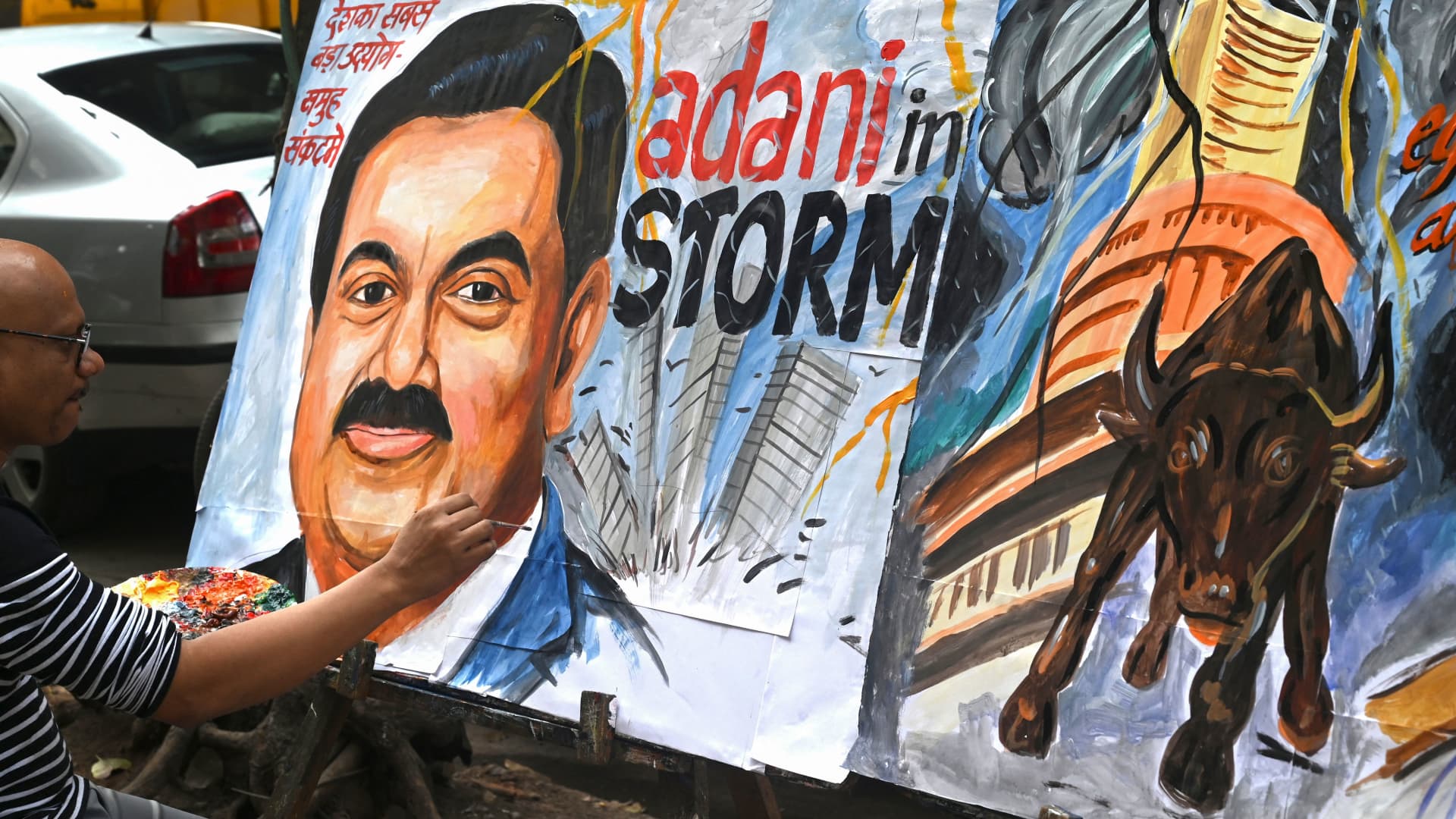

Artwork college instructor Sagar Kambli gives closing touches to a portray of Indian businessman Gautam Adani (L) highlighting the ongoing crisis of the Adani team in Mumbai on February 3, 2023.

Indranil Mukherjee | Afp | Getty Photos

Just one of the most important investors in India’s Adani Enterprises states he may be accomplished doubling down on his investment.

Rajiv Jain, the chairman and chief expense officer of GQG Partners, explained to CNBC Thursday that his profits on Adani stands at about $4 billion, and he is possible accomplished investing more.

“We are really total. So I really don’t know [if] we will double down further,” Jain explained on “Street Indications Asia.”

“We doubled down on Adani in May possibly and June and … possibly tripled down in August. I do not know whether or not we’ll go even more from in this article.”

Adani Enterprises, owned by a person of India’s richest gentlemen Gautam Adani, is a person of the country’s leading 3 conglomerates. It has small business spanning from ports, airports, renewables, cement amid other things.

In late January 2023, a shorter-vendor report by New York’s Hindenburg Research accused the corporation of manipulating share costs and alleged that it had pretty significant stages of financial debt. The organization has rejected these allegations.

The team has 10 detailed entities on the Indian inventory marketplace.

In the initial quarter of 2023, Adani shares fell far more than 54% and wiped out in excess of $100 billion in value as a result of the report. That is also when GQG Partners started investing in the conglomerate.

The U.S. boutique financial investment company was the fifth major stakeholder of Adani Enterprises as of November, according to LSEG details.

LSEG info also confirmed GQG manufactured considerable investments in Adani throughout the 2nd and third quarters of last year, but slowed its speed by the fourth.

By the finish of 2023, Adani Enterprise shares experienced recovered from the significant fallout and finished the yr with smaller sized declines of 26%.

It has risen about 2.3% in January so much, soon after a recent courtroom ruling in early January.

The Supreme Courtroom of India said at that time that no further inquiries have been wanted beyond the ongoing scrutiny by sector regulator Securities and Trade Board of India (SEBI), which is at the moment investigating the conglomerate following allegations produced by Hindenburg Research.

“We increase our posture when we come to feel the marketplaces have evidently spoken,” Jain informed CNBC on Thursday.

“Vast the vast majority of the allegations are type of yesterday’s news. There was no genuine material. So I am even now form of shocked how, how animated everybody was when the substance was not there. So yeah, do we truly feel vindicated? The answer is of course.”

GQG Companions is also positive on India’s tech sector, and highlighted semiconductors and application firms.

“We entered 2022 incredibly underweight on tech and the same happened in early 2023. But then we pivoted by the 1st and 2nd quarter due to the fact we assumed tech had started to enhance much faster than we would have anticipated little,” Jain said.

He explained he continues to be bullish on India’s wellness-treatment and cement industries heading into 2024.