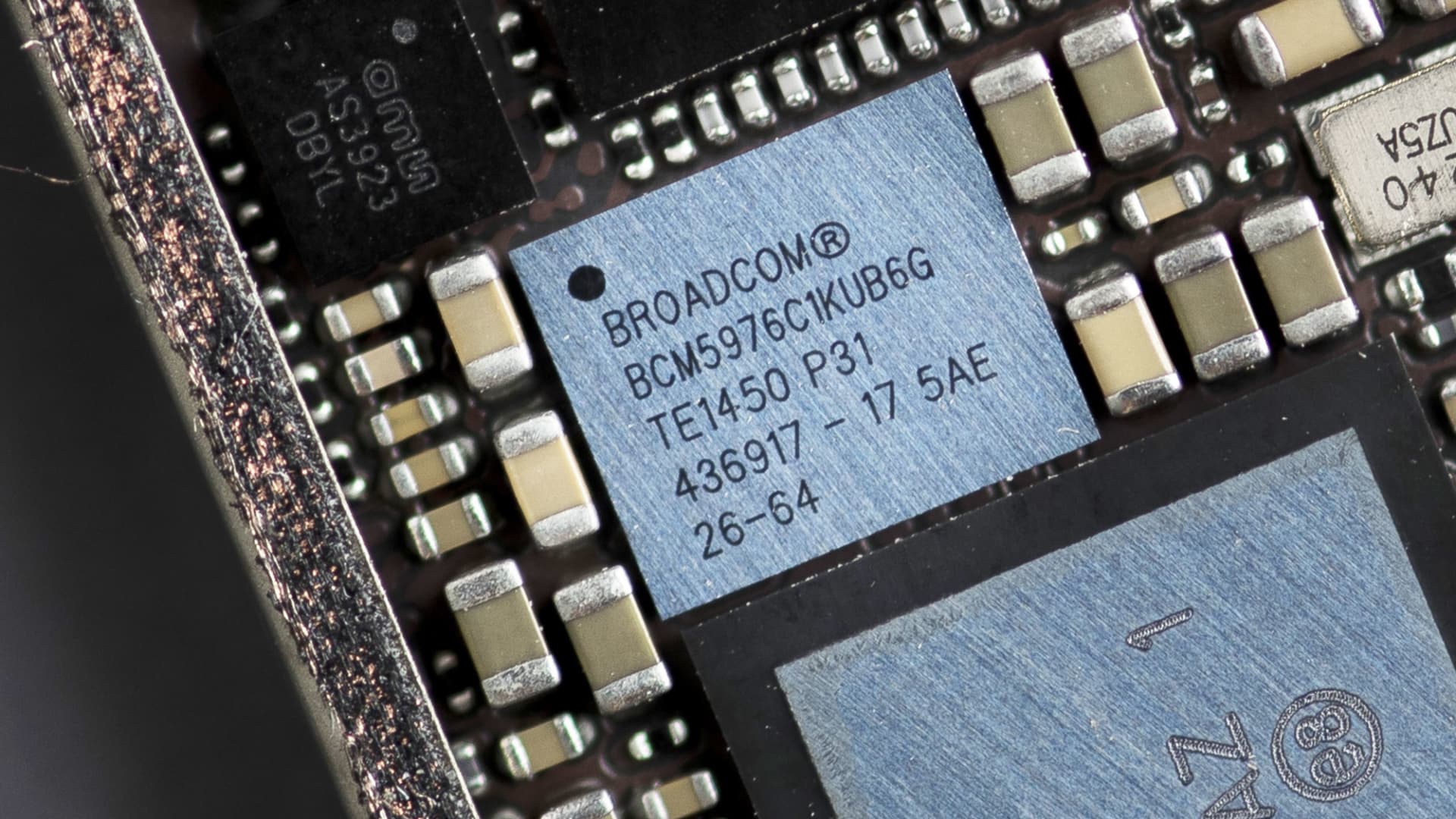

Goldman Sachs states its new inventory basket has outperformed the market place around the earlier 20 a long time. The firm’s portfolio strategy desk recently released two new baskets based mostly on corporate asset depth, which was described as “the ratio of property, fewer dollars and intangibles, to revenues.” Asset-mild shares can be assumed of as “lean” businesses, having handful of belongings, but sturdy growth. The asset-gentle stocks experienced a ratio of .3, and the asset-weighty team experienced a ratio of 1.5. Each individual basket contains 50 shares drawn from the S & P 500, but are sector-neutral to 1 a further. By back again-tests the baskets, Goldman identified that the asset-light-weight cohort has outperformed the substantial-asset intensity group because 2002 by 40 percentage points. “Outstanding return on fairness (22% vs. 15%) assists to make clear this very long-phrase outperformance. For the duration of the exact interval, S & P 500 capex as a share of overall dollars use has declined from 46% to 29%,” strategist Jenny Ma wrote in a be aware on Feb. 28. Ma reported the asset-heavy class could potentially outperform by all around 100 foundation points more than the upcoming 12 months as the cost of funds falls. Larger-than-expected funds expenditures would also be a tailwind for the asset-major course, Ma added. Just take a glance at some of the lean stocks that built Goldman’s screener, and in which analysts see them headed following. Semiconductor giant Nvidia has an asset intensity ratio of just .5, according to Goldman. Nvidia has the highest 12 months-to-day return on the record, at 73.1%, as properly as the greatest market place cap. The consensus 2024 earnings for every share progress for Nvidia is 87%, the organization states. Wall Road remains bullish on the stock, and 51 out of 55 analysts covering Nvidia have issued possibly a get or potent buy rating, for every LSEG, formerly Refinitiv, knowledge. Nonetheless, the ordinary cost focus on implies share selling prices are at their peak. NVDA 1Y mountain Nvidia shares more than the past 12 months Yet another chipmaker in the basket is Broadcom . Shares are up 27% in 2024. The stock has a calculated asset intensity ratio of .3, and consensus earnings for every share expansion this 12 months is envisioned to be a 19% bounce from 2023. The majority of analysts covering the inventory also give it a sturdy invest in or get score, in accordance to LSEG. Even so, Wall Street’s common selling price target indicates shares are thanks for approximately a 13% pullback from their recent concentrations. On the internet relationship platform operator Match Team is a further asset-light-weight firm featured. Shares are down 4% in 2024 and additional than 11% over the earlier 12 months, but analysts surveyed by LSEG think the inventory could rally 25.5%. Match Team has a .3 asset intensity ratio. Live Nation Enjoyment is a lean corporation that has outperformed in the past 12 months, surging 36%. Normal per-share 2024 earnings estimates predict a 44% climb yr over calendar year, for every Goldman. The organization has an asset depth ratio of .4. All but two of the 19 analysts who protect Stay Nation level it a solid invest in or buy, for every LSEG. The inventory could carry on its gains and increase an more 18.3%, its typical value goal implies. LYV 1Y mountain Reside Nation shares around the final 12 months On the other hand, some asset-heavy providers in the S & P 500 incorporate chipmakers Micron Technologies , Intel and On Semiconductor . Telecommunication products and services names AT & T , Verizon and T-Cell had been also showcased. — CNBC’s Michael Bloom contributed to this report.