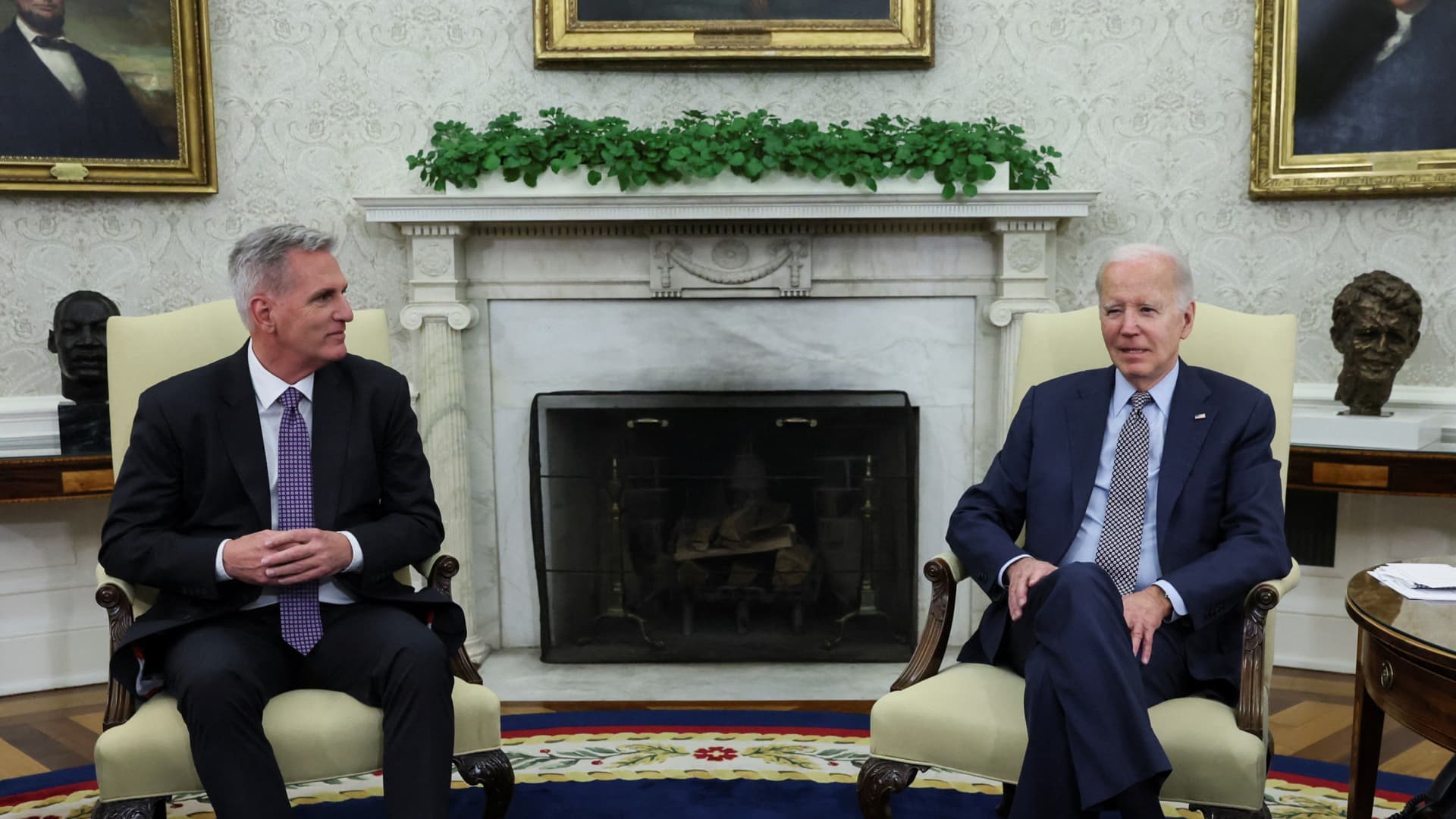

U.S. President Joe Biden hosts credit card debt restrict talks with U.S. Residence Speaker Kevin McCarthy (R-CA) in the Oval Place of work at the White Residence in Washington, U.S., Could 22, 2023. REUTERS/Leah Millis

Leah Millis | Reuters

A standoff concerning the White House and Congressional Republicans over raising the U.S. debt ceiling has pushed the world’s largest financial system to the brink of defaulting on its expenditures.

This is not the 1st time the previously procedural mechanism has induced turmoil in Washington. Still in Denmark — the only other democracy with a very similar form of nominal personal debt ceiling — hardly any person is aware of it exists.

President Joe Biden and Republican Residence Speaker Kevin McCarthy held what the latter known as a “productive” conference at the White Dwelling on Monday, but a deal continues to be elusive.

The Republican-led Household desires sweeping cuts to federal discretionary expending, new work demands for welfare recipients and an growth of mining and fossil fuel generation. The White Home has so significantly resisted.

The U.S. will default on its charges for the very first time ever, if Democrats and Republicans are unable to split the deadlock by June 1. This would possible have serious financial ramifications, which includes a recession, mass federal career losses and a international inventory sector collapse.

The debt ceiling has been in result because 1917 and permits Congress to restrict the volume of dollars the federal government is in a position to borrow to include its bills, making up the deficit amongst what it collects in taxes and spends on federal government functions previously authorised by Congress.

It has been lifted 78 occasions given that 1960, last mounting by $2.5 trillion in December 2021 to $31.381 trillion.

When schedule, conversations about boosting the debt ceiling have ever more come to be a platform for political brinkmanship — especially since 2011, when Republicans also threatened a default if the Obama administration did not grant investing cuts.

The episode prompted S&P Worldwide to concern a initial-ever downgrade to the U.S. credit rating, when Senate Minority Leader Mitch McConnell reported at the time that the financial debt ceiling — and by implication the U.S. economic system — was a “hostage truly worth ransoming.”

The limit was raised unconditionally by the Democratic-led Home 3 moments less than previous Republican President Donald Trump’s administration, but historical past is now repeating itself.

Separation of church and point out

While the U.S. financial debt ceiling restricts government borrowing to a distinct determine, most other economies established personal debt restrictions as a proportion of GDP.

For occasion, international locations that are aspect of the European Union, less than principles established out in the Maastricht Treaty, pledge to hold their public debt beneath 60% of GDP and to preserve an once-a-year price range deficit of much less than 3%.

Denmark is the only other democratic country in the globe with a credit card debt restrict set at a preset nominal figure, nonetheless it never creates the similar political and financial turmoil. In reality, it is scarcely even talked about.

This is largely because the Danish credit card debt ceiling was created to be a synthetic constitutional provision and was established so higher that it would under no circumstances grow to be the “political bargaining chip” it has in the U.S., as govt borrowing demands regularly run up in opposition to it, according to Laura Sunder-Plassmann, affiliate professor of economics at the College of Copenhagen.

Sunder-Plassmann also spelled out that Danish politics is less politically polarized than the U.S., with two substantial and a dozen or far more more compact but not insignificant get-togethers represented in parliament.

“Whilst there are certainly arguments to be manufactured for fiscal guidelines, most state-of-the-art countries have opted for non-binding restrictions on financial debt to GDP ratios (and deficits) alternatively of nominal amounts, which although maybe not excellent at the very least avoids the kind of debates we now see in the U.S.,” she claimed via electronic mail.

The Danish personal debt ceiling, or “gældsloft,” was executed as a constitutional requirement in 1993 after a restructure of the country’s federal government, and established at 950 billion Danish krone ($137.5 billion). Danish politicians take into account it extra of a artificial formality, largely in place to reassure parliament and the community that the governing administration of the day cannot go rogue.

COPENHAGEN, Denmark – Feb. 28, 2023: Users of the Danish Parliament show up at a session prior to a vote at the Folketing. Denmark is the only other state in the globe with a credit card debt ceiling equivalent to that of the U.S., but it never results in the same political crises that Washington usually faces.

LISELOTTE SABROE/Ritzau Scanpix/AFP through Getty Illustrations or photos

Denmark has historically retained a strong fiscal situation, but endured a significant deficit in the wake of the 2008 fiscal crisis, prompting the personal debt ceiling to be enhanced in 2010 to 2 trillion Danish krone.

This is a hefty restrict for a modest nation of all over 6 million people today with a nationwide debt of just 323 billion krone at the end of 2022, according to the Danish National Financial institution.

Denmark is jogging a budget surplus and has viewed its debt fall substantially more than the earlier 10 years. National personal debt to GDP declined steadily up right until a spike in 2020 brought on by the Covid-19 pandemic and fell all over again to just more than 30% of GDP by late 2022.

Jesper Rangvid, professor of finance at the Copenhagen Enterprise School, advised CNBC on Tuesday that the Danish process is structured so that political choices about fiscal plan are confined to the public spending budget for tax and paying out of every calendar year, with the debt ceiling an totally individual formality.

“It can be only not discussed in this nation simply because it is just not an challenge, and that is, of system, owing to this variable that there has been all of individuals surpluses for several yrs on the authorities spending budget, and for that reason personal debt has essentially been falling for quite a few many years,” he defined by way of telephone from Copenhagen.

“We have the political discussion when we determine on expenditures and taxes and so on, and the financial debt limit must not be proscribing that, which is of class really distinctive to the U.S., the place you the two have the once-a-year discussions on the spending plan, on expenditures and incomes, and simply because you constantly have deficits, then you also have the discussions on the debt restrict.”

Rangvid additional that, whilst Danish politicians across the country’s plethora of political functions have a quite wide spectrum of sights on fiscal policy, the key big difference is that the forum for talking about them is confined to the once-a-year budget. Other capabilities of government therefore simply cannot be held hostage by the fiscal demands of opposition functions.