Kate_sept2004 | E+ | Getty Illustrations or photos

Investing can seem extremely intricate, and that complexity could paralyze Us citizens into performing absolutely nothing.

But investing — and accomplishing so smartly — does not have to be challenging. In actuality, having began can be rather effortless, in accordance to economic authorities.

“You never need to be a rocket scientist. Investing is not a sport where the man with the 160 IQ beats the man with 130 IQ,” Warren Buffett, chairman and CEO of Berkshire Hathaway, famously claimed.

For many people today, investing is a requirement to improve one’s personal savings and deliver financial protection in retirement. Beginning early in one’s career gains the trader because of to a for a longer time time horizon for desire and investment returns to compound.

While acceptable long-term ambitions may vary from human being to man or woman, a person rule of thumb is to save approximately 1x your wage by age 30, 3x by 40 and in the long run 10x by 67, according to Fidelity Investments.

A ‘fabulous, very simple solution’ for inexperienced persons

Target-date cash, identified as TDFs, are the most straightforward entry stage to investing for the lengthy term, in accordance to money execs.

“I believe they’re a amazing, simple answer for novice buyers — and any investor,” stated Christine Benz, director of own finance and retirement planning at Morningstar.

TDFs are based mostly on age: Traders pick a fund based on the year in which they purpose to retire. For illustration, a latest 25-calendar year-old who expects to retire in roughly 40 many years may well select a 2065 fund.

These mutual money do most of the tricky work for investors, like rebalancing, diversifying across lots of distinctive stocks and bonds, and deciding upon a fairly correct degree of threat.

Asset administrators mechanically throttle back threat as traders age by minimizing the share of stocks in the TDF and boosting the publicity to bonds and income.

How to decide a focus on-day fund

TDFs are a excellent starting stage for “do very little” buyers who search for a hands-off method, reported Lee Baker, a licensed money planner and founder of Apex Monetary Solutions in Atlanta.

“That is the most straightforward issue for a great deal of individuals,” explained Baker, a member of CNBC’s Advisor Council.

Buyers need to have only opt for their TDF service provider, their target calendar year and how a great deal to make investments.

Benz endorses picking out a TDF that uses fundamental index money. Index money, contrary to actively managed cash, aim to replicate broad inventory and bond industry returns, and are usually less costly index cash (also known as passive funds) are inclined to outperform their actively managed counterparts about the extended time period.

“You certainly want a passive TDF,” claimed Carolyn McClanahan, a CFP and the founder of Existence Preparing Companions in Jacksonville, Florida.

Benz also advises traders seek out out resources from between the most important TDF companies, like Fidelity, Vanguard Group, Charles Schwab, BlackRock or T. Rowe Selling price.

Other ‘solid choices’ for beginner buyers

Investors who want to be a bit far more fingers-on relative to TDF traders have other easy selections, industry experts explained.

Some could opt for a focus on-allocation fund, for case in point, Baker claimed. These resources are like TDFs in that asset supervisors diversify among shares and bonds in accordance to a particular asset allocation — say, 60% shares and 40% bonds.

But this allocation is static: It will not change in excess of time as with TDFs, that means buyers may perhaps sooner or later want to revisit their decision. They can decide which fund may well be a very good starting issue by filling out an on the net risk profile questionnaire, Baker claimed.

A lot more from Particular Finance:

Why Social Safety COLAs may well be more compact in 2025 and beyond

‘Take the emotion out of investing’ throughout an election 12 months

Why Social Security is so crucial for gals

As another choice, investors may well as a substitute opt for a global market place index fund, an all-inventory portfolio diversified across U.S. and non-U.S. equities, Benz explained. As with focus on-allocation money, these resources you should not de-threat as just one ages.

“I believe in some cases beginner buyers problem the very simple elegance of some of these quite solid selections,” Benz reported. “Individuals crave anything more advanced because they suppose it has to be improved, but it’s not.”

Request yourself: Why am I investing?

Young, extensive-expression investors ought to normally make sure their fund — irrespective of whether TDF or usually — has a significant allocation to shares, around 90% or far more, claimed McClanahan, a member of CNBC’s Advisor Council.

Retirement buyers below age 50 would probable be effectively-suited with a portfolio tilted generally to stocks, with some hard cash reserves established apart in the function of emergencies like career reduction or health problems, Benz reported.

You really don’t require to be a rocket scientist. Investing is not a recreation where by the male with the 160 IQ beats the person with 130 IQ.

Warren Buffett

chairman and CEO of Berkshire Hathaway

One particular caveat: Traders preserving for a quick- or intermediate-time period have to have — it’s possible a property or car or truck — would most likely be much better served putting allotted money in safer cars like dollars current market accounts or certificates of deposit, McClanahan mentioned.

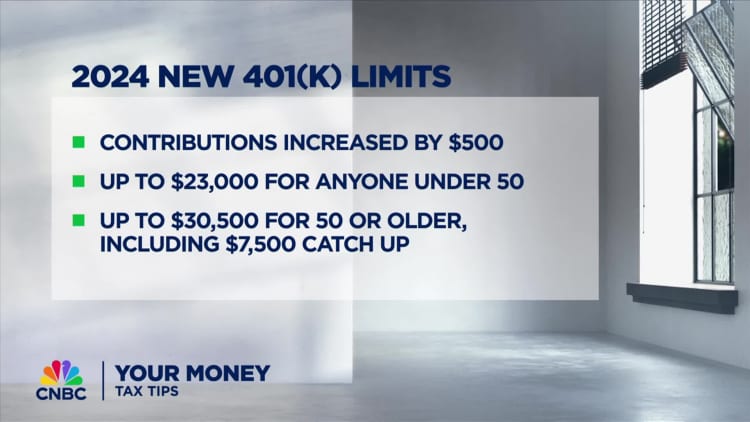

The most straightforward put for very long-phrase investors to save is a office retirement strategy like a 401(k) prepare. Those with an employer match really should aim to invest at the very least adequate to get the full match, McClanahan stated.

“Where else do you get 100% on your funds?” she reported.

Buyers who do not have accessibility to a 401(k)-variety prepare can in its place preserve in an personal retirement account — a different sort of tax-favored retirement account — and established up computerized deposit, McClanahan claimed.

TDF traders who help you save in a taxable brokerage account could get hit with an unanticipated tax invoice, experts mentioned. For the reason that TDFs consistently rebalance, there are probably to be transactions inside the fund that bring about capital-gains taxes if not held in a tax-advantaged retirement account.