A important Democrat wants credit history reporting agencies Equifax, Experian and TransUnion investigated for allegedly failing to reply to purchaser issues in the course of the pandemic.

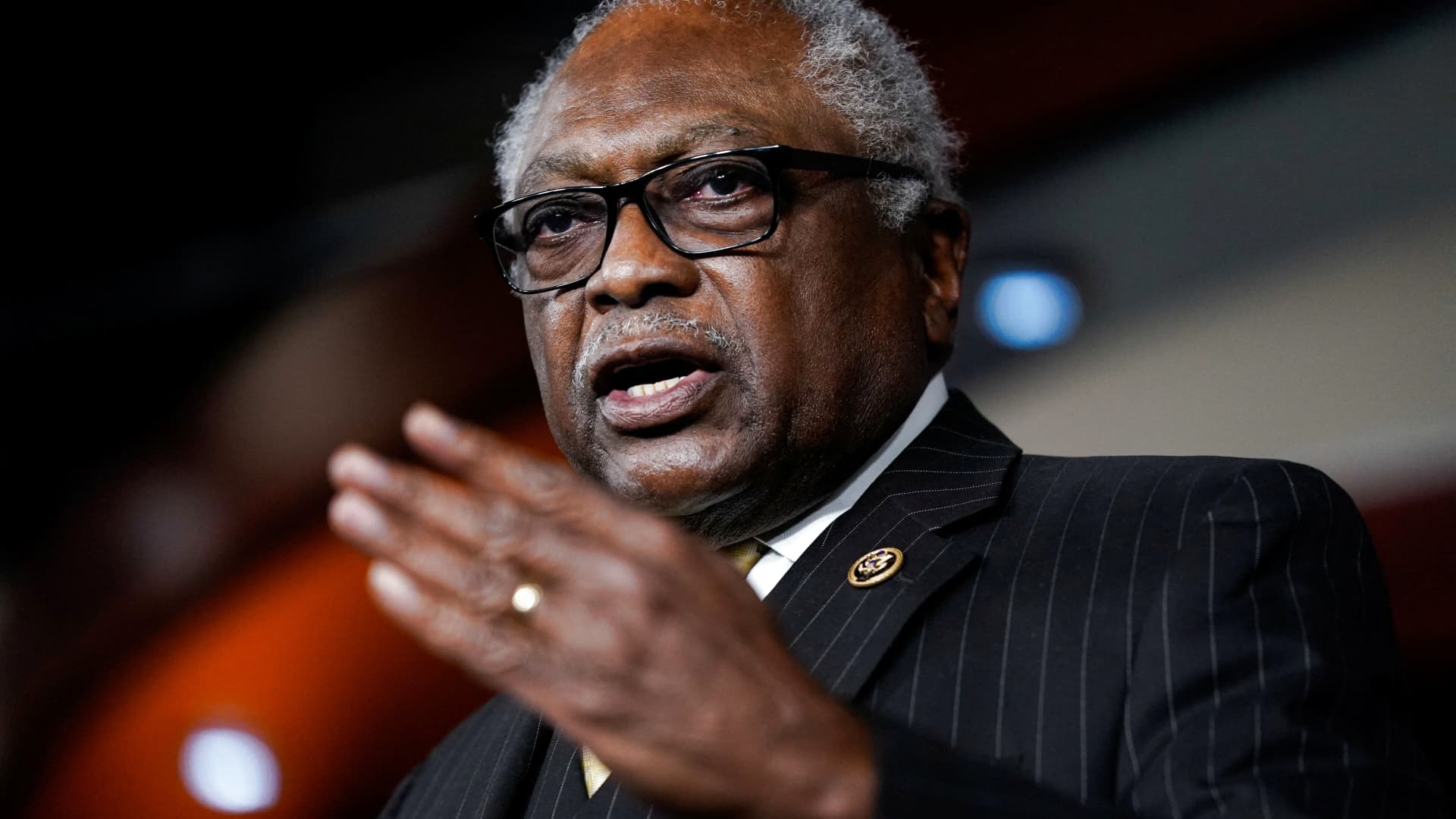

Rep. James Clyburn, the chairman of the Residence Pick out Subcommittee on the Coronavirus Crisis, mentioned the nation’s 3 most significant nationwide shopper reporting agencies have “longstanding complications” with responding to people who raise grievances about credit rating reporting errors.

“These info also increase fears about no matter whether the [credit rating companies] are satisfying all of their obligations to shoppers and to the Customer Economical Protection Bureau (CFPB) under the Fair Credit Reporting Act (FCRA),” the South Carolina Democrat wrote in an Oct. 13 letter to Client Fiscal Security Bureau Director Rohit Chopra.

Clyburn requested the chief government officers of Equifax, Experian and TransUnion in Might for information about the companies’ responses to consumer complaints in the early times of the pandemic.

CFPB described then that 4.1% of problems had been solved in 2021, compared with nearly 25% of grievances in 2019, right before the pandemic.

Clyburn reported in his Oct. 13 letter that the majority of credit score report disputes have not resulted in the correction or removal of documented glitches from credit history studies. The subcommittee identified that Equifax improved between 43% and 47% of the disputed objects just about every calendar year from 2019 as a result of 2021. Experian corrected about 52% of the disputed late payments or other lousy data and TransUnion mounted among 49% and 53% of disputed credit rating stories throughout this time, the subcommittee discovered.

The subcommittee partly credited the pause on college student personal loan payments and an improve in pandemic-similar identity theft to credit reporting glitches.

Less than the CARES act, paused personal loan payments were being meant to be claimed as existing, even though some lenders might have improperly categorized them as late. Client fraud can also direct to defective consumer credit history studies.

But shoppers have been disputing facts found in their credit reviews on a larger scale than earlier known, the subcommittee uncovered. The CFPB approximated the combined quantity of dispute submissions between Equifax, Experian and TransUnion to be 8 million in 2021. But information received by the subcommittee showed Equifax by itself obtained almost 14 million grievances that year.

CFPB also obtained a “file-breaking” amount of money of complaints about the credit rating score organizations from 2020 by way of 2021, with much more than 619,000 in 2021 by yourself. Individuals disputed nearly 336 million items, such as names, addresses or credit accounts, on their credit history stories from 2019 as a result of 2021, the subcommittee identified.

But according to proof received by the subcommittee, the credit history raters discard hundreds of thousands of disputes a yr without the need of investigation. At least 13.8 million were being thrown out involving 2019 and 2021, the subcommittee located.

Discarding disputes violates the fair credit rating legal guidelines if any are submitted immediately by customers to licensed representatives. The companies’ protection, claims the subcommittee, is that disputes are discarded devoid of investigation when they suspect a credit history fix provider is the one particular making the grievance.

But the subcommittee states just about every agency employs obscure standards to identify which disputes are submitted by an unauthorized 3rd celebration. Equifax, for instance, tosses out mail that “tends to use equivalent language and format [and] come from the same zip code.”

Experian accounts for “envelope characteristics” and “letter qualities,” together with “exact same/similar ink shade,” and “similar/related font,” when picking which disputes to disregard. TransUnion also utilizes envelope-primarily based requirements in its discard system.

The subcommittee also observed that the credit score businesses referred more than half of the disputes to information furnishers for investigation amongst 2019 and 2021. TransUnion referred the most, 80% to 82%.

Knowledge furnishers — the vendors of credit rating data, this kind of as credit rating card businesses and lenders — have been cited by the CFPB for conducting inadequate investigations. The bureau also cited the credit score reporting providers for accepting these results devoid of an unbiased investigation.

“The prevalence of credit score reporting errors has been specifically relating to at a time when Americans have essential obtain to credit rating in purchase to weather difficult economic situations brought on by the pandemic,” Clyburn wrote in the letter to Chopra. “Glitches in credit score experiences can lower consumers’ credit rating scores, probably blocking entry to financial loans, housing, and employment, between other serious implications.”

The Shopper Knowledge Sector Association, the trade association that represents Equifax, Experian and TransUnion, stated that all disputes the 3 credit history raters get instantly from people are processed in accordance to federal necessities.

“Latest reviews have highlighted traits such as improved action by certain credit score restore businesses, which can inflate grievance numbers and undermine the method of addressing authentic requests,” a consultant for the association told CNBC. “The credit rating reporting field will carry on to collaborate with the CFPB and policymakers to much better provide individuals and carry on to supply modern methods to boost financial possibilities for customers.”