Carlos Barquero | Minute | Getty Photos

Stock industry volatility and talk about a feasible economic downturn may perhaps have men and women anxious about investing.

However, that should not dissuade anyone from trying to develop prosperity, whether you are just setting up out in your career, are middle-aged or are nearing retirement.

“We cannot forecast the foreseeable future, but by thoughtful paying and conserving all over your lifespan, you can develop economic peace and resiliency for whatever the environment and markets toss your way,” said licensed financial planner Carolyn McClanahan, an M.D. and founder and director of monetary setting up at Lifetime Preparing Associates in Jacksonville, Florida.

Of course, how you go about developing prosperity relies upon on your age. Here is a ten years-by-ten years manual to growing your dollars.

Beginning out in your 20s

The initially thing to do is make certain you have enough income stashed absent for an crisis. If your work is secure, set a cost savings goal of 3 to six months’ worthy of of charges. If it is insecure, these as a commission-dependent revenue career, attempt for 6 to 12 months, reported McClanahan, a member of CNBC’s Advisor Council.

You must also start organizing for retirement. If your employer has a 401(k) prepare and gives a match, contribute plenty of to get that match.

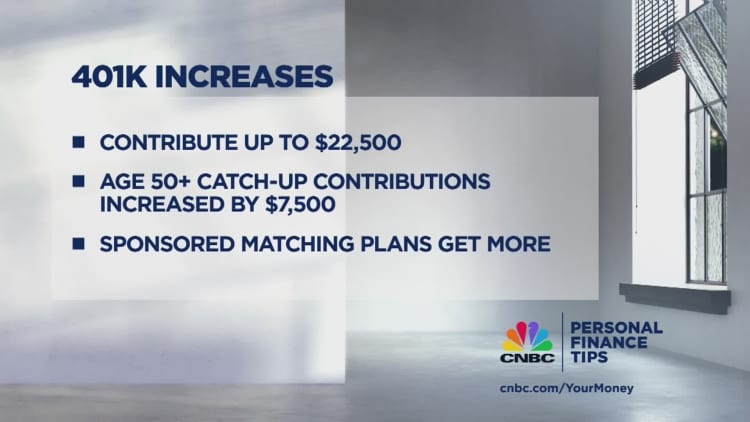

Soon after that, open a Roth personal retirement account, if your cash flow qualifies, McClanahan reported. You can lead a optimum of $6,500 in 2023. Then, if you nevertheless have funds to make investments after maxing out your Roth, lead much more to your 401(k) strategy, she claimed. In 2023, you can set as considerably as $22,500 into the account.

When it arrives to the harmony of your portfolio, you can have extra equities than fastened earnings because you have extra time to recuperate from any down markets.

In addition, make certain you are insured properly, particularly with car and disability coverage, considering the fact that a single accident or health concern could wipe out any financial savings you may perhaps have.

This is also a excellent time to get on a facet hustle, explained Winnie Sun, co-founder and handling director of Sun Team Wealth Partners, centered in Irvine, California, and a member of CNBC’s Advisor Council.

“It may perhaps not be generating a whole lot of earnings, but it is something they can generate a lot more revenue from,” she claimed.

In your 30s

As your vocation grows and you start to earn a increased salary, don’t tumble target to the “way of living creep” and start spending that newfound dollars, warned CFP Matt Aaron, founder of Washington, D.C.-dependent Lux Prosperity Planning, an affiliate of Northwestern Mutual.

Instead, place that added funds into your 401(k) system.

The rule of thumb is to place aside about 10% of your money, if you start out younger, but a economical professional can aid you get the job done out the quantities, he stated.

Just after you max out these contributions, start investing outdoors of your retirement account. Your portfolio should really be diversified, with a blend of shares and bonds.

You might also be wondering about buying a house, having married or obtaining kids.

CFP Elaine King strongly suggests thinking about a property acquire in your 30s. It’s Okay to commence tiny, she said.

“It isn’t going to want to be a major home, just some thing that in your potential can be your rental profits to diversify your property,” explained King, founder of Family members and Revenue Matters in North Miami, Florida.

When you get started preserving for those gatherings, never commit in shares — except your time horizon is for a longer time than five decades, McClanahan recommended.

Rather, she recommends a income market account. These times, money market place fund prices have soared as the U.S. Federal Reserve hiked fascination charges. The average yield on Crane Data’s listing of the 100 most significant taxable dollars money is 4.62%. Equally, certificates of deposits, or CDs, have also observed their interest premiums increase.

If anyone is counting on your income, these kinds of as a husband or wife or little one, it truly is also time to purchase everyday living insurance coverage. For individuals with kids, you might want to begin putting income apart for college or university.

The active 40s

Maskot | Maskot | Getty Images

You might now be in your peak earning years and may also be increasing children.

If attainable, consider to commence a faculty personal savings account if you haven’t completed so presently. If you are not able to afford to pay for to, never divert financial savings from your retirement account.

“You can borrow for college or university, but you can’t borrow for retirement,” McClanahan mentioned.

For people who haven’t started saving for retirement nonetheless, placing apart 15% to 20% of your earnings is deemed a basic rule of thumb at this age, Aaron reported.

You can borrow for faculty, but you can’t borrow for retirement.

Carolyn McClanahan

director of monetary planning at Lifetime Arranging Partners

You may also have getting older mother and father, so be guaranteed to check out on their economic scheduling, McClanahan claimed. If they aren’t ready, it is a further monetary obligation that may perhaps be all of a sudden thrown on your lap.

Solar claimed she’s experienced numerous consumers in their 40s begin to inquire about lengthy-time period treatment, with Covid pushing care worries to the forefront. Traditional lengthy-expression care insurance policy is costly, but there are other insurance policies that are a hybrid — combining daily life insurance coverage and prolonged-expression treatment protection.

“It is seriously figuring out how considerably you can afford to pay for, and if you cannot afford to pay for it correct now, at minimum have the discussion so you are geared up,” Sunlight stated. “You might have to self-insure, or appear for it by way of work.”

Acquiring major in your 50s

Retirement is likely a ten years absent, so it can be time to get serious about how a lot you are truly shelling out, and whether you are on track to help save sufficient to support you all over your lifestyle, McClanahan claimed.

Once you strike 50, you can also established far more apart into your 401(k) or IRA with so-named capture-up contributions. In 2023, the restrict is $7,500 for 401(k) designs and $1,000 for IRAs.

If you will not use a monetary planner, at minimum get an hourly 1 to determine if you are on monitor to help your way of living in retirement, McClanahan encouraged.

Evaluate your assets and make confident your portfolio is balanced to your needs. As you tactic retirement age, gurus commonly endorse cutting down dangerous assets, these as stocks, and escalating set money, these types of as bonds.

On the other hand, it can be vital to retain stock exposure given that it provides you a increased return, Aaron claimed.

In your 60s and over and above

At this position, you will need to have a retirement distribution technique. That signifies comprehending the diverse profits streams you may have coming in.

“We need to have to build an expenditure approach centered on a proper asset allocation, getting on only as a great deal chance that is wanted for the earnings you have to have and your legacy objectives,” Aaron reported.