Newly elected President of Argentina Javier Milei of La Libertad Avanza speaks right after the polls shut in the presidential runoff on November 19, 2023 in Buenos Aires, Argentina.

Tomas Cuesta | Getty Pictures Information | Getty Images

Argentina’s Javier Milei, a significantly-correct political outsider frequently in contrast to former U.S. President Donald Trump, vowed to supply on his radical financial procedures soon soon after winning the country’s presidential runoff.

Milei, whose phrase will run from Dec. 10 by means of to the end of 2027, staged a resounding win in Sunday’s vote by a broader-than-expected margin.

He gained about 56% of the vote, in accordance to provisional success, comfortably beating Peronist Financial state Minister Sergio Massa, who conceded right after obtaining just around 44%.

The shock final result leaves Latin America’s third-major economic climate in uncharted territory.

Happy libertarian Milei, 53, has previously explained himself as an “anarcho capitalist” and at a person stage on the campaign trail even wielded a chainsaw to symbolize his intent to reduce condition spending.

Among the some of his proposed procedures, Milei has pledged to dollarize the financial state, abolish the country’s central lender and privatize the pension process.

“We have the willpower to place the fiscal accounts in check. We have the willpower to correct the problems of the central financial institution. We have the perseverance to put Argentina on its ft and transfer ahead,” Milei said soon just after his victory, according to a translation.

“Nowadays, we return to the route that designed this place great,” he included.

The challenges going through Milei’s presidency are sizeable, nonetheless — particularly specified that the nation is when again in the grip of a profound economic crisis.

The obtaining electrical power of the South American country has been ravaged by an once-a-year inflation level of additional than 140%, although 2 in 5 Argentines now stay in poverty and important agricultural locations have been strike by a historic drought.

Presidential applicant Javier Milei of La Libertad Avanza lifts a chainsaw all through a rally on September 25, 2023 in San Martin, Buenos Aires, Argentina.

Tomas Cuesta | Getty Visuals News | Getty Images

“Governability is likely to be seriously challenging for him,” Nicholas Watson, taking care of director of Teneo, advised CNBC’s “Avenue Indications Europe” on Monday. “We could be in for a roller coaster in advance.”

“If he actually goes through with the sort of ‘shock therapy’ that he is talking about, we would hope to see general public urge for food for that commence to wane potentially fairly quickly,” Watson ongoing.

“Dollarization? I assume they are going to kick that into the long grass. Reform of the central bank? I imply he talked about blowing the central financial institution up, his schtick is with a chainsaw … I mean, some of that is just no for a longer period reasonable.”

Questioned regardless of whether traders could count on sky-higher inflation to begin to appear down after the vote, Watson replied, “Inflation could possibly go up because the distortions and imbalances of the economy are so rigorous and so prevalent that addressing a single thing suggests possibly producing difficulties someplace else.”

‘Dollarization is possible and it is desirable’

Though numerous remain skeptical about Milei’s political skill to provide on some of his financial reforms, some others felt the actions could be “incredibly constructive” for Argentina.

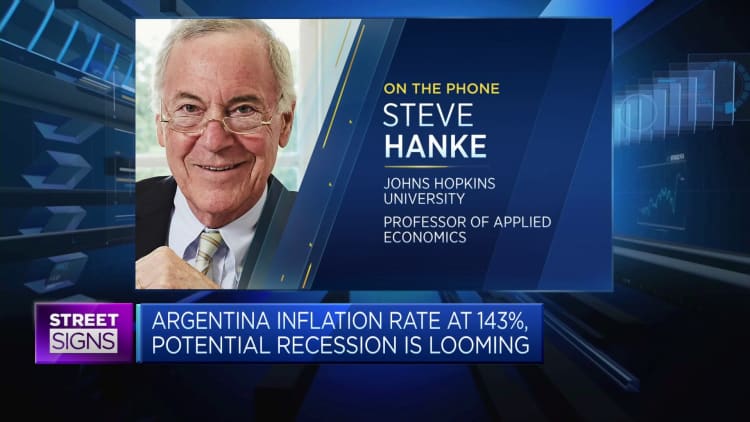

“The essential trouble in Argentina because 1876 has been the peso,” Steve Hanke, professor of utilized economics at Johns Hopkins College, told CNBC’s “Street Signals Asia” on Monday.

“A single currency disaster right after a different. Just one economic downturn right after a different. Defaults on credit card debt — a person proper immediately after another. They have had a few defaults on sovereign debt given that the yr 2000. And the current inflation amount, I just calculated it right now, it really is 220% in Argentina,” he additional.

“It is all tangled up with the central financial institution and the peso. So, Milei has the proper strategy. You’ve acquired to dollarize and a lot of of these arguments in opposition to dollarization are absolute garbage. This strategy that by some means, they really don’t have adequate bucks to dollarize is ridiculous.”

Hanke reported he experienced not been a formal aspect of Milei’s campaign, but had been in shut get hold of with his specialized group and explained himself as an “casual advisor” on troubles this sort of as dollarization.

“Dollarization is possible and it really is appealing,” Hanke reported, indicating the future measures would need to have to be akin to “a precision drill.”

He additional, “We are talking about a extremely exact operation. So, if it is performed right, it will be a enormous economic growth in Argentina. Very beneficial.”

Probability of quick dollarization ‘remains remote’

Jimena Blanco, head of Americas at Verisk Maplecroft, noted that Milei will need to produce considerable structural reforms if he is to make fantastic on his promises together with dollarizing the financial system and scrapping the central lender.

“The former, even so, requires pounds that the central bank presently lacks and, consequently, the likelihood of instant dollarisation remains distant,” said explained in a study notice.

“In the rapid time period, we hope Milei would announce a rough fiscal, monetary and Fx plan to start off stabilizing the economic climate and minimize inflation with the intention of transitioning in direction of dollarisation. And though peso-denominated bonds would choose a hit, marketplace expectations could enhance around the medium-expression horizon.”