“Shark Tank” trader Kevin O’Leary predicts the ongoing cycle of U.S. Federal Reserve fee hikes could guide to much more regional U.S. lender failures.

Fed Chair Jerome Powell claimed the central bank is not however thoroughly self-assured that inflation is defeated even although new headline reads present that cost raises have cooled appreciably.

linked investing news

The buyer price tag index rose 3% from a 12 months back in June — the most affordable level due to the fact March 2021. But Powell mentioned the Fed would need to have to “maintain plan at a restrictive degree for some time” and be prepared to increase fees further more, presented that core inflation is however above 3% — better than its 2% annual target.

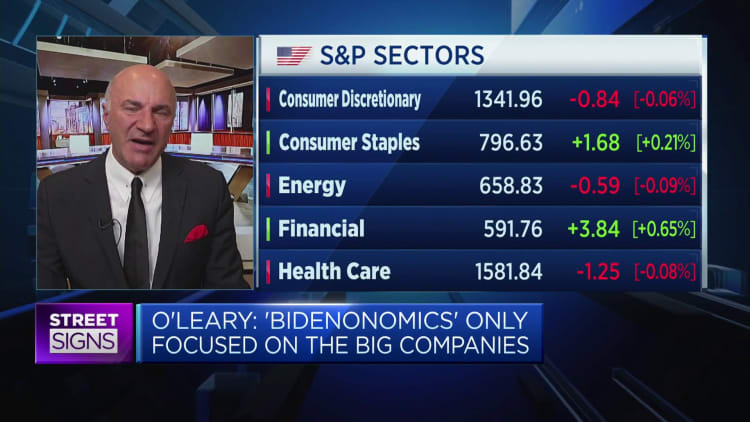

“You keep squeezing the toothpaste tube, you keep rolling it up, you preserve elevating costs, and you know issues are going to crack, you just really don’t know when and in which,” O’Leary, who operates his have early stage enterprise cash agency, O’Leary Ventures, advised CNBC’s “Street Indications Asia” early Thursday right after the Fed’s most current level hike announcement.

“I am just predicting — and I am pretty careful on this — it will crack down in the regional banks, which supports 60% of the economy,” he stated, adding that the rapid increase in the cost of funds is “killing them on their serious estate financial loans.”

“You keep squeezing the toothpaste tube, you continue to keep rolling it up, you hold boosting charges, and you know items are likely to split, you just do not know when and wherever,” Kevin O’Leary explained.

Alex Wong | Getty Illustrations or photos News | Getty Visuals

“Terminal fee, the place the Fed stops, could be 6.25, could be 6.50,” O’Leary claimed. “So you’ve definitely bought to believe about this if you assume about the lengthy expression and the short-expression result.”

That is larger than the Fed’s median finish-2023 forecast of its money charge, which stands at 5.6% as of the June conference. It is also greater than the most hawkish prediction of 6.1%, in accordance to the Fed’s latest summary of economic projections issued in June.

“We’ve started out to see the cracks, the Titanic has not [sunk],” O’Leary reported.

Disclosure: CNBC owns the exceptional off-network cable rights to “Shark Tank.”