The mammoth integration of failed bank Credit Suisse into its previous rival UBS will act as a “case research,” UBS CEO Sergio Ermotti reported on Friday, 1 that will display that major lender mergers should really be authorized.

“It is going to be a situation examine to be evaluated globally, but also specially in Europe, in which ultimately the necessity of creating more powerful financial institutions, and more robust and much more competitive banking companies from a world-wide standpoint of watch, is in my issue of check out a requirement,” Ermotti explained to CNBC’s Steve Sedgwick at an party at the Ambrosetti Spring Forum in Italy.

“Of course, we are not able to just rely on a disaster to develop or facilitate the merger of banking companies,” Ermotti reported.

“It is excellent to have powerful players that can be aspect of the remedy, like UBS was in the Credit history Suisse scenario … But it are unable to be just that portion. So in that feeling, I imagine that the genuine challenge is, there has to be a political desire to facilitate something like that. So it is not the fact of now,” he additional.

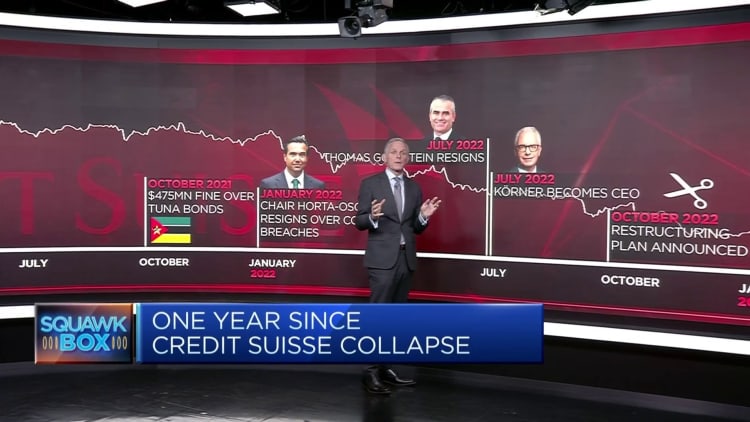

Credit history Suisse collapsed in March 2023 subsequent many years of underperformance, scandals and danger management crises. UBS in June concluded its takeover of the 167-12 months-previous financial institution in a deal controversially brokered by Swiss authorities.

The Swiss Nationwide Lender has stated the dimensions of the new entity flags likely competitiveness issues that will require to be monitored.

Ermotti reported Friday: “The good information is that, in my watch, in lots of nations around the world, there is a recognition that they want to secure their banking institutions or economical institutions as countrywide champions, which is an implied or explicit recognition of their value for their economies.”

“But the lousy news is that they don’t know that in get to truly be significant, and go to the next level of their contribution in their economies, they will want to be also more aggressive globally. But devoid of a banking union, devoid of a capital markets union, it can be likely to be really, incredibly difficult for Europe to compete with U.S. big banking companies.”

In contrast to in the U.S., European economies continue on to depend on the banking sector for organization financing and Europe has a “absolutely distinct actively playing area and a deficiency of crucial mass,” Ermotti claimed.

“So I hope, I am not so certain it’s heading to take place before long, but I hope ultimately one particular working day all those forms of mergers concerning major banking institutions will be authorized and we can add to that by showing that it really is feasible. In the meantime, I feel that in quite a few nations around the world, vital mass and synergies can be created by more rounds of community mergers,” he stated.