Swiss authorities brokered the controversial unexpected emergency rescue of Credit Suisse by UBS for 3 billion Swiss francs ($3.37 billion) in excess of the training course of a weekend in March.

Fabrice Coffrini | AFP | Getty Photos

UBS estimates a economic strike of close to $17 billion from its emergency takeover of Credit history Suisse, according to a regulatory filing, and said the rushed offer may possibly have influenced its owing diligence.

In a new filing with the U.S. Securities and Trade Commission (SEC) late Tuesday evening, the Swiss banking giant flagged a overall adverse effect of about $13 billion in fair price adjustments of the new mixed entity’s assets and liabilities, together with a prospective $4 billion strike from litigation and regulatory costs.

Having said that, UBS also expects to offset this by reserving a 1-off $34.8 billion gain from so-identified as “adverse goodwill,” which refers to the acquisition of assets at a much decreased value than their accurate worthy of.

The bank’s emergency acquisition of its stricken domestic rival for 3 billion Swiss francs ($3.4 billion) was brokered by Swiss authorities in excess of the study course of a weekend in March, with Credit Suisse teetering on the brink of collapse amid massive shopper deposit withdrawals and a plummeting share rate.

In the amended F-4 submitting, UBS also highlighted that the shorter time body underneath which it was compelled to conduct due diligence may have impacted its means to “absolutely consider Credit score Suisse’s assets and liabilities” prior to the takeover.

Swiss governmental authorities approached UBS on March 15 while thinking about regardless of whether to initiate a sale of Credit rating Suisse in purchase to “quiet markets and keep away from the probability of contagion in the money technique,” the submitting exposed. The financial institution experienced till March 19 to perform its because of diligence and return with a determination.

“If the situation of the owing diligence afflicted UBS Group AG’s ability to completely consider Credit rating Suisse’s liabilities and weaknesses, it is doable that UBS Team AG will have agreed to a rescue that is noticeably additional hard and dangerous than it had contemplated,” UBS explained in the Risk Elements segment of the submitting.

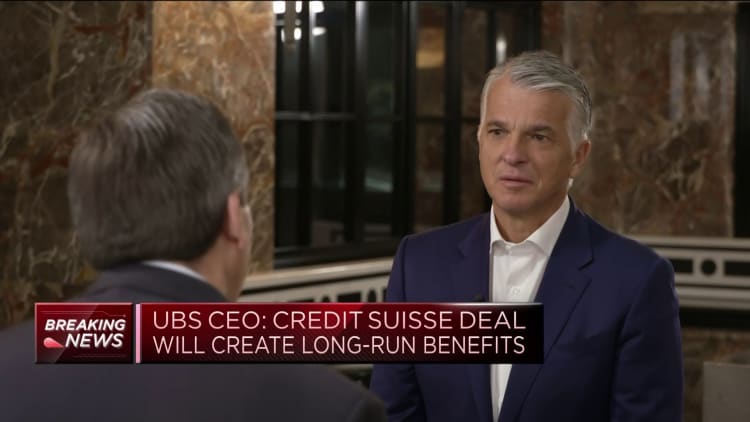

Nevertheless this is highlighted as a likely possibility, UBS CEO Sergio Ermotti instructed CNBC previous month that the Credit history Suisse deal was not dangerous and would build extended-time period rewards.

The most controversial part of the deal was regulator FINMA’s decision to wipe out about $17 billion of Credit Suisse’s more tier-a person (AT1) bonds just before shareholdings, defying the standard get of compose downs and ensuing in legal action from AT1 bondholders.

Tuesday’s submitting showed the UBS Method Committee commenced assessing Credit Suisse in October 2022 as its rival’s monetary scenario worsened. The long-battling financial institution seasoned large web asset outflows towards the conclude of 2022 on the back of liquidity concerns.

The UBS Strategy Committee concluded in February that an acquisition of Credit Suisse was “not fascinating,” and the financial institution ongoing to perform examination of the money and legal implications of these types of a offer in scenario the predicament deteriorated to the issue that Swiss authorities would inquire UBS to stage in.

UBS past week announced that Credit history Suisse CEO Ulrich Koerner will join the executive board of the new put together entity at the time the deal legally closes, which is envisioned within just the up coming couple months.

The group will function as an “integrated banking group” with Credit rating Suisse retaining its brand name independence for the foreseeable foreseeable future, as UBS pursues a phased integration.