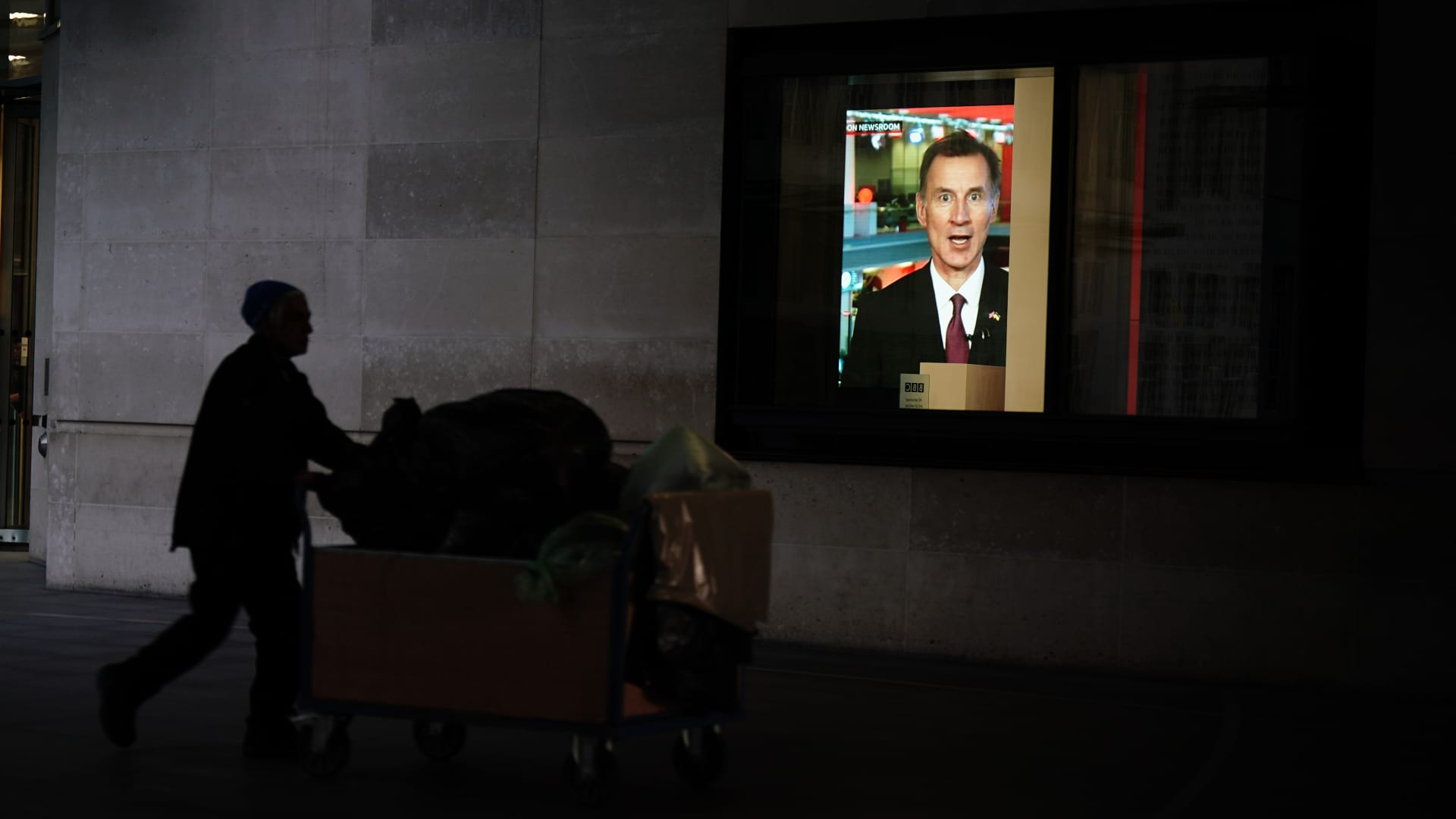

A male wheels a trolley past a display displaying Chancellor of the Exchequer Jeremy Hunt getting interviewed by the BBC the morning immediately after his autumn statement, exterior the BBC studios in central London.

Aaron Chown – Pa Pictures | Pa Photographs | Getty Photos

LONDON — U.K. progress has lagged the world’s biggest economies considering the fact that the Covid-19 pandemic and is significantly underneath the OECD average, according to a new report from the influential Paris-based mostly group.

U.K. gross domestic product has contracted by .4% concerning the fourth quarter of 2019 and the 3rd quarter of 2022, vs . cumulative 3.7% progress in the 38-member Organisation for Financial Co-operation and Improvement.

In the G-7 nations — which features Canada, France, Germany, Italy, Japan, the U.S. and U.K. — GDP has developed by a cumulative 2.5%, with only the U.K. recording a drop.

“We imagine this is happening mostly simply because of expense and because of intake,” Alvaro Pereira, the OECD’s chief economist, explained to CNBC’s Joumanna Bercetche on Tuesday.

“Being aware of the U.K. faces a difficult fiscal predicament, that is why we welcome what the govt has completed in the most current statement,” he reported.

Last week, Finance Minister Jeremy Hunt announced all-around £30 billion in paying out cuts and £25 billion in tax hikes for personnel and businesses in what he said was a bid to rebuild public finances, restrict 41-calendar year-superior inflation and restore financial reliability immediately after the current market-rocking September spending plan.

“We think that it is really critical to preserve fiscal prudence at the exact time that you happen to be equipped to improve or attempt to introduce some varieties of reforms to deal with some of the difficulties that have been plaguing the United Kingdom for a whilst, which is extremely low efficiency,” Pereira ongoing.

“I imagine it’s time to concentration on that as well as monetary and fiscal coverage.”

Pereira added that the OECD’s forecast for the U.K. economy’s magnitude of advancement between 2022 and 2024 was comparable to the unbiased Business office for Budget Responsibility, but it envisioned a shallower .4% recession following calendar year adopted but .2% development the yr immediately after, while the U.K.’s OBR forecasts a deeper economic downturn and a much better rebound.

Previous Lender of England policymaker Michael Saunders this 7 days informed CNBC Hunt’s program had a “massive” gap wherever an economic advancement technique should be.

‘Light at the close of the tunnel’

Tuesday also saw the release of the OECD’s world-wide Financial Outlook report.

This cautioned that the world economic system is set to slow in the year forward due to the energy industry shock induced by the Russian invasion of Ukraine and amid sky-large inflation, reduced client confidence and global threats.

However, it believes the globe will stay away from a recession, with 3.1% development in 2022, 2.2% advancement in 2023 and 2.7% advancement in 2024.

OECD Secretary-General Mathias Cormann reported in broadcast remarks the “world is struggling with substantial headwinds and substantial hazards in excess of the horizon” and “international locations also require to choose bold methods to handle some of the lengthier-expression worries to lay the foundation for a more powerful and additional resilient economic system.”

This incorporated structural reforms these types of as raising childcare assistance and adaptable functioning selections to motivate extra women into the place of work, making incentives to boost financial investment in reduced-emissions technological know-how, and holding global borders open up to trade to ease provide-aspect inflationary pressures.

Pereira advised CNBC: “We are facing a incredibly tough natural environment. I imagine a person of the most spectacular images we have in our outlook is precisely how substantially countries are investing in conditions of electrical power as a share of GDP, and you can see that correct now for OECD countries it’s shut to 18% … which is as large as we have noticed in the oil disaster in the 70s and 80s.”

“We are dealing with a quite massive power shock ideal now which is reducing expansion, at the exact same time that it truly is fueling inflation.”

The key draw back risks had been inside of electrical power marketplaces, significantly upcoming year in Europe and Asia if there are two cold winters and retail costs adhere to wholesale prices better, he stated. The OECD is also concerned about financial sector volatility for very low-earnings nations and emerging marketplaces that have higher credit card debt burdens amid climbing charges.

However, he reiterated the OECD did not forecast an yearly recession, even in significant economies this sort of as the U.S. and the euro zone.

He also reported central bank action on monetary policy would begin to consider outcome to tame inflation, and that the newest U.S. inflation print was “pretty beneficial.”

“We be expecting that not only the U.S. but other components of the earth, the decisiveness of monetary policy will start off to have additional and a lot more of an impression. Our central forecast sees inflation peaking in lots of nations around the world in the mid 50 % of up coming calendar year or late this yr, but generally future year,” Pereira mentioned.

“Especially in 2024 we commence obtaining inflation premiums considerably nearer to target, so there is some light at the close of the tunnel, but we will need not to allow go of monetary and fiscal tightening performing hand in hand.”