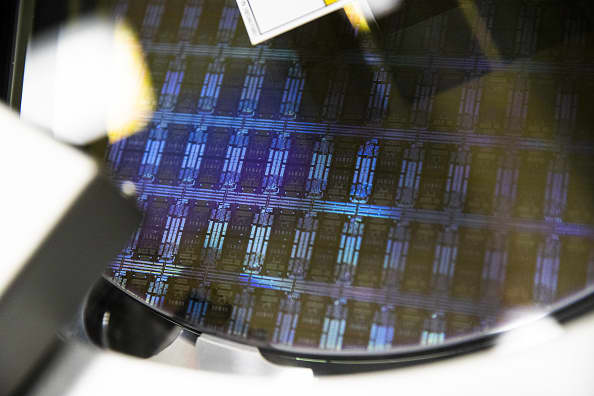

Taiwan Semiconductor Production Enterprise, Minimal at Hsinchu Science Park. Shares of the world’s largest chip maker Taiwan Semiconductor Producing Corporation rose as significantly as 5% on Wednesday early morning in Asia just after Morgan Stanley encouraged the stock.

Annabelle Chih | Getty Images Information | Getty Visuals

Shares of the world’s most significant chip maker Taiwan Semiconductor Production Firm rose as considerably as 5% on Wednesday early morning in Asia after Morgan Stanley suggested the stock.

“We anticipate a semiconductor cycle recovery in 2H23 and recommend discount-searching in high-quality shares correct now. TSMC is our prime select,” the financial commitment lender explained in a Tuesday be aware. It characterized TSMC as “the enabler of long term engineering.”

linked investing information

The inventory was buying and selling 3.73% larger in afternoon trade. U.S.-outlined shares of TSMC rose about 5% right away.

Chip shares this sort of as TSMC, GlobalWafers Company and MediaTek are at trough valuations immediately after a immediate current market correction, analysts at Morgan Stanley said.

Meanwhile, the secular trends of 5G, artificial intelligence of items and electric powered vehicles — which need to have semiconductors — are not reversing, the lender added.

A chip restoration will also be supported by the slipping costs of tech merchandise and logistics, reopening of economies — specifically in China, and a slower maximize in manufacturing ability for foundries, analysts wrote.

Buyers need to prioritize investing in industry leaders with pricing electric power, people with secular progress stories and firms that will advantage from China’s semiconductor localization, the be aware claimed. Secular advancement shares are all those that have prolonged-time period worth and are not so dependent on present-day economic situations.

In a separate observe by Morgan Stanley on Asia’s rising markets, analysts encouraged going chubby on South Korea and Taiwan, as well as the chip sector in people marketplaces.

“Both of those marketplaces are dominated by Semiconductors and Engineering Hardware,” the take note explained.

“Our sector colleagues see the worst place for the inventory cycle as soon as Q4 this calendar year and at the latest Q1 following calendar year dependent on the sub-section. Shares usually make their trough before the inventory cycle tends to make its inflexion,” it included.