The U.S. government’s borrowing demands will decline a bit in the remaining three months of 2023 from the prior quarter, a potentially critical development through a turbulent time for the international bond market place.

In a carefully watched announcement Monday afternoon, the U.S. Division of the Treasury explained it will be seeking to borrow $776 billion, which is down below the $1.01 trillion in privately held marketable debt the office borrowed in the July-through-September period, the greatest at any time for that individual quarter.

The borrowing degree appeared to be rather down below Wall Avenue expectations — strategists at JPMorgan Chase said they anticipated the announcement to be around $800 billion.

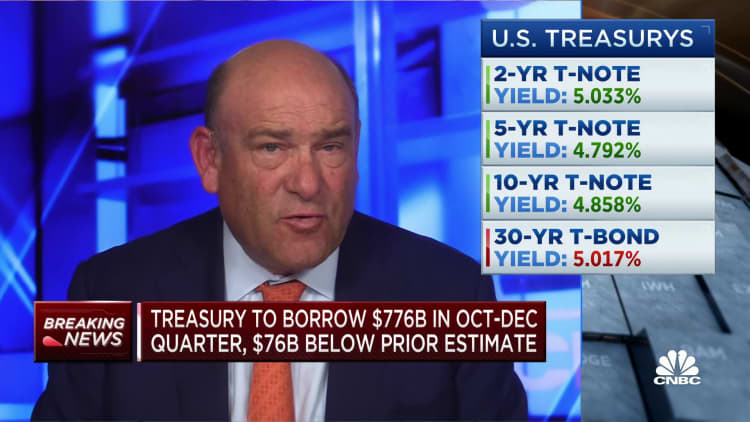

When the Treasury introduced in July its heightened borrowing demands, it set off a frenzy in the bond market place that observed yields hit their optimum concentrations since 2007, the early times of what would come to be a world wide fiscal disaster.

Stocks dropped some of their gains but even now remained strongly favourable just after the announcement. Treasury yields were being largely increased.

Marketplaces have been anxious about the influence of larger yields, and the government’s borrowing need to have, as properly as restrictive Federal Reserve coverage, have exacerbated those problems.

Officials attributed the decreased borrowing demands to increased receipts, which have been offset relatively by bigger costs.

The Treasury said it expects to borrow $816 billion during the January-by-March time period, which is the government’s fiscal 2nd quarter. That amount appeared over Wall Avenue estimates, as JPMorgan claimed it was on the lookout for $698 billion. The file for quarterly borrowing occurred in the April-as a result of-June stretch in 2020, when borrowing hit almost $2.8 trillion throughout the early Covid times.

The section said it expects to keep a $750 billion funds balance for both equally quarters.

Marketplaces next will be watching a Wednesday refunding announcement from the Treasury, which will depth the size of auctions, the duration getting issued and their timing. Later on that working day, the Federal Reserve will conclude its two-working day coverage assembly, with marketplaces overwhelmingly expecting the central bank to keep fascination rates regular.

The Monday announcement will come 10 times just after the authorities claimed the fiscal 2023 funds deficit would be about $1.7 trillion. That was an enhance of some $320 billion from the prior 12 months.

An accompanying financial summary indicated that growth has remained sturdy though inflation has cooled, even nevertheless it is effectively above the Federal Reserve’s concentrate on. However, the assertion indicated that advancement is possible to decelerate sharply, slipping to .7% in the fourth quarter and just 1% for all of 2024.

You should not skip these CNBC Pro tales: