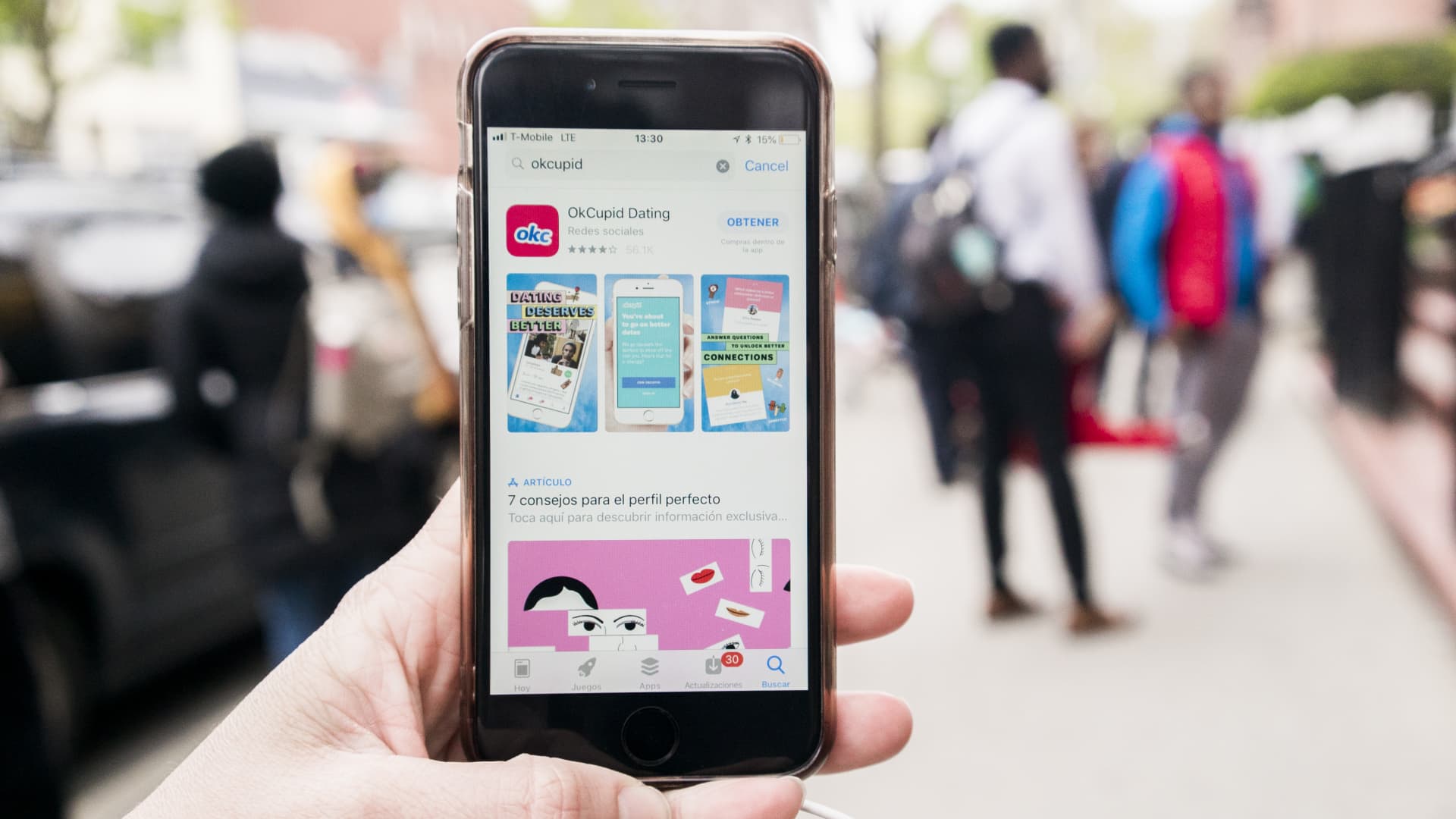

A different chunk of providers are established to report this 7 days, and analysts think earnings are on their aspect. About 50% of S & P 500 corporations have described earnings for the 3rd quarter. Of those businesses, approximately 77% have exceeded expectations, FactSet info exhibits. About 30% of S & P 500 businesses are reporting this week. CNBC Pro screened for the S & P 500 providers reporting this 7 days that analysts are most psyched about, major them to elevate their earnings estimates. Here is the conditions we adopted for the lookup: EPS estimates are up 15% or much more in earlier a few months. EPS estimates are up 15% or much more in past six months. Perfectly-appreciated by analysts: These shares have invest in ratings from at minimum 55% of analysts masking them. Match Group has the maximum probable upside of the record and a lot more than fifty percent of analysts masking the stock charge it a buy, expecting the international relationship service enterprise to pop extra than 68% in the following 12 months. Earnings for every share estimates are also up 18.1% and 29.6% in the previous three and six months, respectively. Shares of the organization — which owns numerous well known dating applications this sort of as Tinder, Hinge and Azar — are down 18% for the year. The enterprise is set to report earnings Tuesday immediately after sector shut. Lender of The usa maintained its purchase ranking on Match Group, indicating it sights the company’s recent valuation as “appealing to progress” and expects many enlargement mostly on profits acceleration, according to an Oct. 23 take note. The company expects Tinder to revive its year-to-12 months user growth in 2024, next a slowdown in users and share decline to Bumble and Hinge. Very first Photo voltaic has the highest alterations in analysts’ earnings for each share estimates, up 90% and 115.1% in the past a few and six months, respectively. The residential photo voltaic firm is rated get by practically 57% of analysts covering it. JPMorgan upgraded the inventory to chubby on Oct. 19, viewing its current pullback as an eye-catching entry position for traders. Shares have slid about 9% this year, with losses accelerating this thirty day period soon after peer solar organization SolarEdge lower its third-quarter direction on slowing demand in Europe. Initial Photo voltaic will report Tuesday just after the shut. Strength names Marathon Petroleum and Entergy also made the list, with analysts expecting more than 15% and 9% upside to the stocks, respectively. Entergy on Monday agreed to market its gasoline distribution business enterprise to a non-public equity management business for about $484 million in cash, sending the inventory 3% better Monday. The firm’s shares are down roughly 16% this calendar year. Entergy is slated to write-up final results Wednesday before the bell. Marathon’s stock, on the other hand, is up 26% for the year. The oil and gasoline big greater its quarterly dividend 10% very last week and introduced a $5 billion share repurchase authorization. A lot more than 50 percent the analysts covering the inventory amount it a invest in. Marathon will article earnings Tuesday early morning. Other names that analysts are bullish on this earnings period incorporate semiconductor firm Superior Micro Units , industrial company Ingersoll Rand and data management products and services business Iron Mountain . — CNBC’s Michael Bloom contributed reporting.