement and earnings may possibly be slowing down, yet again for the reason that the financial system recovered extremely quickly and had key advancement that flattens out a tiny bit. If you see damaging GDP prints, of course corporate earnings could sluggish down,” he included.

“But on the other hand they’re however making funds, the margins are still keeping … the fundamental credit, the fundamental construction of the credit rating, the fundamental credit rating good quality is quite robust.”

Power exports

Moynihan reported Europe could see a recession early-to-mid next year in advance of “coming back again out the other aspect,” with the war in Ukraine and vitality crisis risks on the horizon.

“But correct now you do not see the ailments mainly because the employment’s solid, the underlying activity’s solid, the sum of stimulus that was set in is continue to in the marketplaces that people today don’t see it as a deep economic downturn.”

He extra: “The electricity concern is a lot distinctive than the U.S. The great news is the U.S. is a big economic climate, if we can get the vitality to Europe, for the men and women to heat their homes and industry to run, that would be a superior matter. And I know all the providers are doing the job on it, simply because I speak to them about it.”