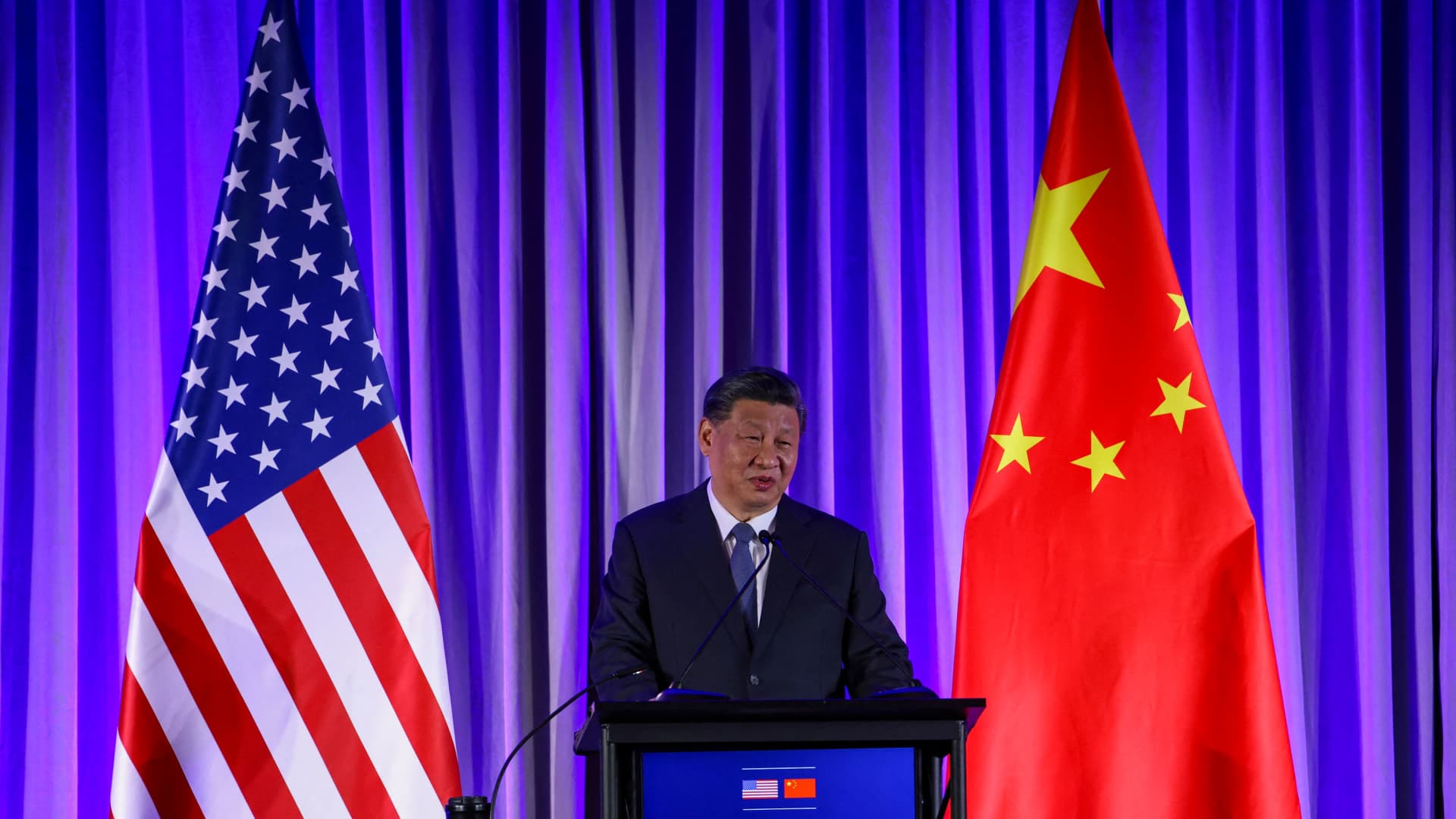

China’s President Xi Jinping speaks at an party held by the National Committee on US-China Relations and the US-China Business enterprise Council on the sidelines of the Asia-Pacific Financial Cooperation (APEC) Leaders’ 7 days in San Francisco, California, on November 15, 2023.

Carlos Barria | Afp | Getty Visuals

Discrepancies among U.S.-led Western and China-aligned economic blocs threaten international trade cooperation and financial advancement, a top rated official with the International Financial Fund warned on Tuesday.

IMF Deputy Running Director Gita Gopinath reported in a speech at Stanford University that gatherings this kind of as the international pandemic and Russia’s invasion of Ukraine have disrupted international trade relations in techniques not witnessed because the Chilly War.

“Significantly, nations all-around the planet are guided by financial safety and national stability fears in pinpointing who they trade with and spend in,” she mentioned, introducing that this has resulted in countries ever more picking sides in between China and the U.S.

Though strengthening financial resilience is “not necessarily terrible,” the trend of fragmentation threatens a move away from a “guidelines-based mostly global buying and selling technique” and a “significant reversal of the gains from economic integration,” Gopinath claimed.

Tensions involving Washington and Beijing have been soaring as the U.S. ramps up trade constraints and sanctions on China, citing countrywide protection problems, although concerns over Beijing’s advances in the South China Sea and the rhetoric around Taiwan have also soured sentiment.

The expanding stress in between the world’s two premier economies has been reflected globally, with more than 3,000 trade restrictions imposed by nations throughout the world in 2022 and 2023, more than triple as opposed with 2019, according to data compiled by the IMF.

Trade amongst the China and U.S. blocs has declined in comparison with trade among the nations around the world in just the groupings, Gopinath stated. The U.S. bloc mostly involves Europe, Canada, Australia and New Zealand, while China-leaning international locations consist of Russia, Eritrea, Mali, Nicaragua and Syria.

Because the invasion of Ukraine, trade amongst the blocs has dropped by about 12% and overseas direct investments are down by 20% in comparison with all those within the bloc’s constituents.

China, in particular, has struggled to preserve overseas expense amid increased tensions with the West. International direct investment flows into the place reportedly fell 26% in the initially 3 months of 2024 as opposed with the identical interval a calendar year before.

Foreseeable future impression

Even though financial fragmentation has yet to arrive at the exact levels as the Chilly War, its probable affect is a great deal higher because of to the world wide economy’s bigger dependence on trade, according to Gopinath.

If divisions are not bridged, the IMF estimates the economic charges to the world’s GDP could be as significant as 7% in the excessive fragmentation situation. GDP will be strike by about .2% in circumstance of gentle divisions.

Minimal-profits countries are probably to be strike the hardest thanks to their greater reliance on agricultural imports and international expenditure from far more highly developed economies, in accordance to the IMF.

Nevertheless, in spite of trends of fragmentation in the environment economy, the ratio of full goods trade to global GDP has been somewhat stable more than the previous two decades, claimed Gopinath.

One particular purpose is that the influence of fragmentation has been cushioned by a group of countries neutral to the U.S. and China, these kinds of as Mexico and Vietnam, which act as “connector” economies by way of which trade and expenditure can be rerouted.

By applying their “financial and diplomatic heft,” these non-aligned countries can play a greater function in maintaining the environment integrated, Gopinath stated.