Just a couple of years in the past, it appeared that house mining was inescapable. Analysts, tech visionaries and even renowned astrophysicist Neil deGrasse Tyson predicted that house mining was heading to be big enterprise.

Area mining organizations like Planetary Assets and Deep Area Industries, backed by the likes of Google‘s Larry Site and Eric Schmidt, cropped up to just take gain of the predicted payoff.

Quick forward to 2022, and both equally Planetary Resources and Deep Place Industries have been obtained by corporations that have nothing at all to do with space mining. Humanity has yet to commercially mine even a single asteroid. So what’s using so prolonged?

Area mining is a extensive-term endeavor and one that buyers do not always have the patience to guidance.

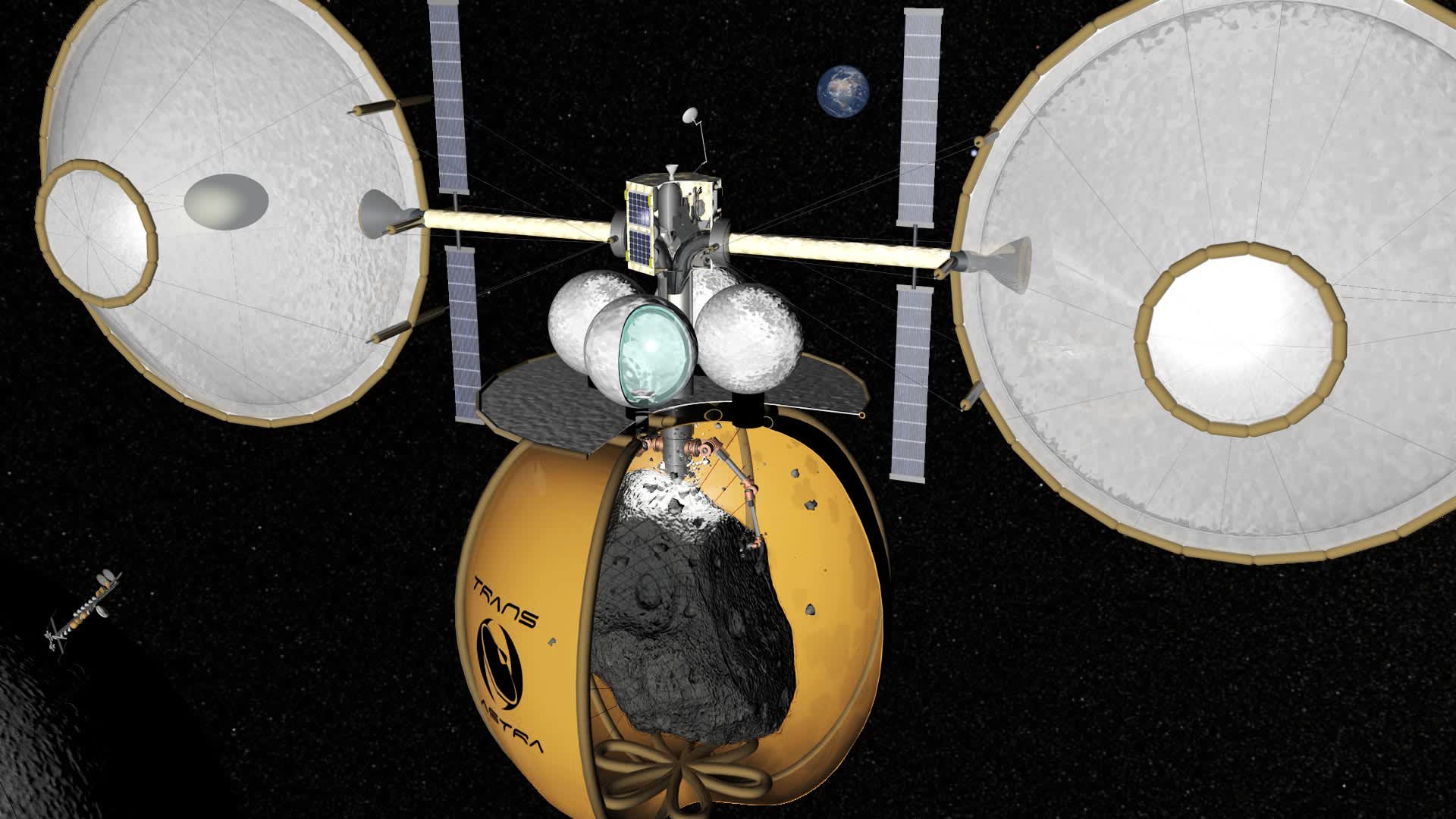

“If we experienced to build a whole-scale asteroid mining car nowadays, we would want a several hundred million dollars to do that working with commercial procedures. It would be hard to influence the investment neighborhood that that is the correct point to do,” claims Joel Sercel, president and CEO of TransAstra Corporation.

“In today’s economics and in the economics of the close to potential, the subsequent few yrs, it will make no feeling to go just after valuable metals in asteroids. And the cause is the charge of receiving to and from the asteroids is so large that it vastly outstrips the value of anything at all that you’d harness from the asteroids,” Sercel suggests.

This has not dissuaded Sercel from attempting to mine the cosmos. TransAstra will initially focus on mining asteroids for drinking water to make rocket propellant, but would like to inevitably mine “anything on the periodic desk.” But Sercel states such a mission is nevertheless a strategies off.

“In phrases of the timeline for mining asteroids, for us, the biggest difficulty is funding. So it depends on how speedy we can scale the organization into these other ventures and then get functional engineering knowledge operating units that have all the factors of an asteroid mining method. But we could be launching an asteroid mission in the 5 to 7-yr time frame.”

Sercel hopes these other ventures maintain it afloat right up until it develops its asteroid mining small business. The concept is to use the tech that will sooner or later be integrated into TransAstra’s astroid mining missions to fulfill previously current industry requires, these kinds of as working with house tugs to produce satellites to their exact orbits and working with satellites to aid in visitors administration as room will get more and more extra crowded.

AstroForge is an additional company that thinks room mining will grow to be a fact. Established in 2022 by a former SpaceX engineer and a previous Virgin Galactic engineer, AstroForge nonetheless thinks there is income to be built in mining asteroids for valuable metals.

“On Earth we have a limited amount of money of uncommon earth features, exclusively the platinum team metals. These are industrial metals that are used in each day issues your mobile mobile phone, most cancers, medicines, catalytic converters, and we’re running out of them. And the only way to entry extra of these is to go off environment,” states AstroForge Co-Founder and CEO Matt Gialich.

AstroForge strategies to mine and refine these metals in area and then provide them back again to earth to provide. To hold prices down, AstroForge will connect its refining payload to off-the shelf satellites and start people satellites on SpaceX rockets.

“There is certainly rather a handful of firms that make what is referred to as a satellite bus. This is what you would commonly feel of as a satellite, the variety of box with photo voltaic panels on it, a propulsion technique being connected to it. So for us, we didn’t want to reinvent the wheel there,” Gialich states. “The past people today before us, Planetary Resources and DSI [Deep Space Industries], they experienced to obtain full automobiles. They experienced to develop significantly, significantly larger and considerably more costly satellites, which demanded a huge injection of funds. And I assume that was the final downfall of both of those people firms.”

The biggest challenge, AstroForge suggests, is determining which asteroids to goal for mining. Prior to conducting their own missions, all early-stage mining providers have to go on is existing observation data from scientists and a hope that the asteroids they have chosen include the minerals they look for.

“The technology piece you can handle, the operations pieces you can regulate, but you cannot handle what the asteroid is right up until you get there,” suggests Jose Acain, AstroForge Co-Founder and CTO.

To come across out a lot more about the issues going through house mining providers and their strategies to make room mining a genuine organization enjoy the video clip.