Top chipmaking nations which includes the U.S. are forming alliances, in part to safe their semiconductor provide chain and to stop China from reaching the slicing-edge of the field, analysts told CNBC.

Locations together with the United States, South Korea, Japan and Taiwan, which have robust semiconductor industries, have seemed to forge partnerships all-around the crucial technological innovation.

“The instant explanation for all this is certainly China,” explained Pranay Kotasthane, chairperson of the Large Tech Geopolitics Programme at Takshashila Institution, in reference to the alliances.

The teaming up underscores how crucial chips are to economies and countrywide security, while at the identical time highlighting a motivation by countries to stem China’s progression in the important technological innovation.

Kotasthane was a guest on the most recent episode of CNBC’s Outside of the Valley podcast released Tuesday, which appears to be at the geopolitics driving semiconductors.

Why chips are in the geopolitical spotlight

Semiconductors are crucial engineering for the reason that they go into so several of the goods we use — from smartphones to autos and refrigerators. And they’re also important to synthetic intelligence programs and even weaponry.

The worth of chips have been thrust into the highlight all through an ongoing lack of these parts, which was sparked by the Covid pandemic, amid a surge in need for purchaser electronics and supply chain disruptions.

That alerted governments all around the planet to the need to have to secure chip supplies. The United States, below President Joe Biden, has pushed to reshore producing.

But the semiconductor supply chain is sophisticated — it contains areas ranging from design and style to packaging to producing and the instruments that are essential to do that.

For case in point, ASML, dependent in the Netherlands, is the only firm in the environment capable of generating the very elaborate machines that are essential to manufacture the most highly developed chips.

The United States, though powerful in a lot of parts of the industry, has shed its dominance in production. In excess of the past 15 years or so, Taiwan’s TSMC and South Korea’s Samsung have occur to dominate the producing of the world’s most innovative semiconductors. Intel, the United States’ greatest chipmaker, fell far behind.

Taiwan and South Korea make up about 80% of the worldwide foundry marketplace. Foundries are facilities that manufacture chips that other firms structure.

The concentration of significant equipment and production in a small selection of providers and geographies has place governments all-around the environment on edge, as nicely as thrust semiconductors into the realm of geopolitics.

“What has occurred is there are a lot of organizations distribute across the globe accomplishing small element of it, which indicates there is a geopolitical angle to it, correct? What if one particular organization isn’t going to source the matters that you will need? What if, you know, 1 of the nations around the world form of puts factors about espionage via chips? So those items make it a geopolitical tool,” Kotasthane explained.

The focus of ability in the palms of a few economies and corporations presents a business enterprise continuity chance, specially in locations of competition like Taiwan, Kotasthane claimed. Beijing considers Taiwan a renegade province and has promised a “reunification” of the island with the Chinese mainland.

“The other geopolitical importance is just connected to Taiwan’s central position in the semiconductor supply chain. And because China-Taiwan tensions have risen, there is a fear that, you know, since a large amount of producing takes place in Taiwan, what occurs if China were being to occupy or even just that there are tensions in between the two nations?” Kotasthane claimed.

Alliances being created that exclude China

Due to the fact of the complexity of the chip provide chain, no region can go it by itself.

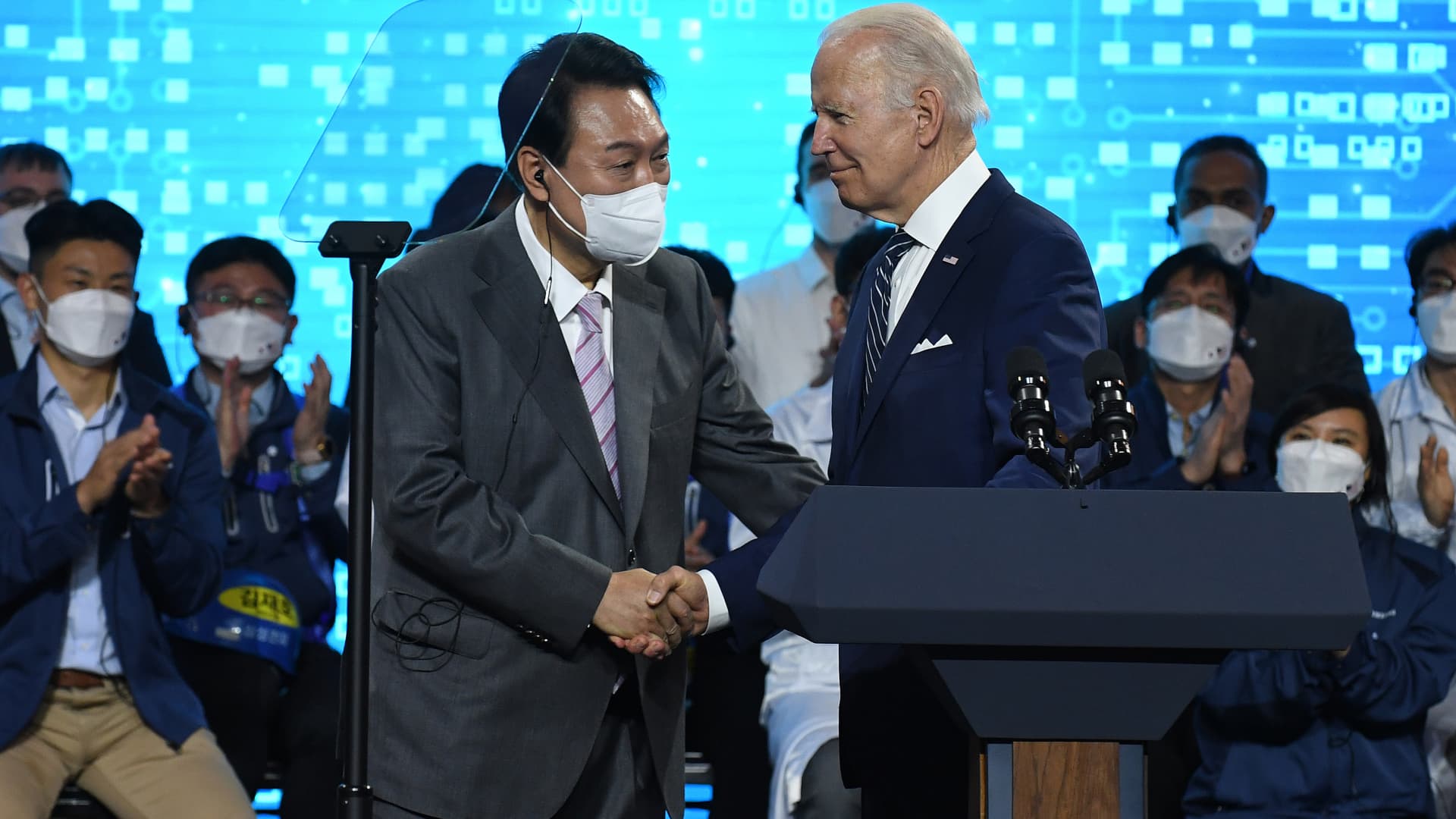

International locations have more and more sought chip partnerships in the previous two several years. On a excursion to South Korea in May possibly, Biden visited a Samsung semiconductor plant. Close to the same time, U.S. Commerce Secretary Gina Raimondo met her then Japanese counterpart, Koichi Hagiuda, in Tokyo and mentioned “cooperation in fields these types of as semiconductors and export regulate.”

Very last thirty day period, Taiwan’s President Tsai Ing-wen informed the viewing U.S. state of Arizona Governor Doug Ducey that she seems to be ahead to developing “democracy chips” with America. Taiwan is home to the world’s most state-of-the-art chipmaker TSMC.

And semiconductors are a critical component of cooperation concerning the United States, India, Japan and Australia, a group of democracies collectively recognized as the Quad.

The U.S. has also proposed a “Chip 4” alliance with South Korea, Japan and Taiwan, all powerhouses in the semiconductor source chain. Nevertheless, details of this have not been finalized.

There are a couple good reasons guiding these partnerships.

A single is about bringing jointly countries, each individual with their “comparative pros,” to “string jointly alliances that can produce protected chips,” Kotasthane reported. “It won’t make feeling to go it by yourself” since of the complexity of the offer chain and the strengths of distinctive international locations and organizations, he extra.

U.S. President Joe Biden achieved with South Korean President Yoon Suk-yeol in Could 2022 on a go to to the Samsung Electronics Pyeongtaek campus. The U.S. and South Korea, together with other countries, are trying to find to sort alliances about semiconductors, with the goal of reducing out China.

Kim Min-Hee | Getty Photos

The push for such partnerships have just one prevalent trait — China is not concerned. In fact, these alliances are built to slash China off from the global offer chain.

“In my look at, I believe around the brief time period, China’s enhancement in this sector will be severely constrained [as a result of these alliances],” Kotasthane reported.

China and the U.S. look at each individual other as rivals in know-how in spots ranging from semiconductors to synthetic intelligence. As element of that fight, the U.S. has seemed to slash off China from crucial semiconductors and applications to make them by way of export constraints.

“The goal of all this energy is to protect against China from developing the capability to make state-of-the-art semiconductors domestically,” Paul Triolo, the know-how policy lead at consulting firm Albright Stonebridge, told CNBC, referring to the aims of the a variety of partnerships.

China ‘cutting-edge’ chips in doubt

So the place does that leave China?

Around the past handful of decades, China has pumped a large amount of money into its domestic semiconductor marketplace, aiming to enhance self-sufficiency and lower its reliance on international providers.

As defined just before, that would be incredibly tough because of the complexity of the offer chain and the focus of power in the hands of incredibly few businesses and nations.

China is strengthening in locations these kinds of as chip style and design, but that’s an location that depends intensely on foreign instruments and devices.

Around the very long expression, I do consider they [China] will be capable to get over some of the present-day problems… still they will not likely be equipped to access the chopping edge that quite a few other countries are.

Pranay Kotasthane

Takshashila Institution

Production is the “Achilles’ heel” for China, according to Kotasthane. China’s major agreement chipmaker is known as SMIC. But the firm’s know-how is nevertheless noticeably guiding the likes of TSMC and Samsung.

“It involves a ton of international collaboration … which I consider is now a massive difficulty for China due to the fact of the way China has form of antagonized neighbors,” Kotasthane stated.

“What China could do, a few, four several years before in terms of worldwide collaboration is not going to just be feasible.”

That leaves China’s capability to access the primary edge of chipmaking in doubt, especially as the U.S. and other important semiconductor powerhouses variety alliances, Kotasthane said.

“Around the very long phrase, I do assume they [China] will be capable to conquer some of the present issues… yet they will not likely be able to attain the chopping edge that quite a few other nations are,” Kotasthane said.

Tensions in the alliances

Still, there are some cracks starting to appear in between some of the partners, in particular South Korea and the United States.

In an job interview with the Fiscal Instances, Ahn Duk-geun, South Korea’s trade minister, mentioned there were being disagreements concerning Seoul and Washington more than the latter’s continued export constraints on semiconductor equipment to China.

“Our semiconductor field has a lot of fears about what the US government is doing these times,” Ahn instructed the FT.

China, the world’s largest importer of chips, is a critical current market for chip businesses globally, from U.S. giants like Qualcomm to Samsung in South Korea. With politics and organization mixing, the phase could be established for additional rigidity involving nations in these higher-tech alliances.

“Not all U.S. allies are eager to indicator up for these alliances, or develop controls on know-how bound for China, as they have main equities in equally manufacturing in China and providing into the China market place. Most do not want to operate afoul of Beijing more than these troubles,” Triolo said.

“A major danger is that attempts to coordinate components of the world semiconductor provide chain advancement undermine the market-driven character of the industry and trigger big collateral injury to innovation, driving up expenditures and slowing the pace of progress of new systems.”