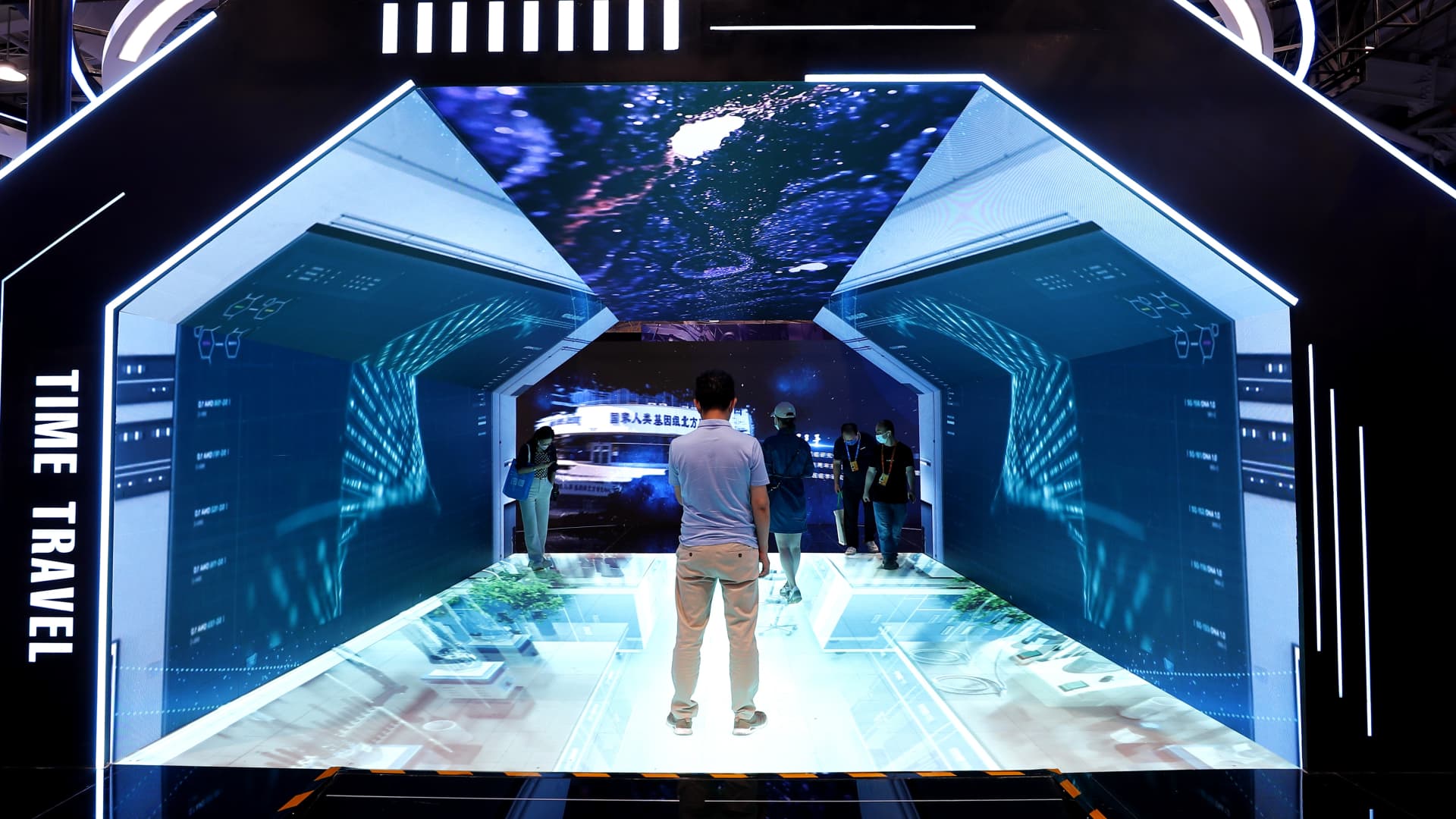

Some components of China have formally promoted metaverse progress strategies. Pictured right here is a metaverse exhibition place at an annual solutions trade expo in Beijing on Sept. 1, 2022.

China Information Company | China Information Service | Getty Visuals

BEIJING — When it comes to futuristic ideas like the metaverse, JPMorgan analysts consider they’ve found a tactic for picking Chinese inventory plays.

The metaverse is loosely described as the upcoming iteration of the web, current as a virtual entire world in which humans interact by using a few-dimensional avatars. Hoopla all-around the metaverse swept by means of the business enterprise market about a yr in the past. But in the United States at the very least, it isn’t gaining the momentum that providers these kinds of as Fb had hoped.

The social network huge even changed its identify to Meta very last calendar year. Even so, its shares are down a lot more than 50% this yr — much even worse than the Nasdaq’s roughly 24% decrease.

China faces the exact buyer adoption issues as the United States. But the Asian country’s metaverse growth faces its have challenge of regulatory scrutiny, a little something the JPMorgan analysts pointed out in their Sept. 7 report. Cryptocurrencies, a big element of the metaverse exterior China, are also banned within the country.

Nonetheless, the stock analysts mentioned some Chinese world wide web organizations can make dollars from particular sector trends pushed by the metaverse’s enhancement.

Top picks

Their major picks in the sector are Tencent, NetEase and Bilibili. And amongst non-web names in Asia, providers like Agora, China Cell and Sony made JPMorgan’s listing of prospective beneficiaries.

Which is based on the companies’ competitive edge in certain factors of the metaverse, these as gaming and social networks.

“Enhancement of cell world-wide-web and AI in the past 5-10 a long time implies that a company’s aggressive edge in just one component of the tech ecosystem is generally far more important in figuring out prolonged-expression price generation to shareholders than which part of the ecosystem the corporation operates in,” analyst Daniel Chen and his staff reported in the report.

In this article are two key methods that corporations can make cash as the metaverse develops, the analysts mentioned.

Gaming and mental house

In JPMorgan’s most optimistic circumstance, China’s on the net sport industry practically triples to $131 billion from $44 billion.

Tencent and NetEase both equally have sturdy gaming companies and partnerships with world-wide field leaders, the analysts mentioned.

For example, Tencent has a stake in virtual environment recreation enterprise Roblox, even though NetEase has partnered with Warner Bros. for a Harry Potter-themed cell game, the report pointed out.

Digitalization of company and use

“The metaverse will probable double digital time spent” from the recent normal of 6.6 hours, the analysts said. They also assume firms will be equipped to produce a lot more income for each web consumer.

JPMorgan estimates the whole addressable current market in China for organization solutions and computer software in the metaverse will be $27 billion, even though digitalizing the offline use of products and providers will make up a $4 trillion current market in China.

In small business companies, NetEase now has a virtual assembly place technique known as Yaotai, while Tencent operates a videoconferencing app identified as Tencent Conference, the report pointed out.

Tencent also has “rich expertise in taking care of China’s biggest social community Weixin/cellular QQ” and can reward from digital merchandise income within just all those platforms, the analysts reported.

In the same way, Bilibili’s “superior person engagement will allow it to capture rich monetization prospective in [value added service]/virtual merchandise income in the extended run,” the analysts explained.

They pointed out the app is the “go-to enjoyment platform” for Chinese persons aged 35 and down below, with every single person spending an typical of 95 minutes a working day on the platform in the to start with quarter.

‘Obstacles to overcome’

But it stays unclear how practical these types of efforts will be from a enterprise viewpoint.

Devoid of naming the companies as inventory picks, the JPMorgan analysts explained a quantity of other metaverse assignments underway in China, such as Baidu’s digital XiRang world, and digital reality growth by Baidu-backed iQiyi, NetEase and Bilibili.

The analysts explained digital fact equipment are at this time as well hefty to be made use of for very long intervals of time, and cloud computing capabilities and metaverse material continue being minimal.

“We assume ‘perfect form’ of the metaverse could get a long time to achieve,” the analysts said. “When we believe that the [total addressable market] for the metaverse is great, we feel there are a variety of technological hurdles to overcome.”

— CNBC’s Michael Bloom contributed to this report.