The international lack of semiconductors is “staying sorted out” following several years of disruptions to source chains that designed them a scarce useful resource, according to the chairman of Swedish-Swiss tech and engineering giant ABB.

Asked irrespective of whether provide chain difficulties with regard to semiconductors have been resolved, ABB’s Peter Voser mentioned that he believes the worst of the chip provide crunch has subsided.

“It was definitely an situation in 2022, particularly the initially two, three quarters,” Voser told CNBC at the Earth Economic Discussion board in Davos, Switzerland, on Monday.

“This was a serious shortage on semiconductors, which afflicted us a ton because plainly when you happen to be in electrification automation and robotics, one particular of the crucial parts is semiconductors, and we are utilizing quite complex kinds, so hence Taiwan is very important but also Chinese semiconductors,” he included.

“But if I search today at it, I think it really is now currently being sorted out. I consider international expansion slowdown has served on this as perfectly, and now for the long run I’m fairly optimistic.”

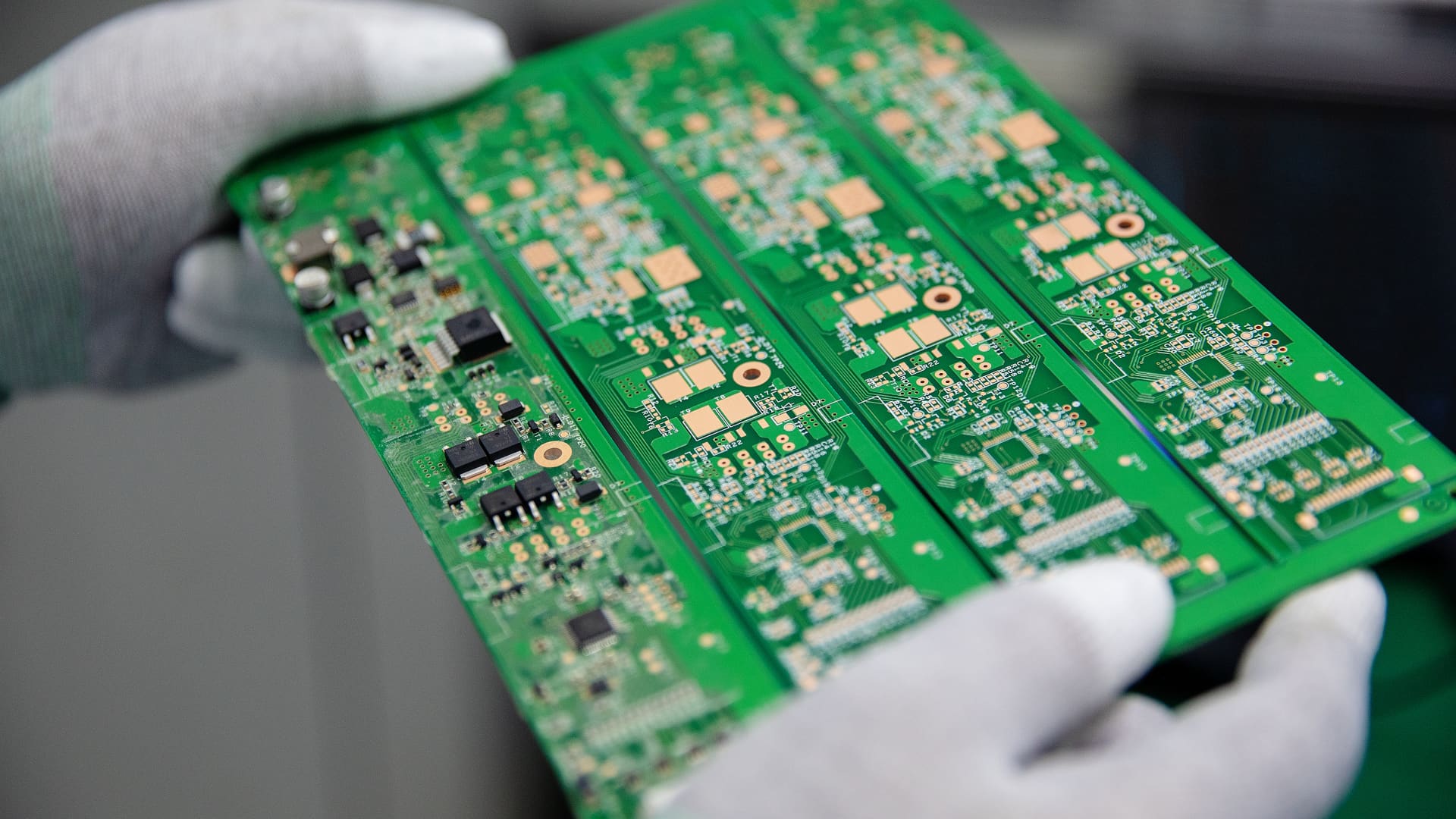

Chips are the brains of electronic units and can be located in a selection of merchandise from cars and trucks to house appliances to smartphones. They’re a core piece of considerably financial activity, so the restrictions in offer have experienced a ripple influence on the broader economic system.

2022 was deeply demanding for ABB, Voser stated, with the coronavirus in China and its linked disruptions to world trade hitting the corporation tricky. In the course of pandemic-similar shutdowns, ABB was compelled to close factories in China, while hundreds of workforce experienced to reside in factories due to rigorous curbs on community lifetime, he included.

“We nonetheless sent in that perception but not at the total capability,” he claimed. “We weathered the storms in a certain way.”

In 2023, on the other hand, Voser expects an enhancing outlook in China whilst the relaxation of the planet activities lessen advancement.

“Now with the most current wave of Covid, I believe which is a diverse wave of Covid and dealing with the pandemic as we all know, I would guess that in a handful of months, this is about and [we are] having into a more regular natural environment in China as perfectly,” Voser mentioned.

“The rest of the planet will see reduced advancement in 2023, I would forecast, the 1st handful of months,” he claimed. “In that sense, I am of the faculty [that in] the next 50 percent, China will bounce again and see growth which is larger than expected.”

In the semiconductor area, slowing economic exercise has served balance out the lack as a increase in the charge of dwelling resulted in a softening of need from customers for dear chip-geared up products, according to Voser.

“I imagine with the world wide CHIPS act in U.S., investments in Europe, we will see extra. Most most likely, we are heading into a ability overhang pretty quickly if the economic climate grows slower than predicted,” the ABB chairman said.

One particular detail the chip lack has highlighted is the dependency of makers on factors from East Asia. TSMC, the Taiwanese semiconductor huge, is by significantly the largest producer of microchips.

Its chipmaking prowess is the envy of several formulated Western nations, which are using measures to enhance domestic production of chips.

In the U.S., President Joe Biden previous signed into law the CHIPS and Science Act, allocating billions to lure brands to produce the broadly utilized chips domestically. It has also sought overseas investments, convincing TSMC to commit $40 billion to develop additional of its chips in the United States at two chip crops in Arizona.

Voser added, even so, that brewing tensions involving China and Taiwan ended up a threat to enjoy moving forward.

“It can be a danger, I do not fear normally, I imagine it truly is a hazard you have to regulate,” Voser stated. “Possessing new sources of semiconductors throughout the world is quite critical, so you go from one supply supply, Taiwan and then China into multiple sources and which is exactly where some of the investments are actually significant.”