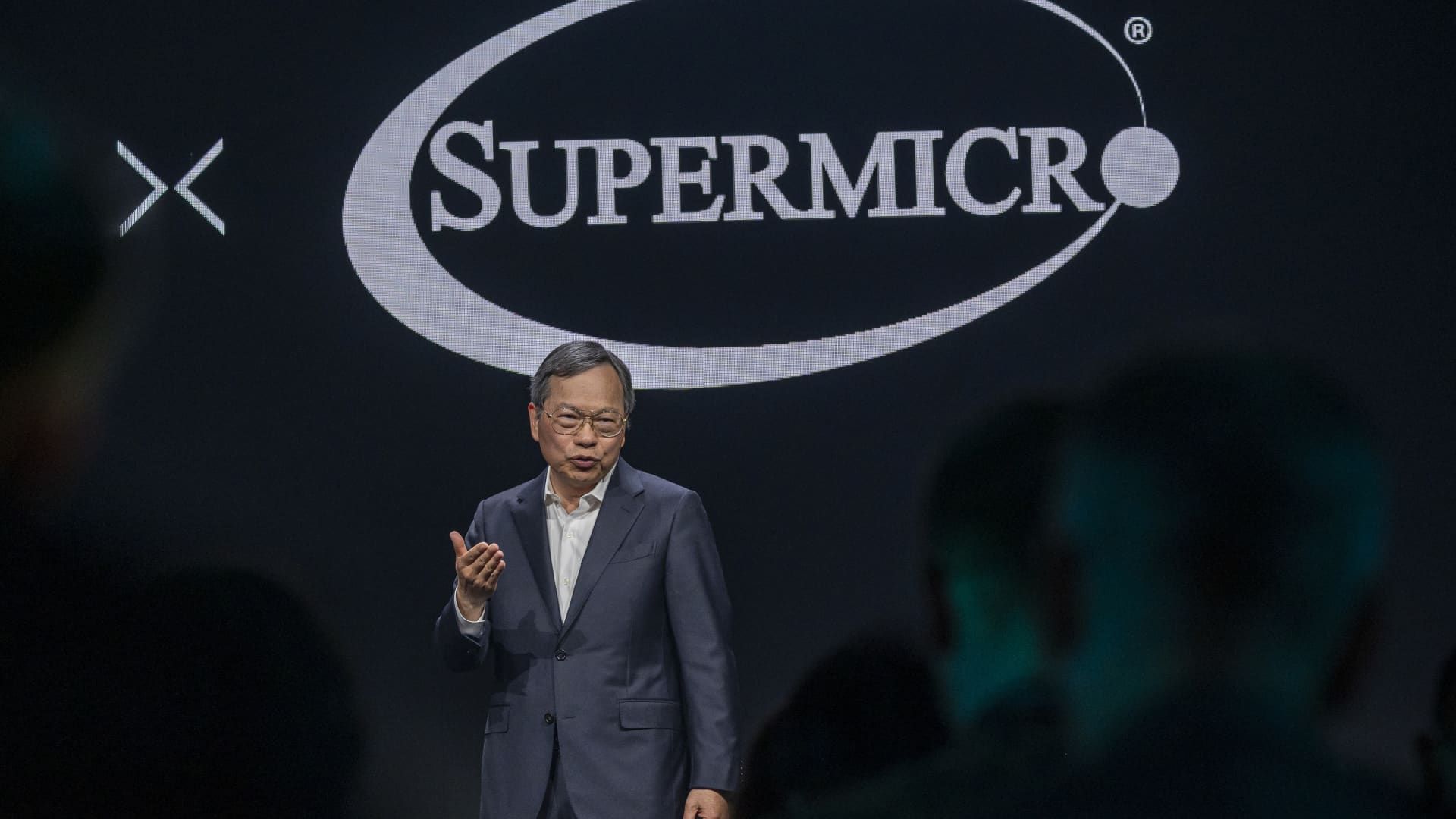

David Paul Morris | Bloomberg | Getty Photographs

Tremendous Micro Computer system is joining the S&P 500 following a historic rally in the stock that has pushed the firm’s marketplace cap past $50 billion.

The shares, up more than 20-fold in the earlier two yrs and in excess of 200% just given that the start off of 2024, climbed another 8% in extended investing on Friday.

Tremendous Micro is replacing Whirlpool, in accordance to a press launch. Deckers Outdoor is also signing up for the S&P 500, changing Zions Bancorporation.

Shares included to the benchmark index usually rise in value simply because resources that monitor the S&P 500 will include it to their portfolios. The median market cap for corporations in the S&P 500 is $33.7 billion.

Super Micro has been a person of the principal beneficiaries of the artificial intelligence increase sweeping the technological innovation business. The organization makes servers and other pc infrastructure, and it truly is one of the major sellers for setting up out Nvidia-primarily based “clusters” of servers for schooling and deploying AI designs.

In the quarter that finished December, Super Micro’s income much more than doubled to $3.66 billion. Analysts assume gross sales in the current quarter to extra than triple.

“We see Nvidia’s effects as a favourable knowledge stage for SMCI which is a person of the major associates that styles and manufactures servers to wrap all over the GPUs and customizes racks to the certain requires of a purchaser,” Lender of The united states analyst Ruplu Bhattacharya wrote in a note past thirty day period. He has a buy rating on the inventory.

Look at: Tremendous Micro is certainly a meme inventory

Really don’t miss out on these stories from CNBC Pro: