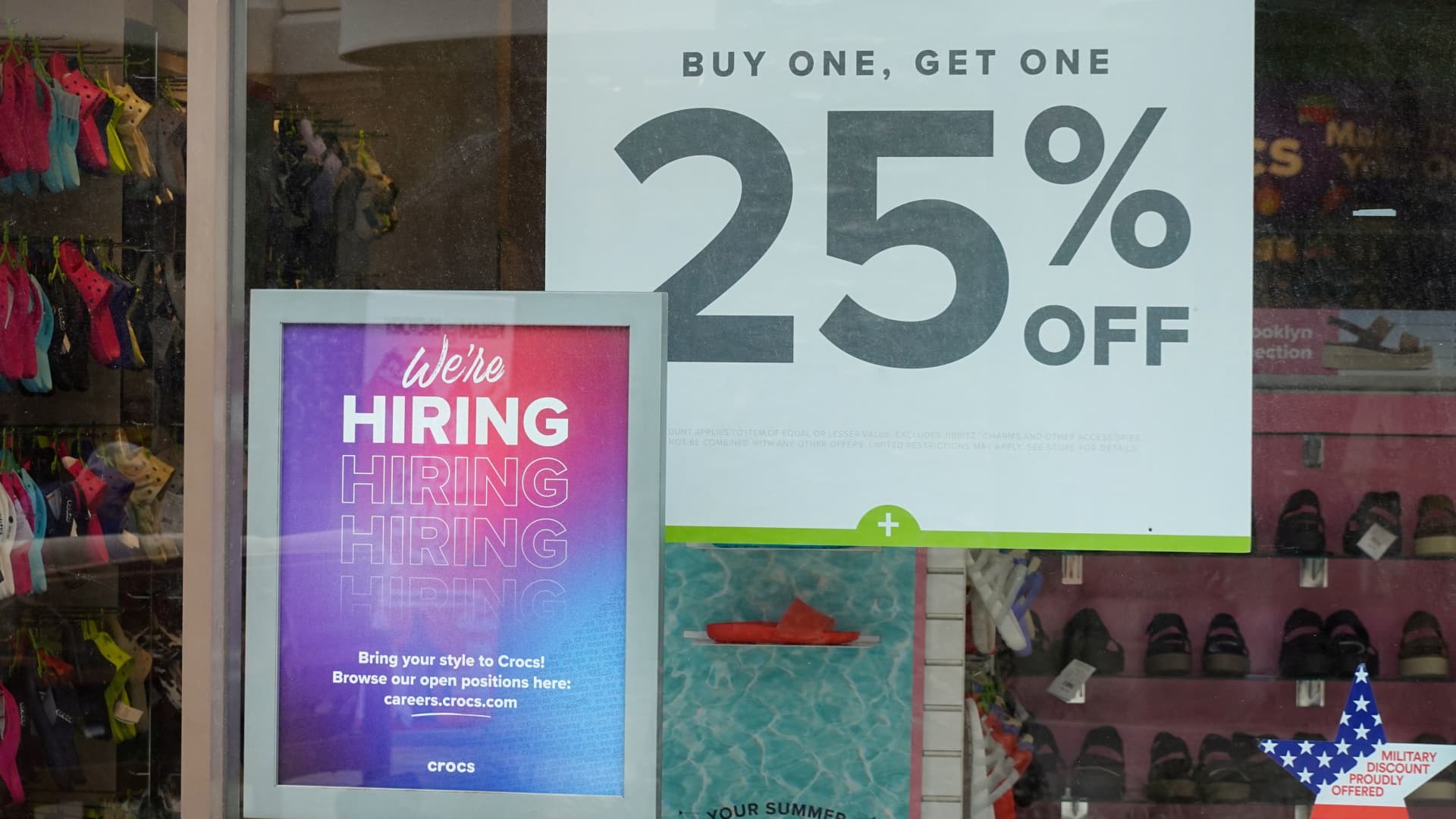

Employment indicator and sale signal are displayed at a retail store in Carlsbad, California, May possibly 25, 2023.

Mike Blake | Reuters

The widely predicted U.S. recession stays out of sight as the very first 50 % of 2023 winds down, but the client sector that has fueled a remarkable restoration from the pandemic shutdowns might last but not least be showing indicators of fraying.

The signals that economists lean on to gauge the odds of a recession are contradictory at the moment. The generate curve remains deeply inverted, and producing surveys have been flashing recession signals for months. But layoffs concentrated in the tech sector have not unfold greatly so significantly, and there are pockets of consumer energy, such as journey, that appear like a downright boom.

With the Federal Reserve predicted to skip a level hike at its up coming assembly, hopes of a so-called “delicate landing” for the economic system have started to sprout once again. On Tuesday, Goldman Sachs decreased its odds of a U.S. economic downturn in the subsequent 12 months to just 25%.

But can the strong consumer sector go on to hold up as the pandemic-era personal savings fade absent and fascination prices continue to be elevated? Not absolutely everyone is certain, with some Wall Street strategists and economists arguing that a recession is just a subject of time as the central bank attempts to convey down inflation — and there is a great deal of proof for that pessimistic circumstance.

“The US and world expansions stand on stable floor, and fears of an imminent economic downturn search overblown. This is the information from the most recent releases demonstrating a astonishing increase in the international producing PMI together with robust gains in US items spending and work. But these facts also advise that the seeds for an end to enlargement are getting sown,” JPMorgan worldwide sector strategist Marko Kolanovic said in a note to shoppers on Monday.

The bewildering purchaser

The housing current market is 1 of the crucial bellwethers for the U.S. buyer and the financial system, and also just one of the most baffling.

New house income have essentially been trending upward all over again in the latest months inspite of elevated mortgage costs and a regional banking disaster, reversing some of a sharp slowdown from past calendar year.

On the other hand, that could not be a terrific study on the overall health of the shopper this time all over. There has been a spectacular drop in the number of present households staying placed on the market place, which is exacerbating the national housing shortage and could make demand glimpse much better than it genuinely is.

“If you personal a household, if you locked in a 2.8% 30-calendar year home finance loan, that is the most effective trade of your existence. Unless of course you have to transfer, you’re not likely to shift,” claimed Lauren Goodwin, economist and portfolio strategist at New York Life Investments.

There are also conflicting signals coming from big shopper providers. Focus on warned past month of sluggish revenue, and Greenback General‘s inventory plunged on June 1 following the lower price retailer slashed its comprehensive-year outlook.

Greenback General’s stock fell sharply following the retailer cut its complete-yr outlook.

But on the other hand, American Airways lifted its earnings steerage on May 31, citing more powerful desire and less costly gasoline. And luxurious apparel model Lululemon topped estimates for earnings and revenue for its fiscal to start with quarter and raised total-calendar year guidance.

That divergence could be a continuation of the post-pandemic financial state, which has observed people splurge in areas like vacation though leaving some shops caught off guard with their inventory designs. But it also could be a signal that the economic restoration is starting to be “K-formed,” Goodwin said. That indicates a problem where different money tiers of buyers diverge from a person another.

“I do not want to dismiss the plan that some firms could have idiosyncratic difficulties all around their inventory administration. It can be constantly a portion of the tale. But we are viewing in the mixture info a significant bifurcation concerning decreased- and center-earnings segments of the customer to the broader overall economy and the larger-earnings individuals,” she stated.

“The bifurcation is occurring not only by earnings segment but also by age,” Goodwin ongoing, pointing to credit history card default costs.

“What that says to me is this is a tale about wealth just as considerably as excess cost savings,” she added.

Labor market’s very last stand?

The principal supply of optimism for the U.S. economy is the labor current market, and ongoing work expansion would increase very low-money customers and aid struggle off the K-formed overall economy.

Even with reports of new rounds of layoffs from key firms together with Meta Platforms, Disney and Goldman Sachs, the monthly positions reviews carry on to defeat anticipations. The April JOLTS report even confirmed a surprise rise in position openings.

Even so, Nick Bunker, the financial analysis director for North The us at jobs web site Without a doubt, claimed his firm’s facts shows that occupation listings have continued to soften in recent weeks and that the employment marketplace has cooled considering the fact that previously in the restoration.

“Items are moderating, even if they are nevertheless incredibly solid,” Bunker said.

And the May possibly employment report was a conflicting document in and of by itself. Although payrolls gained a stunning 339,000 jobs, the unemployment price — calculated by a various study — really rose to 3.7%.

“It is really just a single of those people quirky studies. That 3-10ths of a proportion position soar in the unemployment fee — I will not believe which is an precise illustration of the wellness of the labor marketplace. I also don’t believe the 339,000 positions we included in just one month is an exact reflection … My look at of this is I would not get as well hyped in possibly path,” Bunker mentioned.

The labor market is often witnessed as a lagging indicator of financial weakness, and it truly is no assurance that a recession is not about the corner. On Thursday, original jobless promises confirmed a surprise leap to 261,000, likely a warning indication that the cracks in the labor current market are beginning to widen.

— CNBC’s Michael Bloom contributed reporting.