The Treasury Office introduced plans Wednesday to accelerate the measurement of its auctions as it appears to handle its major financial debt load and with funding costs mounting.

In a growth having close consideration on Wall Road, the section thorough its refunding options for potential financial debt product sales. The announcement arrives with Treasury yields around their best levels given that 2007, a reflection of money markets spooked more than how substantially hurt larger borrowing charges could correct.

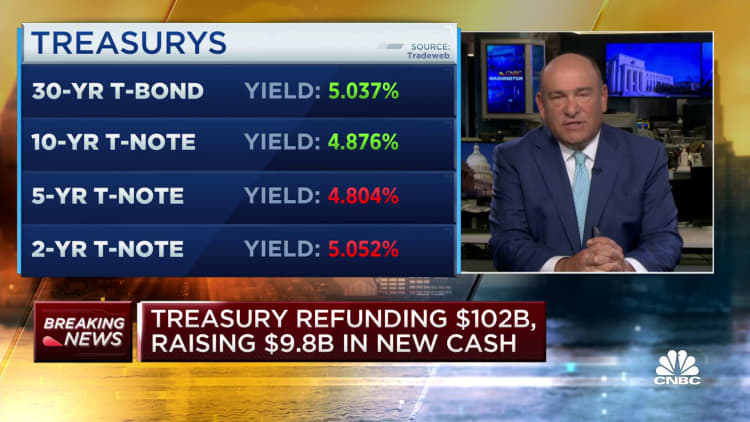

Most quickly, the Treasury will auction $112 billion in financial debt subsequent week to refund $102.2 billion of notes set to mature Nov. 15, boosting a lot more than $9 billion in more cash.

The sale will arrive in three sections, starting up Tuesday with $48 billion in 3-calendar year notes, with subsequent days that includes respective sales of $40 billion in 10-calendar year notes then $24 billion in 30-year bonds. The full sale matched some estimates all around Wall Road in recent times.

From there, the division claimed it will raise the auction size of several maturities, concentrating a lot more on coupon-bearing notes and bonds. The Treasury will keep its present auction measurement for payments until late November, when it expects to have its basic account replenished enough to carry out “modest reductions” as a result of mid- to late-January.

For auctions on coupon securities, the division comprehensive a move-up in the pace from past levels, while it reported for a longer time-dated credit card debt would enhance at a “a lot more average” price.

The Treasury expects to increase the measurements for 2- and 5-year notes by $3 billion a month, the 3-12 months note by $2 billion a month, and the 7-year be aware by $1 billion a month. By the finish of January, the auction measurements will exhibit respective improves of $9 billion, $6 billion, $9 billion and $3 billion.

Stock market futures came off their lows of the morning pursuing the announcement, though Treasury yields have been lessen.

On Monday, the office said it would will need to borrow $776 billion in the current quarter and $816 billion in the first quarter of calendar 2024.

The auction variations are important to traders for the reason that they could deliver a window into wherever yields are heading. Markets have been worried about irrespective of whether there will be enough need to fulfill the Treasury’s wants, which would send yields up even more and possibly bring about money distress.

However, most auctions have been fairly properly subscribed of late, even though yields are nonetheless around their greatest amounts given that 2007, the early days of the world wide economic disaster.

Treasury officers have been attributing most of the increase in yields to anticipations for larger growth. However, that in convert has spurred problem that the Federal Reserve will have to retain benchmark costs elevated as it carries on to try out to bring inflation down to appropriate stages.

A letter accompanying Wednesday’s announcement called the maximize in yields “partially a response to more robust-than-anticipated action and labor marketplace data.”

“Several components have likely contributed to the rise in more time-time period yields,” wrote Deirdre K. Dunn, chair of the Treasury Borrowing Advisory Committee, and Colin Teichholtz, vice chair of the team.

“For illustration, robust action and labor sector data, the risk that the neutral price of fascination is now bigger, supply-demand dynamics and the return of a good ‘term premium’ in extensive-dated Treasury securities have all probable contributed to a certain degree,” they wrote.

Treasury officers will maintain a news meeting at 10 a.m. ET to talk about the improvements further more.